Indianapolis Motor Speedway President Jeff Belskus ascended the track’s Pagoda Tower at the start of the 2010 Indianapolis 500 and surveyed the crowd. The sight of the more than 250,000 spectators in attendance stirred him, but his sense of excitement faded when he caught a glimpse of the track’s north turn. The stands were thin.

|

GETTY IMAGES

A decline in attendance and viewership has taken some of the prestige out of the Indy 500. |

“For any track promoter, that’s disappointing to see,” Belskus said. “That’s our lifeblood.”

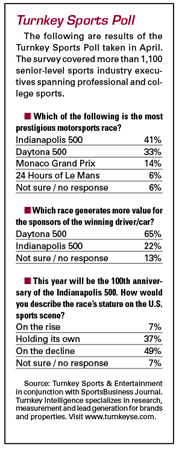

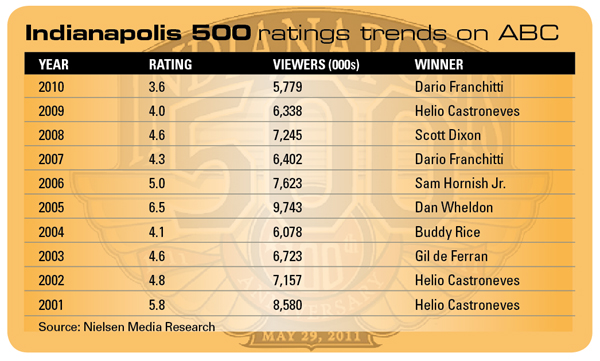

Indianapolis Motor Speedway doesn’t release attendance figures for the Indy 500, but press reports have chronicled attendance declines for several consecutive years. At the same time people stayed away from the track, fewer tuned in to watch the race on ABC. Ratings for the marquee event slid steadily before hitting an all-time low last year with a 3.6 Nielsen rating and 5.7 million viewers.

The attendance and viewership decrease has taken some of the shine off racing’s greatest spectacle. What was once a powerhouse national sporting event has slipped from its perch. Though it’s still mentioned along with the Masters and Kentucky Derby, it fails to captivate the casual sports fan the same way the others do.

“It’s still a huge, must-go-to event, but in terms of being the centerpiece of the IndyCar Series, it doesn’t have that pull or level of importance it once had,” said Mark Coughlin, Octagon Racing Group’s executive vice president and chief operating officer. “If you had asked someone in the mid-’80s to mid-’90s who won the Indy 500, a general sports fan might know. I don’t know if that would be the case now.”

Andrew Craig, the former CEO of CART, added, “The Indianapolis 500 was always the pre-eminent race on the American calendar, but it’s lost some of the magic.”

Belskus, who took over as speedway president in 2009, is working to restore some of the event’s national appeal. As the speedway celebrates the centennial running of the first Indianapolis 500 this month, he sees signs that recent changes ranging from new staff to new events are paying off. Ticket sales are up 5 percent, suites are sold out and three new, blue-chip sponsors have signed on for the 500.

“We’ve been through one of the most difficult economic times in recent years,” Belskus said. “It’s resulted in a lot of softness in a lot of areas. We seem to be coming back. In fact, we are coming back.”

Looking into the future, Belskus envisions an event with higher ratings, more national promotions by sponsors and a sold-out venue. He believes it’s achievable in three to five years but acknowledges that doing it will involve overcoming the past.

Recovering from split

|

INDIANAPOLIS MOTOR SPEEDWAY

Some 60,000 people watched the first Indianapolis 500 100 years ago. |

The Indianapolis 500 was born 100 years ago when the four owners of the Indianapolis Motor Speedway hosted the track’s first 500-mile race. Some 60,000 spectators turned out for the event, and it quickly distinguished itself as the most prestigious race in America.

Over the years, the race added traditions the way young girls once added charms to their bracelets. Fans sang “Back Home Again in Indiana,” drivers drank milk after winning, and race winners ranging from Mario Andretti to A.J. Foyt to Bobby Unser became heroes.

