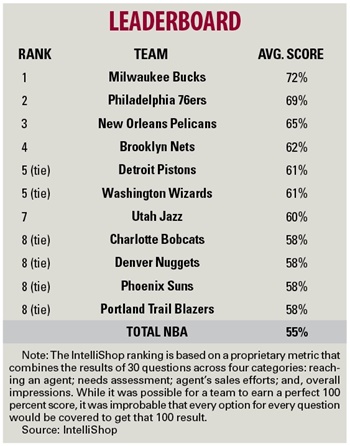

The Milwaukee Bucks and their season-ticket sales staff scored the highest mark among NBA clubs in a mystery shopper survey done this season by research firm IntelliShop exclusively for SportsBusiness Journal.

|

Mystery shoppers found plenty to cheer about in Milwaukee.

Photo by: NBAE / GETTY IMAGES

|

The survey features professional mystery shoppers calling each club multiple times over a five-week period, extending from the start of the preseason through the first two weeks of the regular season, to inquire about buying season tickets. The shoppers evaluated how well the agents performed through the sales process, including touting the benefits of full- and/or partial-season-ticket ownership; assessing the needs of the prospective buyer; closing the sale; and overall ability to engage the prospect emotionally (see methodology, below).

The Bucks led the way in a number of areas. During every surveyed call, for example, the team’s salesperson made an effort to engage in small talk outside the immediate discussion of the ticket sale. The league average for that measure was 46 percent. Additionally, 80 percent of the time, Bucks agents asked the caller to go to the team’s website during the call in order to see the layout of the arena (league average: 46 percent); and 80 percent of the time Milwaukee agents played up the benefit of exclusive access to special areas for season-ticket holders, such as select food vendors or social areas. Less than one-quarter of the agents leaguewide took such actions.

|

Loehrke

|

Ultimately, 90 percent of the Bucks’ conversations were rated by the IntelliShop callers as “above average” or “one of the best sales experiences I’ve ever had,” matching the Denver Nuggets and Washington Wizards for the highest such score in the survey.

Following the Bucks on the survey’s leaderboard were the Philadelphia 76ers and New Orleans Pelicans. Each of those top-three clubs is operating in the wake of notable changes in its front office.

In Milwaukee, Ted Loehrke was hired as chief revenue officer, a newly created position for the club, in October 2012. This past spring, Jamie Morningstar from Madison Square Garden was hired as vice president of ticket sales and service.

|

O'Neil

|

For the 76ers, industry veteran Scott O’Neil came aboard in July as CEO. The team also hired Chris Heck as chief revenue officer and increased its ticket-sales staff over the summer from about 15 employees to 60, with more hires expected since then.

No team staff did a better job asking questions than the Sixers’ staff, according to the survey results. For example, while attempting to assess the needs of the caller, 67 percent of the Philadelphia agents contacted asked “Who will be going to the games with you (spouse, kids, clients, etc.)?” the highest such rate in the NBA (league average: 29 percent). Ultimately, the team’s agents asked an average of 3.75 needs assessment questions during the calls made, compared with a leaguewide average of 2.65 questions.

|

Stanfield

|

In New Orleans, a new team nickname, an improved roster and venue, and a change in sales culture brought on by new ownership helped push the Pelicans this season to their highest season-ticket sales total since moving to the city in 2002. The team now boasts 13,500 full-season-ticket holders, according to Mike Stanfield, senior vice president of sales for the Pelicans and the New Orleans Saints, topping the NBA club’s high of 11,800 for the 2008-09 season.

The Pelicans were bought in April 2012 by longtime Saints owner Tom Benson, who merged the front-office staffs of the two franchises. Stanfield, who has been with the Saints since 2001, said the longtime success of the Saints’ staff (the team has sold out every game since September 2006 and has a long season-ticket waiting list) was parlayed into the Pelicans’ operations.

“We are all singing from the same hymn book now,” Stanfield said. “Everyone here is well-versed on our philosophies, and expectations are high and crystal clear. We do a lot of training … and we feel if we are all telling the same story — new owners, new on-site practice facility, upgraded arena and an exciting team — fans will see that all the promises we made when we bought the team have been fulfilled.”

The strategy of teams selling with a narrative was echoed by Amy Brooks, senior vice president of team marketing and business operations for the NBA.

“The sales focus is on telling a compelling story about the team and the benefits of the season ticket,” Brooks said.

Brooks said the league hosts workshops throughout the year where team representatives share best practices. The league also internally secret shops all the teams regularly on the entire ticket-sales process (using league employees) and provides the results directly to the clubs.

Going into this season, the league had sold more than the record 250,000 full-season tickets it sold last season, and the Pelicans were among the top five in attracting new full-season-ticket clients, Brooks said.

The Washington Wizards, according to the NBA, were also in that top-five class for 2013-14. The Wizards were among the top scorers in the IntelliShop survey, as well.

Overall, 60 percent of the mystery shoppers said that compared to other telephone sales experiences they’d had as mystery shoppers, the NBA call was “one of the best” or “above average.” In addition, according to the results, more than one-third of the agents had a phone personality that was described by shoppers as “truly exceptional.”

“This really is a good-news story for the league as a whole,” said Chris Denove, senior vice president of research and analytics at IntelliShop. “The league overall saw improvement over the 2011 study, and the NBA’s agents, for the most part, provided one of the better call-center sales environments we’ve seen at IntelliShop.”

