|

Tech-savvy parents are turning to mobile apps to navigate their children’s busy sports schedules.

Photo by: GETTY IMAGES |

John Haller was introduced to the youth sports business the way many are, as a well-meaning parent.

The founder of an internet company that took it on the chin during the crash of the dot-coms in the early 2000s, he became increasingly involved in his son’s soccer club while he contemplated where he’d go for his next job. With the busy spring season approaching, his wife volunteered to help the club by overseeing registration.

“She basically ruined a summer of our lives,” chuckled Haller, recalling the long days and nights his wife spent entering information from more than 1,000 registration forms into a spreadsheet.

In the dust of those ruins, Haller found an opportunity — a common problem crying out for a techie’s solution, which he deftly provided. He built that solution into a web-based software business called SportsSignup, which he sold two years ago to Time Inc., one of four larger players who in the last few years have seized upon an opportunity to use the sign-up process to consolidate, and then make money from, the more than 20 million U.S. youths who play team sports.

First Look podcast, with youth sports discussion beginning at 21:20 mark:

Jeff Karp, the CEO of Time Inc.’s mobile app-focused offering called SI Play, estimates that the last 18 months have brought more than $1 billion in investment and consolidation in the youth sports sector, driven largely by the activities of his company and three others like it: Dick’s Sporting Goods, NBC Sports and Blue Star Sports.

Haller’s story traces the life cycle of a business that has evolved on the trailing edge of technology and now appears poised to blossom, as increasingly tech-adept parents turn to mobile apps to navigate their children’s hectic sports lives.

Four players emerge

As most leagues did a decade ago, the upstate New York soccer club that Haller’s son played in handled registration using pen and paper, hosting sign-up days where parents filled out forms and dropped off checks. Volunteers then typed names, addresses, contact info, birthdates, uniform sizes and the rest into a spreadsheet.

Entering the data for more than 1,000 children, Haller’s wife would burst into tears when a sorting error blew up the spreadsheet. As checks came in, they would drive them to the league treasurer’s house. They left printouts of the data in board members’ mailboxes so they could assign players to teams and create schedules.

“I’m a computer guy, so I said ‘This is crazy,’” said Haller, who co-founded a successful tech company that went public in the 1990s but missed on his try at a dot-com. “Computers do all this stuff. You want the families entering the data, not my wife. You want credit card processing, not someone depositing checks in the bank. You want a web-based tool that the volunteers of the moment can log in to and use to send emails about schedules and rosters and when picture day is.”

Dealing with unemployment for the first time, Haller offered to put his skills to work building a system for the league.

He spent the fall and winter developing software, which they implemented in time for registration in the spring. When the system proved able to handle the load of a registration cycle and season, other clubs came to him asking for one of their own. Seeing a market, he started a company. Before long, he had about 50 clients — soccer, baseball and lacrosse leagues in the upstate New York region that all saw similar needs.

Across the U.S., developers of varying skill and stature were doing the same thing, creating companies around a software-as-a-service model, offering player registration, website hosting and services and a communication platform, typically charging fees to license the software and then taking a cut from each sign-up.

This was the dawn of an opportunity that hatched dozens of small companies and ensuing spates of regional consolidation through its first decade. Haller’s company, SportsSignup, grew across New York and then the Northeast and into Canada, emerging as one of the leaders through its own growth, augmented by merger and acquisition.

SportsSignup served about 2,500 clubs and leagues when Time Inc. approached Haller with the pitch to get in on something larger.

Each of the four prominent entities that have emerged has approached its play from a different angle. The SI Play approach leans hard into the desires and demands of the 65 million parents who ferry their children to practices and games during the week, and the increasing percentage of them who cross county and state lines to watch from bleachers and bag chairs on the weekends.

Born of Time Inc.’s desire to build business extensions around the passionate interests of its consumers, SI Play leads with its mobile app, which pushes notifications when practice is rained out or a game changes fields and allows families to create a profile akin to a digital trading card, with photos and stats of their kids, but also contact info for parents.