But in 1994 the event began to lose some of its luster.

Indianapolis Motor Speedway President Tony George announced that he planned to leave the established open-wheel series known as CART and form a new league known as the Indy Racing League. The IRL ran its first race in 1996, and the sport split.

Teams, drivers and sponsors picked a series, and many gave up the Indianapolis 500, which George initially used as leverage to prod teams to join the IRL. Marquee teams with star drivers such as Ganassi Racing, Penske Racing and Bobby Rahal Racing sided with CART and didn’t compete in the Indy 500. Sponsors like Miller Brewing Co. stuck with their team and ended their relationship with IMS.

“Sticking around with the Indy 500 wasn’t an option,” said Steve Lauletta, a former Miller sponsorship executive who is now the president of Chip Ganassi Racing. “We went to renew the deal [with Indianapolis Motor Speedway] and it went from just Indy to several other races in markets that didn’t make sense. The IRL was an unproven thing, and we wanted to keep the one that was proven. You had to pick sides.”

Several other sponsors such as Budweiser, Pennzoil and Domino’s dropped their support of the Indy 500, too. As a result, the race lost the national promotions those companies provided.

Viewers also abandoned the race. Up until the split, the event consistently earned more than an 8.0 Nielsen rating and 11 million viewers. After the 1996 split, it earned a 6.6 rating and 8.4 million viewers. A year later it was down to a 4.3 rating and 5.9 million viewers. It hovered in that range for most of the last decade, spiking once in 2005 to a 6.5 rating and 9.7 million viewers for a race Danica Patrick led with 10 laps to go.

The consequences of the split were compounded by the rise of NASCAR. Three years after CART and the IRL diverged, NASCAR signed its first centralized television deal with Fox, NBC and Turner. The deal gave the sport better promotional exposure on TV, and its ratings rocketed upward as open-wheel racing’s ratings declined.

Motorsports observers say NASCAR also may have hurt attendance at the Indy 500. The speedway added a NASCAR race in 1994, and Craig said the move cannibalized some of the regional interest in attending the Indy 500 because the track was no longer reserved for one special motorsports event. It had two major races, and even more after it later began hosting Formula One and Moto GP races.

“Inevitably, if you chip away at these things, it cuts into the appeal,” Craig said. “The split didn’t help at all. It never really came back.”

Capitalizing on a centennial

Belskus and IndyCar Series CEO Randy Bernard are focused on reversing the trends of the last decade. The series reunified three years ago, and they believe open-wheel racing’s signature event is positioned to regain some of its national prominence.

|

GETTY IMAGES

Since taking over as president of Indianapolis Motor Speedway in 2009, Jeff Belskus has been working to restore some of the sport’s national appeal. |

“In early 2008, you were going through the reunification process between IndyCar and Champ Car, and there was a good feeling,” Belskus said. “That’s taken a few years to translate into positive results. You combine that with this 100-year anniversary stuff and it puts us in a real good place right now.”

The speedway launched a three-year celebration of the centennial in 2009. After replacing Joie Chitwood as CEO that year, Belskus changed some of those promotional plans and took steps to shore up the speedway’s finances. The track laid off at least 70 employees, privatized a golf course and catering service, closed a motel operation and cut the number of events it hosted in May by a third. All of it was designed to make the facility more efficient.

In an effort to boost ticket sales, Belskus hired Mark Dill and James Newton as the vice president and director of marketing, respectively. Dill came with a marketing background from Nortel Networks, and Newton had experience as a field marketing manager for Red Bull.

In addition to those hires, Belskus restructured the ticket operations, creating the speedway’s first group sales team. He also looked to add new events for sponsors.

This year the track created an Emerging Tech Day, the “Back Home Again In Indiana” tour in 26 Indiana communities, and a Celebration of Automobiles competition featuring more than 250 vintage cars. Allison Transmission, AT&T and The Indianapolis Star signed on as the presenting sponsor of each. Belskus said sponsorship revenue from the Emerging Tech Day, which showcased sustainable auto technology, provided a six-figure boost to the speedway’s bottom line.

