The NBA’s focus on gambling and its related business impact continues, with the league using its recent All-Star Weekend to push ahead its support of legalizing sports wagering.

NBA Commissioner Adam Silver highlighted the issue of further legalization of gambling on pro sports by making it a subject of the opening panel at the Technology Summit, which always attracts the most industry insiders of any event during All-Star Weekend.

To be fair, the first session of the summit was titled “Gaming in a Digital Universe,” but gambling was the topic du jour, catalyzed by Silver’s earlier advocacy of legalizing wagering on pro sports along with the league’s subsequent sponsorship deal with FanDuel.

That agreement included the NBA taking an equity position in the pay fantasy site.

Daily fantasy has turned into a gold rush of sorts for NBA teams, 16 of which now have such sponsorships since the category opened up last fall.

“It has become one of our top sponsorship categories,” said Amy Brooks, executive vice president of team marketing and business operations for the NBA.

As for legalized forms of more traditional wagering, while there is a feeling of inevitability on the topic across pro sports, no one is willing to bet on when exactly it will happen.

At the Technology Summit, it was suggested that prohibitions against gambling would eventually disappear the way earlier misgivings about secondary ticketing have vanished. Others suggested that widespread legalized sports betting would eventually roll out along the line of blue states (pro-gambling) and red states (anti-gambling).

Gambling as a stimulus for greater engagement was trumpeted, as well. One piece of supporting evidence offered was that 75 percent of all NBA bets in the U.K. (where sports wagering is legal) occur after the games begin.

An intriguing tangential issue is whether pay fantasy will fade away if wagering on pro sports becomes widespread.

“I’m not smart enough to answer that question definitively,” said Golden State Warriors President Rick Welts, “but you aren’t the only one asking. The one thing we all know now is that fighting consumer behavior fueled by technology is a losing strategy, and this is all being fueled by technology.”

There’s still considerable time left for pay fantasy to grow, but it’s interesting to consider that the NBA’s support of sports gambling could eventually kill a company like FanDuel, in which it owns a stake.

■

NBA: NOTHING BUT ANALYTICS: Analytics have been all the rage in the NBA in recent years, as teams look for deeper measures of player performance. Now, the league is taking a similar big data approach on the executive front with a new “talent analytics” effort designed to measure and compile data on sales executives across the league.

The league, in partnership with Mc-Kinsey & Co., calls the effort “Sales DNA.”

|

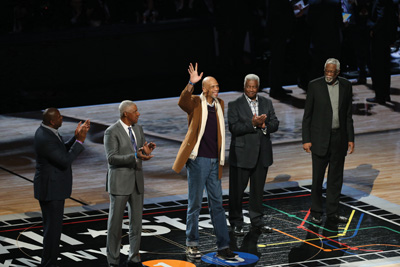

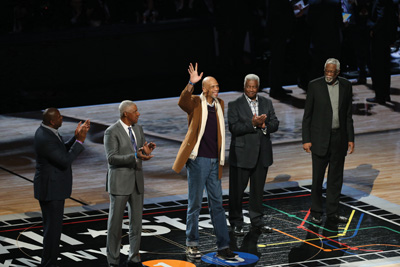

Legendary lineup: Magic Johnson, Julius Erving, Kareem Abdul-Jabbar, Oscar Robertson and Bill Russell were honored during the game.

Photo by: NBAE / GETTY IMAGES

|

The program was unveiled last month and is designed to identify characteristics regarding top sales performers: which skills they possess, and which incentives motivate them to perform at the highest level.

Using an online survey and offering anonymity in the process, team representative were asked a series of questions intended to identify strengths and areas of improvement for sales staffers. Representatives from all 60 NBA, WNBA and D-League teams participated, with about 1,400 sales and service representatives ultimately taking the survey. The results were aggregated and analyzed by McKinsey and presented to the NBA, which then shared the results with the teams.

The league and teams aim to use the data to determine the best qualities of their top sellers and then use that information for hiring, training, and motivating their sales staffs, said the NBA’s Brooks.

“We are just scratching the surface on it,” she said. “It shows what our best performers look like. From a recruiting standpoint, we want to be interviewing in a way that points out the intrinsic skills that lead to success. We are just rolling it out and feel the notion of talent analytics has a lot of potential.”

The NBA is banking on the use of the data to help its teams beat this season’s record of 280,000 full-season tickets sold. The rise of the Toronto Raptors, the rebranding of the Charlotte Hornets and the LeBron James-led Cleveland Cavaliers have helped drive this year’s sales.

Additionally, through All-Star Weekend, the NBA had sold out 55 percent of its games, with 25 of the league’s 30 teams either up or flat in their number of sellouts compared to midseason last year. Overall, the total number of sellouts leaguewide through All-Star Weekend was up 23 percent.

