When talks between NFL Network and Time Warner Cable broke off last month, a familiar refrain was heard time and again from corners of the sports industry: The country’s second-biggest cable operator once again was failing to support TV sports.

Time Warner Cable is the only one of the top eight distributors that has not signed a deal to carry NFL Network. It waited more than a year after Big Ten Network’s launch before reaching a deal to carry that channel. It relegated Tennis Channel and Charlotte Bobcats games to poorly distributed tiers. And it has been battling Mid-Atlantic Sports Network for carriage in North Carolina for years.

It’s been seen as an obstacle rather than a partner for sports rights holders.

|

Time Warner Cable will pay the Los Angeles Lakers $200 million a year and create seven channels for the Pac-12 Conference.

Photo by: GETTY IMAGES

|

That’s what makes Time Warner Cable’s current position as the darling of the sports rights marketplace so surprising. Over the past eight months, the cable operator has been in the middle of several industry-changing deals that revolve around sports, and it expects to be part of many more future negotiations in markets where it owns cable systems.

For example:

■ SportsTime Ohio has been talking to suitors about selling the Cleveland-based regional sports network. Sources say Time Warner Cable is among those suitors. So, too, is Fox.

■ Time Warner Cable is monitoring the Los Angeles Dodgers bankruptcy closely and is prepared to bid on those TV rights if they ever hit the open market.

■ Dallas Mavericks owner Mark Cuban has been public about the opportunity he sees to launch a new RSN with Time Warner Cable when his rights deal with Fox Sports Net expires in 2018.

■ Since February, Time Warner Cable has been part of deals that will see the creation of nine sports channels over the next few years: two with the Los Angeles Lakers and seven with the Pac-12 Conference.

This is the new Time Warner Cable, one that industry insiders say has changed the way it deals with sports leagues and sports teams. That includes a deal to pay the Lakers a jaw-dropping average of $200 million a year for the next 25 years. The size of that deal was so big, it is providing a constant undercurrent to the NBA’s labor problems, with small-market owners complaining that the size of the deal gives the Lakers an unfair advantage.

Even Time Warner Cable’s NFL Network negotiations were closer to being finalized this year than they ever had been, according to several sources.

This change is not the result of new personnel. It’s a mind-set change within the cable operator’s

offices — a concerted effort to get more involved in sports, giving the cable operator an opportunity to cut out the middleman and deal directly with rights holders.

The company launched a sports division this year — Time Warner Cable Sports — to identify opportunities and build relationships among rights holders and sports networks. Time Warner Cable hired longtime sports and media executive David Rone to run the division. Rone has spent his career at Fox Sports and CAA Sports developing deep relationships in the sports industry — relationships that Time Warner Cable believed it needed to tap.

“We felt like we had held back over the years and really had not done what we could,” said Melinda Witmer, Time Warner Cable’s executive vice president and chief video and content officer. “We certainly had interesting moments in time over the last several years when we could have gone more in the direction that we’ve gone now. For an assortment of reasons, we chose not to do that.”

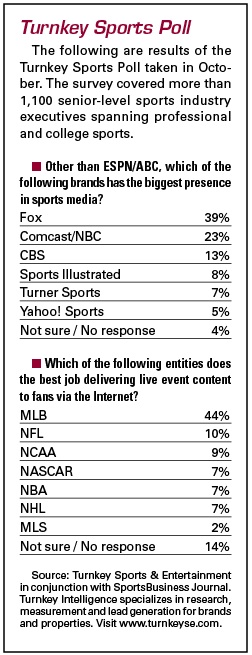

Sports rights have always represented a conundrum for distributors like Time Warner Cable. The biggest distributors — like Comcast and Cox — own a lot of sports content. But sports channels are, by far, the most expensive ones available on cable systems because live competitions — like sports, “American Idol” and “Dancing with the Stars” — make up the most significant programming genre that distributors carry exclusively. Time Warner Cable’s move deeper into the sports marketplace demonstrates that it wants more control over those rights.

