Amanda Staveley insisted she "is not a time-waster" and that her £250M ($346M) offer to buy Premier League side Newcastle United "remains on the table," according to George Caulkin of the LONDON TIMES. Despite Staveley’s insistence that she "remains interested in buying Newcastle," a deal now "appears further away than ever" after a source close to club Owner Mike Ashley said on Friday that the club is "not considering any further talks with [Staveley’s firm] PCP Capital Partners" and claimed that "we are not aware of any bid that doesn't contain relegation clauses." Staveley and PCP "have made three offers to purchase Ashley’s controlling interest in Newcastle," the last of which was made on Nov. 17. She "had heard nothing from Ashley since mid-December, until an anonymous source, apparently sanctioned by the Sports Direct owner," said on Tuesday that the process had proved "exhausting, frustrating and a complete waste of time." While Staveley’s most recent bid of £250M was "significantly below" Ashley’s £350M ($485M) asking price, she was committed to investing a further £200M ($277M) on "new players and updating Newcastle’s training ground and academy." She said, "This is an investment, but it has to be a long-term investment. Newcastle would be run as a business, but we want it to be a successful, thriving business that is an absolutely integral part of the city." In each of Staveley’s bids "was a stipulation that Rafa Benítez must remain as manager and agree to a new contract." Staveley: "Rafa is doing an incredible job. We want Rafa to be part of this project" (LONDON TIMES, 1/19).

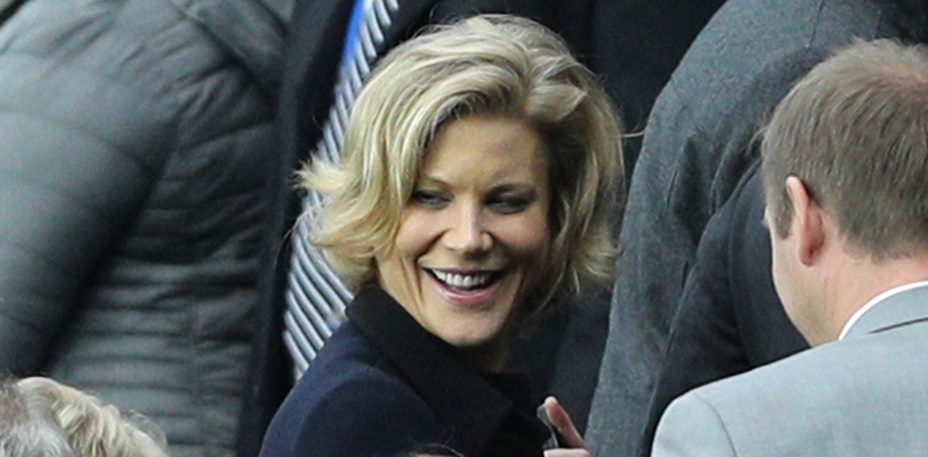

BREAKING THE SILENCE: Caulkin also reported Staveley was "stung" by the "complete waste of time" comment and "irked by the suggestion that her pursuit of Newcastle, which has been very open, was nothing more than an exercise in self-publicity." The source close to Ashley said on Tuesday, "It is only right to let the fans know that there is no deal on the table or even under discussion with Amanda Staveley and PCP." On Friday, Staveley spoke publicly about Newcastle for the first time "since she launched 1,000 headlines and more conspiracy theories by attending" a home game against Liverpool on Oct. 1. There "has been a non-disclosure agreement in place with Newcastle" since the middle of October, but she felt "obliged to defend herself." Staveley: "I’m very concerned, I’m very surprised and I’m disappointed about what’s been said this week." If she "was not serious, why would PCP have made three offers to put Ashley out of his misery after his loveless, contentious 11 years" at St. James’ Park? Why would she have "engaged Chris Mort of Freshfields as her lawyer," a man who worked as Newcastle’s chair under Ashley? Why would she "involve the Reuben family," which has an estimated worth of £13B ($18B) and a "significant property portfolio on Tyneside," in her bid? Staveley said, "This is something we’ve been working really hard on. It’s not something we’ve just thrown together. I’m putting a lot of my own capital into this and our investors, who come from around the world, include sovereign wealth funds" (LONDON TIMES, 1/19).

DEEP POCKETS: In London, David Conn wrote Staveley’s reputation "derives principally from two deals she was involved in with the same investor, Sheikh Mansour of Abu Dhabi, both completed in quick succession" almost 10 years ago. She reportedly has £28B ($39B) under management -- "an extraordinary sum" -- including "wealthy investors" in the Middle East, Far East and the U.S., and countries' sovereign wealth funds. It "has been suggested that Newcastle may be too small a deal for such investors and that Staveley might pay for the club mostly out of her own wealth." Given "this portrayal, it is striking" that PCP, Staveley’s U.K.-registered company, "has no assets or employees." It qualifies for official Companies House filings as a "micro entity," having "had no income" in the year to March 31, 2017, and debts of £3.6M (GUARDIAN, 1/18).

NOT GOING ANYWHERE: Caulkin opined when a source on Friday said that "we are not aware of any bid that doesn't contain relegation clauses," it was "interesting" because there was reportedly a £250M bid -- "payable in full on completion" -- made for Newcastle on Nov. 17, which does not "contain relegation clauses." And "they can consider what they want, but Staveley is not going away." Her three bids "are there in black and white and so, too, now, is her vision for the club" (LONDON TIMES, 1/19).