■ TURNER TIME: Turner President David Levy was the picture of calm courtside at the Barclays Center an hour before his network would begin their Saturday night All-Star broadcast from Brooklyn.

|

Turner’s Levy says summer meetings

produced innovations in All-Star coverage.

Photo by: GETTY IMAGES

|

Levy had good reason to relax given that he has locked up the league’s All-Star programming for Turner for years to come as part of the NBA’s new $24 billion deal with both Turner and ESPN/ABC that runs through the 2024-25 season. That deal takes effect in 2016.

Holding onto the bulk of the All-Star programming was a priority for Turner in the new TV deal. The network has aired the Saturday night all-star programming since 1985. It added the All-Star Game to its lineup in 2003.

“It was important to keep this weekend,” Levy said on Saturday night, just before TNT would inject some new wrinkles into the All-Star Saturday broadcast. The network looked to liven up the crowd at the Barclays Center during the skills contest coverage by piping into the arena the audio from Turner’s TV coverage — at the same time trying to make the television viewers feel closer to the in-arena action.

On Sunday night, Turner for the first time simulcast on TNT and TBS the All-Star Game, from Madison Square Garden.

“We are just testing it,” Levy said. “There are some displacement costs, so we will see.”

The changes came out of a weeklong All-Star Game skull session Turner held last summer. “We sat for seven days and watched every All-Star weekend,” Levy said. “We see things we want to do better.”

Levy also was circumspect in discussing the logistics of broadcasting this year’s All-Star events at two venues with two host teams in the same market.

“It’s double the number of trucks and double the number of technicians, but overall, the city is one of the best places to be,” he said.

The All-Star Game on Sunday night drew 7.2 million viewers, down about 4 percent from last year, when the game aired solely on TNT. Meanwhile, TNT drew 6.1 million viewers for its Saturday night coverage this year, up from 5.7 million viewers last year.

■ UNIFORM CODE: Adidas has held NBA on-court apparel rights since 2006, an agreement that extends through the 2015-16 NBA season.

The party line from league officials is that it’s still too early to be talking about the next deal. However, uniform deals are usually completed a year or more out — to accommodate design and manufacturing deadlines and to allow time for possible liquidation of old inventory — so it’s certainly not too early to handicap.

Historically, the NBA has valued partner loyalty more than any of the big leagues. As the most global of the U.S. stick-and-ball leagues, the NBA values Adidas’ overseas reach, even while decrying its lack of domestic potency. Under Armour’s brand equity is second only to Nike’s among teens and in the sporting goods channel, but look no further than last year’s bidding war over Kevin Durant to see who wins when the Eager Beavertons are focused.

If the bidding escalates — and judging by the gains the NBA got with its new TV contract, it likely will — this will get down to how much Nike values the exposure an NBA uniform deal entails. Keep in mind that Nike has had the vast majority of NBA players under contract for years.

Two other important factors: As of the current contract, NBA uniforms do not carry branding from the manufacturer (NBA warm-ups do); and there is always the possibility of ads on uniforms, which would change the business model.

Silver has termed uniform advertising inevitable.

■ BUCKS BUSINESS: Milwaukee Bucks President Peter Feigin was used to the arctic weather in New York over All-Star Weekend given that he works in Wisconsin. Sitting in the lobby of the Four Seasons Hotel on Friday afternoon of All-Star, he quickly warmed to the team’s future as he works to develop a new arena in Milwaukee’s downtown.

|

The Bucks’ Peter Feigin says work on a new arena should start this year.

Photo by: SCOTT PAULUS / MILWAUKEE BUSINESS JOURNAL

|

“We should have a shovel in the ground by November,” Feigin said.

The clock is ticking.

Bucks owners Wes Edens and Marc Lasry have said they will pay at least $150 million toward the project, with former owner Herb Kohl set to contribute $100 million. But financing is not complete, as the team, city and state officials work to find a way to pay for the project in full. If construction of the arena does not begin by late 2017, the NBA has the option to buy the franchise.

Feigin said the team is moving closer to choosing an architect for the planned 17,500-seat arena and retail development project. While he would not provide any specific design details, look for the team’s potential new home to reflect a bit of a North Woods flavor.

“There will be the inclusion of wood,” Feigin said.

The Bucks have seen their local television ratings on Fox Sports Milwaukee skyrocket this year along with a 10 percent increase in average attendance compared with last season. But there is a lot of runway at the gate still: The Bucks’ average attendance of 14,835 fans per game and their full-season-ticket base of about 5,000 are among the lowest such marks in the NBA.

■ MERCHANDISE MATTERS: League officials termed this year’s All-Star licensed merchandise sales as being among the top four all time, ranking behind Las Vegas in 2007, Dallas in 2010 and Los Angeles in 2011.

The winter weather accelerated sales of cold-weather products, like the knit ski caps from various licensees bearing the All-Star “New York subway” logo. Other top sellers: Adidas’ All-Star Game jerseys (with first and last names on the back); Spalding’s replica All-Star Game basketball; and the new on-court socks from Stance.