“As Hulu, Netflix, video-on-demand and non-linear viewing changes and people’s viewing habits disperse, the one thing you can’t get without a [cable/satellite] subscription is live sports,” said media consultant Chris Bevilacqua. “It just becomes more valuable.”

At the table

It’s hard to pinpoint exactly when Witmer had the idea to start a sports division.

Time Warner had already dabbled in sports. It owns a small stake in the Mets’ RSN, SportsNet New York. It handles advertising for SportsTime Ohio. And it held Bobcats rights in Charlotte before selling them to Fox in 2008.

Until this year, though, Time Warner Cable was more focused on maintaining its subscriber base than acquiring sports rights. It sold the Bobcats rights to Fox Sports South, in part, because it didn’t feel that sports programming fit its News 14 Carolina program schedule.

At the time, Time Warner Cable was not considered a viable option for sports rights holders. In 2007, the Big Ten Network launched through a partnership with Fox. Last year, the University of Texas partnered on a channel with ESPN. Both channels have a big effect on Time Warner Cable, which operates cable systems throughout the Big Ten and Texas footprints. Neither channel called the cable operator about making an investment. Now, Witmer wants to be part of those conversations.

“It was an increasing realization that there was a need to have greater control over our destiny,” Witmer said. “I needed to make sure that Time Warner Cable is being brought these kinds of opportunities.”

While Time Warner Cable was on the sideline, other distributors were trying to pick up sports rights. Over the past several years, AT&T has been part of sports TV conversations in Houston (with the Astros and Rockets) and Detroit (with the Tigers, Pistons and Red Wings). Dish Network also has been part of those Detroit conversation, and DirecTV has kicked the tires in Houston.

But nobody was talking with Time Warner Cable and its 12 million national subscribers. Time Warner Cable operates nine hyper-local sports channels, like Metro Sports in Kansas City and Time Warner Cable Sports 32 in Milwaukee. These channels primarily have focused on high school and local college games for the past five or six years. “They don’t really hit the radar,” Witmer said. “They are very, very local exclusive channels, except for where we share D-1 college content with others.”

Witmer decided that she wanted to start pursuing professional rights. Married to a sports executive herself (senior NBA executive Bill Koenig), Witmer reached out to sports business executives to see how Time Warner Cable could get more involved with sports.

One of her first meetings, about two years ago, was a lunch in New York with longtime sports executives Bevilacqua and Rone.

Their message to Witmer was simple: It would cost a lot to get into pro sports through rights acquisitions and new channels. But owning sports rights and dealing directly with rights holders could help a company like Time Warner Cable retain subscribers.

“With consumer behavior and technology changing the face of how people consume, you need to have the direct relationship with the rights holder in order to adapt the business model,” Bevilacqua said. “Time Warner Cable is buying control and buying the ability to be flexible and adapt business models as consumer behavior changes. I think that has high value.”

Witmer’s team drew up a list of sports rights that they could pursue — ones that were expiring soon. As their first choice, they settled on the Lakers, one of the NBA’s marquee franchises, which was preparing to negotiate a new deal with Fox Sports Net.

In November of last year, Witmer reached out to the Lakers. By all accounts, the Lakers were surprised to hear from her. Time Warner Cable was not on the team’s list of potential suitors.

But after just three months, the two sides fashioned a blockbuster deal that would have Time Warner Cable agree to pay an average of $200 million per year to pick up the Lakers’ rights for the next 25 years. In exchange, Time Warner Cable planned to launch two new RSNs in the Los Angeles market: one in English and one in Spanish.

It instantly became one of the most significant media deals of the year.

“The door’s swung wide open, particularly since that Lakers deal was done,” Witmer said. “That probably as much as anything demonstrated that not only were we really interested in the right opportunity, but we were interested in acting on it, not just talking about it.”

