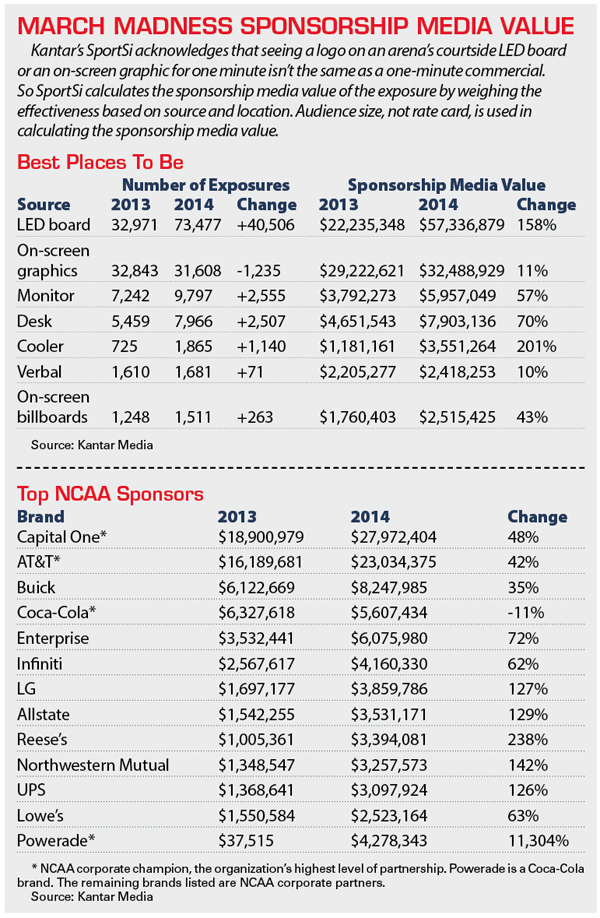

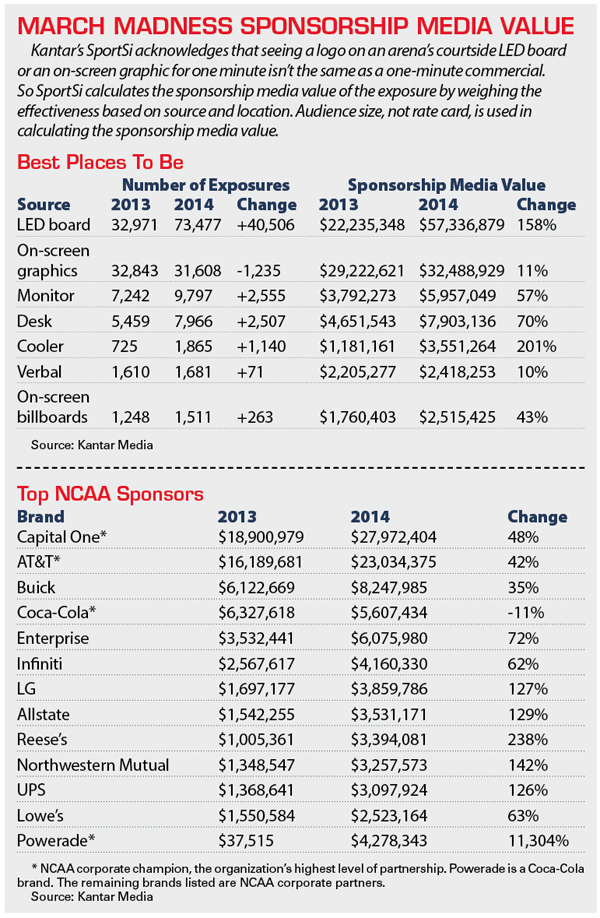

It was 2013 when the NCAA finally welcomed corporate sponsors inside arenas during March Madness with limited visibility on the LED courtside signage. Two years later, research shows that NCAA tournament courtside signage is now the most visible and valuable exposure that NCAA sponsors receive, even more than the impressions from on-screen graphics or studio shows.

“The regular season is so segmented; everything comes down to these three weeks,” said Larry Mann, executive vice president of rEvolution’s media group, which represents NCAA corporate partner Northwestern Mutual. “Courtside has really become a big deal. You used to never see that in the arenas. Now it has added tremendous value.”

Specifically, the LED courtside signage is doing more to drive up sponsor visibility during the tournament than any other source, according to a study by Kantar Media in association with West Virginia University’s sport management master’s degree program.

“The LEDs are delivering more quality exposure for the sponsors over a shorter period of time,” said Tracy Schoenadel, a vice president at Kantar Media.

Kantar teamed with West Virginia to conduct an in-depth study on sponsor exposure during March Madness beginning with the 2013 men’s tournament and compared it with 2014. Among the more than two dozen brands measured each year, Capital One ranked first in sponsorship media value, followed by AT&T, Buick, Coca-Cola and Enterprise.

