Boosted by its lucrative new Canadian media deal and other revenue growth, the NHL is preparing a groundbreaking credit facility of at least $1 billion that for the first time would allow clubs to borrow from a centralized loan pool, finance sources said.

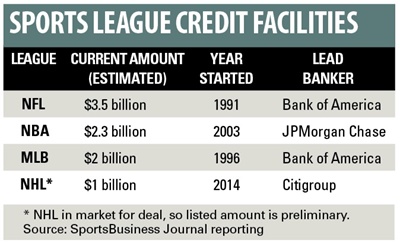

The NHL’s longtime banker, Citigroup, is in the market lining up banks to participate. The NFL, NBA and MLB have had credit facilities valued in the billions of dollars for years, the NBA the last to add one more than a decade ago. The NHL, however, has been without, as the league has endured a host of economic issues that have prevented such a financial undertaking — ranging from canceled and shorted seasons because of labor disputes, to financially ailing teams and subpar TV ratings.

The NHL does currently have a $600 million financing with Citigroup, but that is for use by the league office, sources said. The new deal would be separate from that debt.

What’s driving the new financing is the lucrative Canadian TV deal the league signed late last year with Rogers Communications: a 12-year contract valued at $5.2 billion Canadian ($4.8 billion U.S. last week, based on currency exchange rates). The league’s U.S. TV deal with NBC Sports pays an annual rate about half the amount of that Canadian deal.

The deal with Rogers came in a year that began with the NHL securing a new 10-year collective-bargaining agreement that should help the league’s economics. Then, last fall, the league outlined plans to increase revenue generated at the league-office level by $1 billion over a three-year span.

The NHL posted $3.2 billion in total revenue for the 2011-12 season, the last full season before the lockout-shortened 2012-13 campaign. For 2012-13, when each team played 48 regular-season games instead of the usual 82, the league posted $2.4 billion in revenue.

The NHL declined to comment, as did Citigroup.

Rob Tilliss, a former banker who now advises sports teams through his firm, Inner Circle Sports, said that with the new north-of-the-border media revenue, a credit facility in hockey is feasible.

“The Canadian rights deal was very strong for the league,” Tilliss said. “As a lender, both their U.S. and Canadian revenues now can underlie the credit facility, in addition to the franchise values. That gives lenders comfort.”

A banking source said how high the credit facility might get ultimately is determined by how many banks are willing to lend into the pool. In deals like this, a lead bank signs up other banks to also take shares of the credit, a process called syndication. Another finance source pegged the final deal at $1.5 billion.

Loans from insurance companies and other similar institutions (deals known as private placements) are also likely to fuel the coming financing, in addition to credit from banks.

Leagues organize these loan pools because for teams they are almost always cheaper to borrow from than if the clubs were to organize financing on their own. League credit facilities use leaguewide collateral, like the Canadian TV deal, and pledge those assets as repayment to lenders.

For NHL teams that have experienced financial losses and operate in challenging markets, the credit facility would represent a significant financial savings. Loans to these sorts of teams carry high-yield rates, while a league credit facility charges far lower terms. Such teams could then refinance their debt by tapping into the new credit facility.

Teams are generally free to use the loans for any purpose, though leagues do restrict how much debt a franchise can have. The NFL, for example, limits that no more than $200 million be secured against a team. The NHL, bankers said, generally allows debt for a franchise that’s equal to half of that club’s value.

For the sports finance world, news of the NHL deal is sure to be somewhat bittersweet. It means the NHL, which has had a string of troubled franchises, is on firmer financial footing. The league credit facilities, however, have in the past dried up business for sports lenders. Because teams can borrow cheaply from the league-backed pools, they do not have to rely on individual banks. The NHL has been an active arena for sports lenders.