Witmer followed up the Lakers deal by formally setting up the sports division, which currently numbers about 12 employees. In May, she hired Rone, one of the executives whose counsel she sought on sports issues, to run the division. A little more than a month later, Rone hired Mark Shuken from DirecTV Sports Networks to launch the Lakers RSNs in Los Angeles. It also hired cable veteran Dan Finnerty from Comcast to help sell the channels to cable and satellite operators.

Witmer immediately followed those hires later in July with a deal to launch the Pac-12’s planned channels through In Demand, a consortium of cable companies.

Bevilacqua was advising the Pac-12, and obviously knew of Time Warner Cable’s interest. He encouraged Pac-12 Commissioner Larry Scott to spend time with distribution executives to establish a relationship with them. That led to a July agreement to have Time Warner Cable, Comcast and Cox launch a national Pac-12 channel and six regional networks.

“To her credit, she was the one who was able to co-opt Comcast and Cox and help position and sell in what ultimately became the series of deals that we made. She was the spearhead from that side,” Bevilacqua said. “It took a lot of work and a lot of understanding.”

Time Warner Cable’s sports division was not done. In September, it agreed to pay an average of $1.5 million per year to wrap up high school rights to the California Interscholastic Federation for the next 15 years.

After the whirlwind seven months, it was clear that Time Warner Cable was no longer going to be ignored when sports rights arose in their markets.

Exacerbating the problem?

The size of those contracts, however, has led to charges of hypocrisy. How can Time Warner Cable complain about the high cost of sports on one hand, while actively bidding up those rights on the other hand?

|

Some see Fox’s deal with the Texas Rangers as evidence that the cost of sports still would soar regardless of Time Warner Cable becoming another competitor for rights.

Photo by: GETTY IMAGES |

It’s one thing for Time Warner Cable to achieve cost certainty through these long-term deals. It’s another for a cable operator that has gained a reputation as tough on sports rights to take part in bidding up those rights.

For example, the Lakers deal is six times higher on average than the current deal between the team and Fox. The Pac-12 deal will see the creation of the type of local sports channels that Time Warner has been bemoaning in other markets.

The deal also will turn Los Angeles into a market with four RSNs, which are among the most expensive on cable systems. The only other market with four RSNs is New York. In 2011, distributors are paying close to $10 per subscriber per month for the four combined RSNs: YES Network, SportsNet New York, MSG and MSG Plus, according to SNL Kagan. Distributors pass those costs on to their subscribers.

Cox’s Bob Wilson said that he worries not so much about the absolute cost of sports networks as the ability for customers to make their own value judgments and exercise discretion about paying or not paying for them.

“The costs of sports networks that currently require distributors to include them in the most widely distributed

multichannel video service tier have come to represent an unacceptably disproportionately high share of the total cost of that tier relative to the share of customer viewing they generate,” he said. “Distributors and those sports network providers really need to figure out how to give customers more reasonable discretion to buy or not buy sports programming rather than the all-or-nothing proposition that networks effectively currently require of distributors.”

It’s noteworthy that Cox pulled out of the San Diego market (where it previously had held the Padres rights) and opted not to bid for the rights to the NBA’s Oklahoma City Thunder. Cox’s deal with the New Orleans Hornets is up soon.

Others say that rights still would be skyrocketing even if Time Warner Cable were not involved.

“It would be one thing if you had only one or two buyers,” Bevilacqua said. “But in the world of sports you have seven or eight buyers. What’s the difference if you have eight or nine? There’s only a finite amount of sports programming and you’ve got a large set of buyers.”

Witmer agreed. She pointed to Fox’s deal with the Texas Rangers (for a reported $1.6 billion over 20 years) and ESPN and Fox’s deal with the Pac-12 (for a reported $250 million per year) as evidence that the cost of sports is rising whether Time Warner Cable is involved in the bidding or not.

“Right now, there is a realization that live sports matters to consumers,” Witmer said. “Live sports are very important to the linear television business. That, more than anything, is reflected in the marketplace right now.”