The speedway invited every living driver who competed in an Indy 500 to what it’s calling the “World’s Largest Autograph Session” scheduled for May 28. Legends such as Johnny Rutherford and Bobby Unser have committed to attend.

|

GETTY IMAGES

IndyCar Series sponsor Izod held a party in March in New York City celebrating the Indy 500’s milestone. Open-wheel drivers past and present took part, including (left to right) Mario Andretti, Helio Castroneves, Ryan Briscoe and Simona de Silvestro. |

“What Jeff’s trying to do bringing back past champions is a wonderful idea,” said Matt Petersen, Momentum Worldwide’s director of motorsports. “The pageantry they’re building upon with the centennial has been an impetus for me and others to think about watching and engaging in the event.”

Belskus credited the centennial with contributing to a 5 percent increase in ticket sales, the sellout of 128 suites, strong hospitality sales and the addition of sponsors Kroger, Mattel, Verizon, Shell and Allison Transmission.

ESPN’s “SportsCenter” is showing historic highlights from the Indy 500 throughout the month of May, and Belskus said that should help increase TV viewership, as well.

An increase would be a major benefit to the track and the IndyCar Series, whose five-race agreement with ABC is up for renewal after this season. The parties currently receive more than $6 million a year for the package. They hired IMG to assist with the TV rights negotiations and plan to seek more promotion and marketing support in the next deal.

Securing future support

Increasing its ratings is critical to the Indy 500’s future. Just Marketing International President Jon Flack said the declining ratings have meant that while the 500 still holds tremendous strength for business-to-business and customer entertainment, corporations are less reliant on the event to build a brand through television advertising.

The event needs corporate advertisers to promote the race nationally in order to increase ratings and restore its national significance.

“You have to get sponsors to get [the event] past the IndyCar fan and the motorsports fan,” Lauletta said. “That was lost over a period of time when you had these two [series]. The promotion wasn’t the same.”

This year’s Indy 500 has made some strides to restore that promotional support. Shell is back as a sponsor of a team for the first time since 2002 and signed on to sponsor the race, as well. It is promoting its affiliation across the U.S. by featuring Penske Racing driver Helio Castroneves in a campaign that promotes its Shell V Power fuel nationwide in print advertisements. But Heidi Massey-Bong, Shell’s senior business adviser for motorsports, said the company’s heaviest promotions — a $10 voucher good for a pole weekend ticket — are taking place in the Midwest region where interest in the event is strongest.

|

MATTEL

Mattel is using the Indy 500 for a publicity stunt by launching a race car off a giant ramp that resembles one of its Hot Wheels track sets. |

Others sponsors are making similar efforts to promote their relationship with the event. Izod, the IndyCar Series’ title sponsor, continues to promote the history of the Indy 500 outside the Midwest. It held a media event in New York earlier this month and decorated six windows at the city’s Herald Square Macy’s with Indy-related themes. And Mattel is doing a massive publicity stunt at the track in which a crew of stunt drivers will try to break the world record for a distance jump in an automobile by launching a race car off a ramp that resembles one of its Hot Wheels track sets.

Observers say activations like that will raise the Indy 500’s profile, but a great deal of the event’s future success will be contingent upon the success of the IndyCar Series. The more recognizable the series’ drivers become and the amount of interest it generates with the new car it plans to adopt in 2012, the more the Indy 500 will benefit.

“The next couple of years are going to be a big proving ground,” Bernard said. “The Indy 500 was always about who could bring the best car and best driver and win the best race of all time. They lost that. I’m optimistic that will come back in 2012.”

Belskus is similarly optimistic about the future. He believes the economic headwinds that tested the speedway the last few years have passed, and he believes the track is poised to increase its ticket sales in coming years.

“Getting to that goal of selling this place out, we know it’s not going to happen in 2011, but is it achievable in three to five years?” Belskus said. “Yeah, I think it is.”