When a player is assigned to a team, the app notifies parents and automatically pulls in the new roster and schedule. A live feed is topped by prompts that ask whether a player will be at an upcoming practice or games, lists recent scores and includes a section to post photos from games that other users can then comment on. There’s also a message section that’s restricted to coaches, parents and players from that team.

“We think about the youth sports market in general as antiquated and underserved,” said Karp, who agreed to head the company after senior management stints with social gaming leaders GSN and Zynga, as well as Electronic Arts. “For lack of a better term, we think we can Uberize it and lean into the passion of the consumer to simplify it so I can celebrate my sports life.

“How do you tap into those people whose VCRs are still blinking 12 … so that people aren’t afraid of technology and it feels accessible to them? We think there’s a huge opportunity to help support a fragmented market and make it much simpler for all the users involved.”

Even with regional consolidation underway almost from the start, the market remained overwhelmingly fragmented and absent a consumer-facing brand.

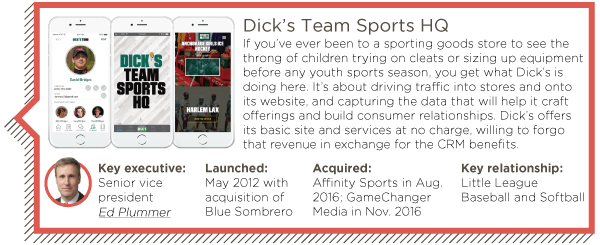

The first big one to come in was Dick’s Sporting Goods, which in 2012 purchased Blue Sombrero, a then 10-year-old league management software provider that offered the standard range of services: Online registration, roster management, scheduling, email communication, web design and an online store, with premium versions for those willing to pay for enhanced services.

It was an intriguing marriage, but it remained the only one of significance for almost three years until Time Inc. launched SI Play behind the acquisition of SportsSignup and League Athletics, which when combined served about 8 million participants in 8,500 leagues, and iScore Sports, a developer of live score-keeping apps. A year later, SI Play added Tourney Machine, which provides software that offers to tournament operators the services that other companies provide for leagues.

|

In April of last year, payments company entrepreneur Rob Wechsler, venture firms Providence Equity and Bain Capital, and Dallas Cowboys owner Jerry Jones announced the launch of Frisco, Texas-based Blue Star Sports, which entered the market with a $100 million war chest that Wechsler raised in about 60 days. Blue Star quickly went to work consolidating, announcing nine acquisitions, most of them similar to those of its competitors, but a few in less explored sectors, such as operators of events and camps. It also landed tech provider deals with two massive organizations, AAU and USA Football, and expects to close on nine more acquisitions in the coming months.

Three months after the founding of Blue Star, NBC Sports entered the fray, acquiring Minneapolis-based league management software company Sport Ngin, which it renamed NBC SportsEngine. In the year since then, SportsEngine, which already was the leader in youth hockey, has worked to differentiate itself by acquiring leading service providers in swimming, gymnastics and wrestling, natural connections for Olympics broadcaster NBC.

Late last year, amid the wave of consolidation and introduction of well-funded competitors, Dick’s doubled down, acquiring a leading in-game scoring provider and another league management site with a large footprint in soccer, as well as cutting a deal as official technology provider to Little League.

It’s a frenzied time in an intriguing sector.

Consider the disparate interests of the four players that have risen to the top through the spate of consolidation and investment: Two media companies with contrasting portfolios, a Fortune 500 sporting goods company and a VC-backed startup founded by a man whose pedigree is in payment services.

“Everyone is looking at it through one lens,” said Wechsler, setting aside for a moment the attraction of improving youth sports for families and kids. “Everyone is saying sports is one of the biggest markets in the world for making money. And every part of it has been completely picked apart — except for one. Youth sports.

“Billions of dollars are spent every year from kids playing a sport. And no one has actually figured out how to monetize it. I think people see that and say — someone’s going to figure it out. It should be me.”

