The Sacramento Kings have signed a 20-year media rights extension with NBC Sports Group worth between $690 million and $700 million, another sign of the team’s resurgence under owner Vivek Ranadivé.

Ranadivé bought the team in June 2013 for $535 million and is set to build a $477 million arena complex for the franchise. Now, he has a media rights deal for the team that will keep the Kings on Comcast SportsNet California through the 2033-34 NBA season.

|

|

Vivek Ranadivé bought the Kings in 2013 for $535 million.

Photo by: NBAE / GETTY IMAGES

|

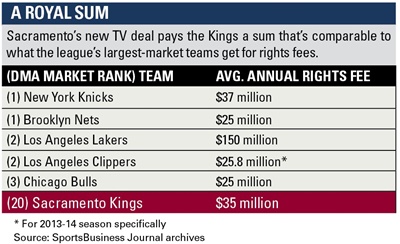

Sources peg the deal as being worth an average of $35 million a year over the next two decades, an amount that represents a significant windfall and long-term stability for a midmarket franchise that plays in the country’s 20th biggest designated market area. Terms of the team’s current deal were unavailable, but NBC Sports Group, which operates CSN California, will pay the team between $25 million and $26 million next year, with close to a standard 4 percent increase kicking in annually.

If the contract were to run the entire 20 years, NBC Sports Group would be paying the Kings more than $50 million in rights fees in the deal’s final year.

Like most local NBA media deals, the agreement includes a “reset,” which would adjust the fee to match market rates. It’s not clear when that reset kicks in, but similar deals have reset provisions that take effect at the 10-year mark of the deal, if not sooner.

The deal’s starting value falls in line with similar NBA teams’ media contracts. For example, FS Ohio pays the Cleveland Cavaliers an annual average of $25 million, and Sun Sports pays the Miami Heat an annual average of $20 million. In Los Angeles, Prime Ticket paid the Clippers $25.8 million last year.

The deal terms point to higher revenue for CSN California, which will sell all pregame, in-game and postgame advertising and sponsorships. The Kings handled those sales in the prior deal.

The deal also provides CSN California with more Kings content. The RSN will carry more games (80 compared to 70 last season, when 10 were sold to a local over-the-air broadcaster), and CSN California will produce more shoulder programming around the team, as well. The RSN has committed to add 30-minute pregame and postgame shows for each game. CSN California also has agreed to hire a reporter solely devoted to the Kings and will produce a monthly magazine show called “Kings Central.”

In addition, the deal calls for the RSN to produce season-preview and season-review shows, plus an annual NBA draft show.

The new deal replaces an agreement that expired this summer. It was negotiated by Kings President Chris Granger and NBC Sports Group President Jon Litner. Evolution Media Capital’s Alan Gold consulted with the Kings in negotiating the new agreement.

“I believe the terms of our new long-term agreement reflect a 21st century media deal,” Granger said. “NBCUniversal and Comcast SportsNet are best-positioned to help the Sacramento Kings provide fans with an unmatched viewing experience. We look forward to working together to create unique perspectives and innovative content across the many platforms where we interact with our fans.”

Last season, the Kings on CSN California averaged 26,000 homes per telecast, up 15 percent compared with the previous season but still toward the bottom of the league when compared with all NBA teams. Only seven NBA teams posted lower viewership figures last season.