Gatorade sits high atop the sports drink marketplace but still faces challenges and challengers.

According to data from Euromonitor, Gatorade last year held an enviable 77 percent share of the U.S. sports drink market. Its closest competitor, Coca-Cola-owned Powerade, posted 20 percent.

“Powerade was the only competitor significantly funded enough so that it could go toe-to-toe with Gatorade on the shelf and support with a real marketing arsenal,” said Jeff Urban, Gatorade’s former senior vice president of sports marketing, who worked on the brand from 1999-2009. “I was never quite sure how interested Coke was in driving brand equity for Powerade. I imagine part of their goal was eroding our margins.”

The task for Gatorade is not only maintaining its market dominance but increasing the size of the sports drink

|

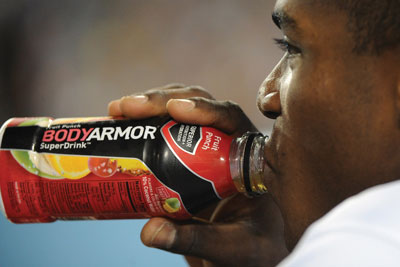

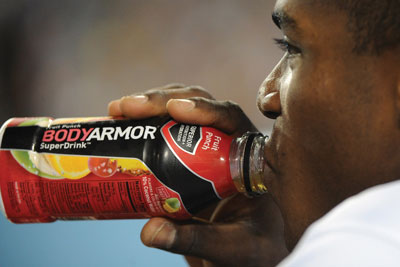

BodyArmor has signed a stable of young

star athletes to promote the brand.

Photo by: Getty Images |

category at a time when more consumers are seeking alternatives to sugary beverages.

A 2014 poll conducted by research firms Lightspeed GMI and Mintel showed that 18 percent of respondents said sports drinks are too high in sugar, while 11 percent said they are too high in calories. In the same survey, 23 percent of respondents said it is important that sports drinks are made with natural ingredients and 11 percent said sports drinks contain too many artificial ingredients.

Beth Bloom, an analyst at Mintel, said that in light of such consumer trends, new players in the sports drink category are touting formulas that contain no artificial ingredients. To compete with a behemoth like Gatorade, those new players are taking unique approaches to establish themselves in the market.

BodyArmor, a brand co-founded by Mike Repole in 2011, has established a stable of young star athletes including Andrew Luck, James Harden and Rob Gronkowski by offering them ownership stakes in the company. Repole, who co-founded Vitaminwater before selling it to Coca-Cola in 2007, said of BodyArmor’s approach, “These athletes have done partnership deals with us where they’ve invested in the company, they have options in the company.

They believe in this product. So, to me, it’s partnering up with the young, hottest up-and-coming superstars.”

BodyArmor in April scored its first team-level partnership with the Los Angeles Angels with the help of endorser Mike Trout, replacing Gatorade as the team’s official sports drink. Repole said the company is in talks with 15 to 25 pro teams and college programs about sideline rights. Despite the marketing momentum, BodyArmor is available at retail in only 35 states, and Repole said the brand has less than 1 percent brand awareness nationwide.

“It took 50 years for Gatorade to become as dominant as they are now,” Repole said. “Anybody who’s going to be the No. 1 sports drink can’t come in there and tell you this is going to be done overnight, or this is going to be done within the next year or two.”

Glukos, a line of sports nutrition products being launched by former Nike executive Mark Jensen, is seeking to establish its place in the market with distribution through specialty athletic retailers, as opposed to convenience and grocery stores.

Glukos President and CEO Mick McCormick said, “We’re not going to go there because they own that space. We’re going to say, ‘Continue to own it.’ We’re going to go over here based off of performance, and we’ve got a big business opportunity over here.

“We’re like a little fly to [Gatorade] right now because we’re a startup. But if you know how to market, and you have a better product, you’re going to have a good opportunity in the marketplace.”

Alex Silverman writes for SportsBusiness Daily.