Building affinity

The business case that makes the passion play possible begins with an assessment of the youth sports market: 38 million participants, 65 million parents and 6 million coaches and administrators, coming together in an ecosystem that SI Play conservatively estimated to be worth $14 billion a year.

Unlike the economic impact figures frequently attached to youth sports by the tourism industry, these are direct dollars, untouched by multipliers. About half of that is from travel, which has been the attraction for the many tourism-based entrepreneurs drawn to the business. But there’s also a hefty $3.5 billion in registration fees, $2.2 billion in active wear and $1.5 billion in equipment, all annual and thus far resistant to the swings of the broader economy.

When assessing this massive, and as yet still largely fragmented market, Karp describes it as two-sided, and his strategy to attack it as similar to that of Uber, which endeavors to serve both drivers and riders.

On one side are what he refers to as the “managers,” the legion of moms and dads and granddads and grandmas who annually assume the daunting role of corralling a youth sports league. While the boom in travel sports has brought an increasing number of profit-driven entrepreneurs to the trough, this massive herd is populated largely by volunteers who cycle in and out with their children.

While SI Play estimates that about two-thirds of registrations now are processed online, that still leaves a hefty swath of new business to chase.

Thus far, much of the acquisition side of the story has been around the purchase of a client base. Similarly, many of the deals cut by providers, national governing bodies and other sanctioning bodies are, at their core, marketing plays for the sign-ups in those respective sports.

The tricky thing about youth sports is that it’s tough to buy anything in a one-stop way, including those sign-up opportunities. Typically, the individual leagues, clubs and events that deliver them are independent of the larger entities. Little League can promote Dick’s to its members and can make processes that include its site seamless, but it can’t make any of its more than 6,000 local leagues switch.

Still, NBC SportsEngine founder and CEO Justin Kaufenberg said he is confident that his company’s deals with NGBs in hockey, wrestling and fencing, will prove valuable, so long as they are based on the quality of software and service offered by the provider.

Kaufenberg’s story is reflective of the spirit you’ll find across the sector.

As a college junior majoring in economics and playing hockey at the University of Wisconsin-Eau Claire, Kaufenberg and a friend launched a pair of software startups, one of which he designed to meet the needs of his father, a dedicated youth hockey coach and board member who spent far more time than he expected compiling rosters, scheduling ice time and collecting checks.

“We looked at all the analog tasks he was doing and said we believe we can build an enterprise-grade piece of software for that,” said Kaufenberg, whose company was among the largest league management providers when it was purchased by NBC Sports. “We were about one thing: Help Dave Kaufenberg spend more time on the ice coaching kids and less time on administration. A platform that would do that is what we set out to build.”

Kaufenberg’s platform proved popular not only with hockey leagues but with investors, attracting about $40 million in venture capital by the time it was acquired by NBC.

After the transaction closed, NBC Broadcasting and Sports Chairman Mark Lazarus visited the SportsEngine staff of about 250 at its Minneapolis offices. One of the first questions he got was whether big and burly NBC was as committed to youth sports as the company founders had been.

“We have the Olympics through 2032,” Lazarus answered. “For the next 16 years, they’re going to be your customer until I get them for three weeks. If you think we aren’t ready to invest, you’re wrong. We’re committed.”

While NBC Sports builds affinity among youth sports properties around the Olympics movement and SI Play points to the bells and whistles of its mobile app, Dick’s is hanging its hat on ease of use for league volunteers and coaches. It’s difficult to handicap how that debate will play out, but this much is clear: Dick’s has distinguished itself from its competitors by offering its basic services to leagues for free, an advantage that stems from an essential difference in its business model.

When Little League chose Dick’s Team Sports HQ as its tech provider last year, it pointed to both simplicity and free basic software as two reasons.

“You can’t beat free,” said Liz DiLullo Brown, Little League vice president of marketing and communication, who pointed to high adoption rates as an indicator that local leagues agree. “That is super important. But then, we’re also looking at technology that, frankly, anybody could pick up and learn and implement. That’s important to that volunteer who may change from year to year.”