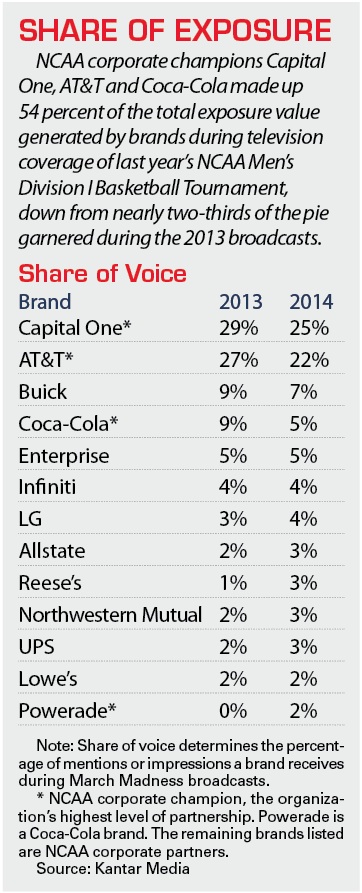

But a different category — share of voice — showed that those top brands were not receiving quite as much exposure because there were so many new brands. Turner and CBS, which jointly sell and manage the NCAA’s corporate program, now have 18 sponsors, up from 12 in 2011.

Share of voice determines how many mentions or impressions a brand receives out of all the mentions and impressions during March Madness broadcasts. Capital One, the leader, had a 29 percent share of voice in 2013, but that dropped to 25 percent in 2014. AT&T and Coca-Cola saw similar drops in share.

Despite the loss of share, those same companies saw their value increase in 2014 because of the value added by courtside signage. Capital One saw its sponsorship value go up 48 percent, while AT&T was up 42 percent.

“We’re not plowing new ground — in fact we’re behind the curve, intentionally,” Mark Lewis, the NCAA’s executive vice president of championships and alliances, said of the increased sponsor presence in the venues. “You still see less at our events than you see in other sports. And that less-is-more approach, I think, is one of the reasons the research shows more value coming through.”

NCAA corporate champions — AT&T, Capital One and Coca-Cola — receive more time on the courtside signage than the 15 corporate partners because their financial commitment is higher. Corporate champions typically spend $20 million to $30 million a year or more, while those companies at the partner level spend $10 million to $15 million annually.

Brands that were not an official NCAA partner, such as venue naming-rights holders — Honda Center, FedEx Forum and Lucas Oil Stadium, for example, hosted regional semifinals and finals last year — did not receive any measurable exposure in either year. Other than AT&T Stadium, site of the 2014 Final Four, announcers and on-screen graphics referred to the name of the city, rather than the naming-rights holder.

SEE ALSO:

Kantar calculates value by factoring in, among other things, television audience size, the duration of the brand’s logo and its location and clarity on the television screen. Schoenadel also said Kantar uses the actual cost of the spot, as opposed to each network’s “rack rate,” which historically has been industry standard. Additionally, when an announcer mentions a brand, that’s given a weight of 10 seconds of exposure.

|

Coca-Cola’s courtside signage has helped put it fourth among NCAA sponsors in media value.

Photo by: GETTY IMAGES

|

The 2013 tournament marked the first time that sponsors received exposure courtside in a limited capacity. In 2014, the exposure that sponsors received was more constant and more vivid in its full-color presentation. The NCAA contracts Van Wagner Big Screen Network to install the courtside signage at tournament sites that don’t already have them.

The same is holding true with this year’s tournament, Schoenadel said, especially considering that ratings reached new highs for the first

{podcast}

SBJ Podcast Archive:

From March 16: College writer Michael Smith and editor Tom Stinson discuss some of the ways in which a panel of athletic directors would like to make college basketball better.

weekend of the tournament.

Kantar’s research showed that sponsor duration and sponsor occurrences shot up in 2014, thanks primarily to the courtside visibility. Sponsor duration on screen increased 56 percent in 2014 over 2013, while sponsor occurrences went up 21 percent.

In previous years, the on-screen graphics were the best source of sponsor visibility, but courtside signage surpassed on-screen graphics in 2014. Based on results of the first weekend of March Madness, Schoenadel expects the data to be similar this year.

While courtside signage ranked No. 1 and on-screen graphics were No. 2, in terms of greatest exposure, the monitor and desk during the CBS and Turner pregame, halftime and postgame studio shows came in next (see chart below). The Powerade/NCAA co-branded cooler, another courtside element, placed fifth.

A more cluttered NCAA space could be something sponsors contend with in the future as Turner and CBS sell more deals. Kantar counted 20 brands that had an NCAA affiliation in 2013 compared with 25 in 2014. That includes multiple brands within a company. For example, Unilever is an NCAA partner, but it uses both Dove Men+Care and the Axe brands in its commercials during March Madness. Coca-Cola has Powerade. Amazon advertises its Kindle Fire.

But marketers gave Turner and CBS high marks for enabling each partner to carve out its own space.

“You’re seeing more ways and more opportunities for sponsors to participate, and when that happens, value goes up,” said Tyson Webber, GMR Marketing’s executive vice president of client management. GMR’s NCAA clients include Reese’s and Lowe’s. “There are more partners now, but there’s plenty to go around.”