|

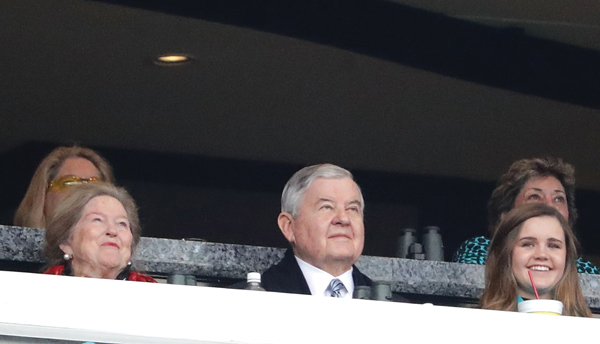

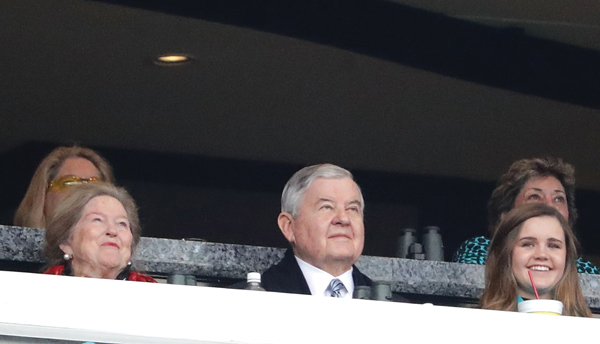

Jerry Richardson has owned the Panthers since the team’s formation in 1993.

Photo by: GETTY IMAGES |

Carolina Panthers owner Jerry Richardson walked out of the Mercedes-Benz Superdome on Sunday, Jan. 7, in what would likely be the final game of his nearly quarter century-long ownership of the team. His sale of the franchise comes amid a turbulent time facing the league, as many wonder if the league’s current challenges will affect the sale price of the franchise.

One example of those challenges comes with national viewership. The national rating on Fox for that wild card weekend playoff game, which came down to the final minute, was down 15 percent, underscoring a two-year skid in viewers of America’s top sport.

Richardson’s sale of the Panthers is clearly one of the most closely watched stories of the start of the year, as it is the first team to change hands in the NFL since ratings peaked in 2015. But despite the nearly 20 percent downward trend of the national ratings, and suggestions the NFL could fall from its catbird seat atop American sports, finance experts expect a league-record sale price over $2 billion, notwithstanding the controversies buffeting the league.

One investment banker even tossed out a figure of $3 billion as a possibility for the Panthers, which would be a record in all sports. The last NFL team to sell was the Buffalo Bills in 2014 for $1.4 billion.

Who's handling Panthers sale

Financial matters: Allen & Co.’s Steve Greenberg

Legal matters: Proskauer’s Joe Leccese and Moore & Van Allen’s Billy Moore

The “only headwinds in my view are concerns around concussions and the fact that the NFL is decidedly less global than other leagues, the NBA in particular,” said an investment banker, who like others in his position requested anonymity because he is seeking to represent potential buyers. “That may eventually impact value but [I] don’t think the Panthers will get dinged yet.”

The litany of issues that bedeviled the league in 2017 are well known: player protests, declining TV ratings, struggles in the new L.A. market. Richardson himself decided to sell after a report that he had acted inappropriately with female employees.

And indeed, one team position for sale, a one-third stake in the Tennessee Titans being shopped by Goldman Sachs, is finding little interest, sources said. Of course, that stake does not bring control (new controlling owners need to own at least 30 percent of an NFL team), and is complicated by other non-sports interests tied to the position.

No such issue clouds the Panthers, whose sale has several pluses in its favor.

“Scarcity [of teams for sale], huge demand to be an NFL owner, anticipated continued rise in value of media rights, ability [theoretically at least] to move the team, tailwinds of experiential/live entertainment generally, East Coast team that is easy for billionaires to get to,” said another investment banker.

While NFL TV ratings are down, football games are far and away the top content on television. And according to Gallup, 37 percent of Americans choose football as their top sport, more than three times the 11 percent who choose basketball, the No. 2 sport.

There are some factors unique to the NFL that will hold the price down. Roughly 80 percent of all league revenue is shared equally among the 32 teams, and league debt rules are strict and overly conservative.

That’s why marquee teams in the NBA and MLB can sell for over $2 billion, and it’s possible the Panthers might not set an all-time record sale price in sports.

Allen & Co. is handling the sale for Richardson, with a transaction finalized likely by the start of the 2018 season.