While there is debate around whether fees for player registration, credit card processing and other services dilute the value of “free” software to a league, there is little doubt that Dick’s can afford to price its offering lower than its competitors because its profit center isn’t the software or services; it’s selling more cleats and bats.

“That’s where I think you are going to see us set ourselves apart,” said Ed Plummer, senior vice president of Dick’s Team Sports HQ. “We’re in it to enable youth sports to grow and assist our core business. We’re not in it for the monetization of charging people to register or charging NGBs fees to sign up.

“The software complements a broader set of businesses. It’s driving sales.”

Plummer chuckled at the observation that he spent the last six years as Dick’s vice president of CRM and customer insights, a fancy way of saying he was in charge of turning data into dollars.

The data attraction for Dick’s is an obvious one. A family that signs a child up for baseball likely will be in the market for cleats and a new bat. If they’ve opted in, the retailer already knows which of its nearly 700 stores they live closest to, how old their children are and what sizes they wear.

But the other companies also see broader possibilities.

Because practices are at a specific time and place, there’s particular value for potential sponsors in other categories. Soccer drills slated to wrap up at 6:15 p.m. and there’s an Applebee’s near the fields? That might be a good time for that chain to push mom or dad a reminder or a tonight-only coupon.

Last year, the teams using SI Play’s Tourney Machine app booked about 3 million hotel rooms. What better time for one of them to stumble upon a discounted hotel rate that includes a room for a pizza party than when they’re signing up for an event.

“Click here if you want that,” Karp said. “We can provide it.”

Opportunities for all

The entry story of Wechsler, the Blue Star founder, is a reminder that the volunteers processing registrations are no less frustrated than the parents signing up their kids.

This realization, and the business opportunity that goes along with it, came to Wechsler one morning a bit more than a year ago, after a clunky sign-up experience that had become commonplace for him, since each of his three children has played at least two sports.

“You spend 20 minutes on a website registering your kid when he’s been on the same team for five years,” said Wechsler, glancing up at an office wall covered by blown up action photos of his children. “And you’re going to do it again and again and again, in multiple sports with multiple kids.”

With his payments background, Wechsler naturally was taken by the volume of youth sports sign-ups. Not only are there a lot of them, but they’re almost always paid by credit card. While most merchants choose their payment processor based on cost, the volunteer board members who make that decision for leagues and clubs prefer convenience and reliability, typically opting for the provider that integrates easily with the services that they do care about, like registration and communication.

Wechsler estimates that the margins made processing payments for youth sports sites are about four times higher than those of traditional businesses.

“I wasn’t going to get back into the working world again,” Wechsler said. “But this is interesting.”

After negotiating out of non-competes with the buyer of his last two companies, Bain Capital, Wechsler went to work finding the funds for a consolidation of the youth registration market. Bain joined him as a condition of his release from his non-compete. For the bulk of the $100 million in funding, he landed Providence Equity Partners.

During an unrelated meeting, Wechsler mentioned the venture to Cowboys COO Stephen Jones, who suggested that his parents and two siblings might want to invest.

At a second meeting, Jerry Jones and family committed to invest $5 million. But Wechsler said he wanted more. He had access to capital. What he needed was contacts — and a degree of access to the Cowboys brand, or some form of it. Thus was born Blue Star, headquartered in prime office space at the Cowboys’ swanky headquarters in Frisco.

While Blue Star’s deep-pocketed acquisition spree has caught the attention of its competitors, they wonder aloud about the degree to which Wechsler can integrate them. He says there is no point in beginning that project until more pieces of the puzzle are in place, but that his intention is for a unified brand that provides high-end software, and to a far broader range of youth and amateur sports users than SI Play, Dick’s or SportsEngine have targeted.

Studying the approaches of his three competitors, he can see potential in all of them: Dick’s to sell more shoes and bats; SI and NBC to aggregate an attractive audience; all of them building around the premise that the digital natives now cycling in as youth sports parents and board members will not only expect, but demand, more than their predecessors.

“What’s interesting is, I don’t know what happens in the future, because we’re all right,” Wechsler said. “There are opportunities for each one of us.”