Wanted: Company willing to spend as much as $70 million a year promoting NASCAR. Qualifications: Aggressive and effective advertising history and an ability to connect with millennials while keeping Gen Xers and baby boomers involved. Must have expansive interest and demonstrated success in social and digital media.

Other than those prerequisites, replacing Sprint as the title sponsor of stock car racing’s top series should be a snap. In December, Sprint told NASCAR that the mobile provider would leave racing when its contract expires after the 2016 season.

In 2004, Nextel replaced tobacco brand Winston as NASCAR’s top backer. That 10-year, $750 million deal came

|

Sprint is pulling out at the end of the 2016 season.

Photo by: Getty Images |

during a decade-long boom for the sport. In 2005, Sprint inherited the sponsorship after buying Nextel and, several years later, changed the name of NASCAR’s top circuit to the Sprint Cup Series.

“It’s the most coveted position in sports because of the positioning of it, so we’ll get out and see where we’re at,” NASCAR Chairman Brian France said during the annual media tour in Charlotte in January. Brent Dewar, NASCAR chief operating officer, told SportsBusiness Journal that the national presence of the sport and the length of the season make the sponsorship a unique opportunity.

Dewar and NASCAR want to have a new title sponsor committed by the start of the 2016 season. Then the company would have ample time to plan tie-in marketing and promotional campaigns for when the new deal started with the 2017 season. And, as every sports league and franchise knows well, bringing a sponsorship to life in a big way means as much as raking in the fee.

“The balancing act NASCAR will face is making sure they can identify and secure a partner that brings the best of all worlds: a solid financial investment combined with commitment from the new partner’s executive team to make this platform an active part of their business strategy,” said Brian Corcoran, president of Shamrock Sports & Entertainment. Corcoran, then at NASCAR, helped sell the sponsorship to Nextel, starting with an email to an intrigued marketing executive at Nextel.

|

NASCAR’s tweaks to the series championship format reinvigorated the sport.

Photo by: Getty Images |

Nextel and then Sprint spent an estimated $70 million to $75 million annually on the sponsorship, advertising time during race broadcasts, contributions to the drivers’ points fund, and extras such as a traveling mobile tour visiting speedways on race weekends.

France, during his state of the sport address in January, said he was doubtful Sprint would leave its current three-year contract early, but already there is much talk of the lead sponsor cutting back. The mobile tour has been discontinued, based on recent reports. And, as marketing executives made clear in interviews with SportsBusinss Journal and others, human nature and logic dictate that as a lame-duck sponsor the company, no matter how well-intentioned, is unlikely to have the same focus.

“It’s been my experience that when somebody makes a declaration they’re out, they’re out,” said Mike Boykin, CEO of Bespoke Sports & Entertainment. The next title sponsor is, in his words, crucial. “We’re at a very important time — is the sport going to take the next step and grow? There will be a lot of scrutiny and due diligence by NASCAR [on the next title sponsor].”

Sprint reduced its spending in the sport during the three-year contract extension that started in 2014. One expert estimates a price range of $40 million to $50 million annually for the next title sponsor.

Whatever the figure, NASCAR has spent the past decade trying to regain the momentum that pushed it to peak popularity in ticket sales, TV interest and sponsor spending a decade ago. Executives tout NASCAR trailing only the NFL most weekends, but the Sprint Cup Series is once a week with all the stars in one event. Cumulative audiences for the NBA and Major League Baseball on a weekly basis are more than comparable. Between 2005 and 2014, average viewership for NASCAR Sprint Cup races slipped to 5.3 million from 8.5 million people.

Marketing executives cited several factors as challenges beyond the decline in attendance and TV audiences.

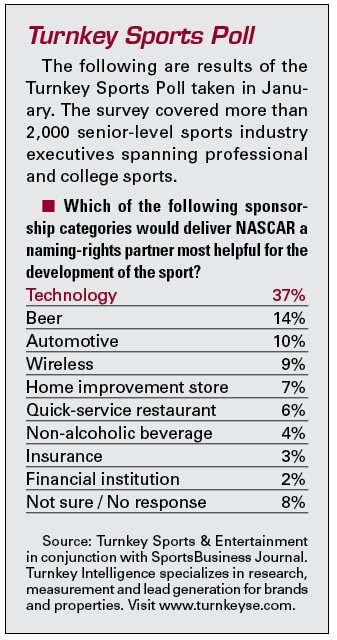

NASCAR must navigate the murky waters of sponsorship, problems of their own making. Prospective candidates will be ruled out because of conflicts with others in the sport (auto, beer and soft drink companies, to cite several obvious examples, could never have an exclusive deal in NASCAR). Or, another scenario might be that a company already supporting a team or track could be tempted to become title sponsor, but such poaching would be difficult to smooth over.

All sports, as France has said, suffered from the recession and sluggish economy starting in 2008, but NASCAR lost

more than most and has yet to fully recover.

Charlotte Motor Speedway began removing 41,000 seats this winter, the latest sign from tracks of downsizing caused by lagging ticket sales. Race teams have transitioned during the past six or seven years to combining multiple brands and companies as primary sponsors, a circumstance created when corporate backers became reluctant to foot the bill alone for a full season commitment.

On the upside, Fox and NBC begin a 10-year, $8.2 billion TV contract this season, an increase of nearly 50 percent over the previous broadcast rights agreement. Both networks seem committed to pushing the sport on various sister networks and through cross-promotion with entertainment shows and other programs.

Perhaps most important, NASCAR reinvigorated the championship format in 2014 with a simpler, reconfigured playoff format. Fans, race teams and others in the sport responded with enthusiasm. Add in the sponsor loyalty of racing fans, and the chance to have a brand mentioned constantly for a 10-month season, and the odds for finding a series sponsor improve.

“You’re out there front and center for months — that’s a hell of an opportunity,” said David Grant, co-founder of Team Epic. “Nextel and Sprint got their brand on the map with NASCAR. … It’s hard [for NASCAR] because so many logical prospects are already in the sport.”

Erik Spanberg writes for the Charlotte Business Journal, an affiliated publication.