The Ohio-based market research company was scheduled to conduct its first team-by-team NBA survey before the 2011-12 season but scaled back when labor issues delayed the start of that season by two months. No NBA-based survey was done for the 2012-13 season.

IntelliShop has also conducted a survey of each MLB club in each of the past three springs and conducts similar customer experience surveys in other industries, including automotive, luxury retail and health care services.

Denove expressed surprise at the large disparity between the performance of the 25 individual NBA teams, “especially since each team is selling the same basic product: a pair of season seats,” he said. He noted that the survey’s higher-ranking clubs were more likely to use a sales approach aimed at converting fence-sitters into season-ticket buyers, while other teams’ agents “often seemed to be there only to process ticket orders from fans who are already committed to buying.”

Among other findings in the survey:

■ Callers to the Houston Rockets spent the least amount of time on the phone between making the call and when an agent came on for assistance: 7 seconds. The leaguewide average was 1 minute, 27 seconds.

■ Across the NBA, 39 percent of agents took advantage of the call opportunity to advance the sales process from the telephone to a face-to-face meeting by inviting the caller to come down to the arena to sit in the targeted seats. The Cleveland Cavaliers led the way, with two-thirds inviting.

About the survey

IntelliShop, an Ohio-based market research company, provides customer-focused research services such as mystery shopping and customer satisfaction surveys. The company has an in-house staff of about 50 employees and it retains and manages panels of nearly 400,000 “mystery shoppers” who are brought in as topic-specific independent contractors for the company.

From Oct. 5 through Nov. 11, IntelliShop representatives contacted each NBA club indicating that they were interested in purchasing season tickets. Chicago, Miami, New York, Oklahoma City and the Los Angeles Lakers were excluded from the survey after their representatives indicated on the first call received that such tickets were no longer available. A minimum of 10 calls were completed to each of the remaining 25 clubs, with each call marking a survey opportunity.

IntelliShop educated its “shoppers” (each of whom lives in the same market as the team he or she was shopping) on the teams and the physical layout of each club’s arena. It also trained the shoppers to sound disappointed that the season seats they wanted would cost as much as they did once they learned that the quoted price was more than their budget. This allowed IntelliShop to measure which alternatives the sales agents used to overcome the price objection. The time and day of each call was randomized; the goal was to speak to as many agents at each club as possible.

The survey consisted of 30 mostly objective, multiple-choice questions. One question — “Which of the following ‘selling points’ did your agent mention as a reason for buying season tickets (or a partial-season-ticket plan)?” — had 13 answer options, all of which could have been checked off by the caller. More subjective topics included evaluating volume and clarity of the sales agent’s voice, the agent’s ability to retrieve and access information, and background noise.

IntelliShop conducts about 200,000 mystery shops and 230,000 customer surveys per year. The firm in the past year has evaluated event-day experiences at several arenas and stadiums but does not have an NBA team as a client.

ASSESSMENT OF CALL EXPERIENCE

Select results of the top-performing teams

To read: Representatives of the Milwaukee Bucks made an effort to engage in small talk outside the immediate discussion of the ticket sale on 100 percent of the calls made by IntelliShop surveyors to the club. That compares to 76ers representatives doing so on 92 percent of the calls, Pelicans representatives doing so 45 percent of the time, and leaguewide such conversation happening on 46 percent of the calls made.

| Sales representative made an effort to engage in small talk outside the immediate discussion of the ticket sale |

| 100% |

92% |

45% |

60% |

67% |

30% |

40% |

45% |

30% |

70% |

55% |

46% |

| Caller considered the conversation an “above-average” experience compared to other telephone sales calls, or “one of the best” ever had |

| 90% |

83% |

63% |

70% |

75% |

90% |

60% |

73% |

90% |

70% |

45% |

60% |

| Personality of the agent was “truly exceptional”* |

| 90% |

83% |

64% |

50% |

50% |

70% |

20% |

55% |

50% |

60% |

27% |

41% |

| Strong effort was made to convince the caller of the benefits of alternative ticket options once it was determined he/she couldn’t afford the full-season plan in the seats desired |

| 80% |

75% |

91% |

50% |

60% |

90% |

80% |

73% |

80% |

60% |

64% |

63% |

| Sales representative mentioned as a selling point that there is a system to allow season-ticket buyers to sell or exchange their unused seats |

| 80% |

67% |

73% |

40% |

25% |

60% |

30% |

45% |

30% |

30% |

45% |

33% |

| Sales representative mentioned as a selling point that season-ticket prices were discounted compared to single-game tickets |

| 20% |

41% |

54% |

50% |

33% |

30% |

50% |

18% |

40% |

20% |

54% |

32% |

| Strong effort was made to convince the caller to come to the arena and sit in the seats before buying |

| 70% |

42% |

36% |

40% |

58% |

60% |

60% |

45% |

70% |

50% |

18% |

39% |

| Strong effort was made to sell the benefits of the specific suggested seats by stressing intangibles** |

| 60% |

67% |

45% |

70% |

67% |

60% |

60% |

36% |

20% |

50% |

36% |

42% |

| Sales representative asked the caller at least once if he/she wanted to buy now, or put down a deposit |

| 60% |

75% |

73% |

50% |

75% |

30% |

60% |

73% |

70% |

50% |

73% |

62% |

* Defined as being “unusually engaged and enthusiastic — someone who sounds like they really love their job and dealing with people.”

** For example, being “really close to the action,” “near the home team tunnel,” or “one of the agent’s favorite places to sit.”

Source: IntelliShop