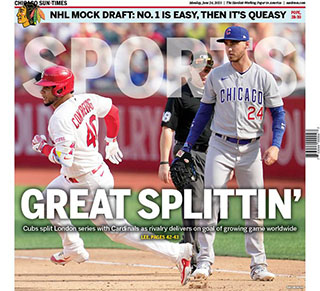

MLB sees big crowds, enthusiasm at London Series

The Cardinals and the Cubs "split Major League Baseball’s second London Series" over the weekend, and the sounds around London Stadium yesterday "suggested a decent number of the 55,565 in attendance were genuinely invested in the sport." Players from both teams "emphasised the seriousness of MLB’s trip across the pond." MLB will be "evaluating if and how they can continue to stage games in London after the last scheduled series" in 2026 (London INDEPENDENT, 6/25).

MLB is playing a couple of games in London this weekend, and the British broadcasters are putting on a show 🔥pic.twitter.com/dYNiw1WvjD

— Joe Pompliano (@JoePompliano) June 25, 2023

England’s newspapers and tabloids "didn’t dedicate much space to MLB’s London Series over the weekend." Still, the London Series "drew over 54,000 each game," with an announced attendance of 54,662 on Saturday and 55,565 Sunday -- which "weren’t quite sellouts" (CHICAGO SUN-TIMES, 6/25).

The weekend "offered everything sports watchers in Britain have come to expect" from visiting American major league events -- "a large crowd with considerable enthusiasm for the sport, but understandably limited emotional investment in the result." The crowd "seemed to consist of a good-natured cocktail of American tourists, baseball-curious sports fans and British baseball enthusiasts" (London GUARDIAN, 6/25).