Venue sales were juiced by having three prime ancillary events that are typically featured at an NBA FanFest convention center location — the celebrity game, the D-League All-Star Game and the All-Star practice — in NBA arenas for the first time.

Merchants of licensed products were supported with an impressive 22 retail appearances by NBA players, including 13 at Modell’s, highlighted by slam-dunk winner Zach LaVine on Sunday. Unfortunately, 60 mph wind gusts on game day forced Modell’s to remove the tents housing pop-up retail outside of Madison Square

|

The All-Star ball, jerseys and socks were hits with fans.

|

Garden.

“There was good buzz and it was a great branding opportunity, but the cold weather kept a lot of people at home,” said CEO Mitchell Modell. “On the other hand, the [All-Star Game] pompom hats were blowing out.”

For the year, another merchandise sales record is in reach, said Chris Brennan, NBA senior vice president of sales development and retail marketing. He said sales are buoyed by the strong performance of Take-Two’s “NBA 2K15” licensed video game, a category now “on par with apparel” for sales among NBA licensees.

As for the league’s own retail plans? An Oct. 15 opening of a new NBA Store at 45th Street and Fifth Avenue is still on track, Brennan said. The league signed a 20-year lease for the 25,000-square-foot space late last year.

■ ROUNDBALL RENEWAL: As the NBA heads toward the home stretch of its regular season, league marketers are looking at renewals in some of its biggest sponsorship categories.

Up after the current season is State Farm, one of the league’s most active partners and a brand that dropped a long-standing MLB partnership to invest more heavily in the NBA.

Sprint, a league sponsor since 2011, also has rights expiring after the current season. Sprint signed with the NBA for a then-record number in 2011. Having dropped its NASCAR commitment, it will be interesting to see if it wants back in.

With its MLB deal expiring after this season, rival cell carrier and former NBA sponsor T-Mobile has some interest in those rights.

The carbonated soft drink category should be captivating, as well. Coca-Cola has been an NBA corporate sponsor since 1986, and its Sprite brand is dug in as sponsor of the All-Star Slam Dunk event. However, business has fallen off at Coke, producing thousands of layoffs.

An interesting side note: Coke is the league’s second-oldest corporate sponsor, at 29 years. The only NBA sponsor with a longer tenure (31 years) is Gatorade, owned by … Pepsi.

■ STAR GAZING: Among league sponsors activating at All-Star, the sleek Nike/Foot Locker House of Hoops pop-up store adjacent to Madison Square Garden was worthy of admiration. It was as much of a basketball museum as it was an elegant pop-up retail concept.

|

The Manhattan NBA House had sponsors and MSG proximity, but suffered from a dark, drafty site.

Photo by: TERRY LEFTON / STAFF

|

At the other end of the spectrum was the Manhattan NBA House, within the old Farley Post Office, behind Madison Square Garden. Some of the league sponsor exhibits were there, notably American Express’ “Pivot,” a digital video experience designed to connect fans with NBA stars, and State Farm’s social media center, tied to its “National Bureau of Assists” campaign. However, the NBA House space was dark, unfinished and had all the charm of a high school science fair in a drafty and under-lit gym.

Without having the Javits Center available, perhaps the league should have suspended the idea of a fan fest instead.

The merchandise store within the NBA House was jammed with products but serviceable. However, did anyone from AmEx observe there was not a single sign promoting use of its payment products there? A notable omission.

|

Kumho Tire was all aboard its All-Star effort with considerable subway ad inventory.

Photo by: TERRY LEFTON / STAFF

|

One couldn’t help but be impressed by the branding efforts of Kumho Tire, a second-year sponsor, signed too late to activate around last year’s game. The Korean tire brand’s signage buys included the top of the backboards at the All-Star Game and considerable subway inventory, including a takeover of the Times Square/Grand Central Shuttle. The amount of subway ad inventory raises the question of whether public transportation in the nation’s biggest city was the most effective place to advertise tires, though.

The Brooklyn Nets used the All-Star showcase at Barclays Center to host some 20 executives with the hope of winning their sponsorship business. The executives not only attended the All-Star Saturday night event at the Barclays Center, but the executives also played pick-up basketball on the Barclays Center hard court on Sunday morning.

Next year, the All-Star Game heads north of the border to Toronto, and at least three teams are hotly competing for the 2017 game: Cleveland, Charlotte and Portland. In addition, the Sacramento Kings are looking to leverage their new $477 million arena (due to open for the 2016-17 season) by planning a bid to land the 2019 All-Star Game.

“Our downtown arena will serve as a global model of technology and sustainability while showcasing Sacramento’s unique culture,” said Kings President Chris Granger. “Together with our regional neighbors, we’ll make the case that Sacramento is ready to host the NBA All-Star Game and other major events.”