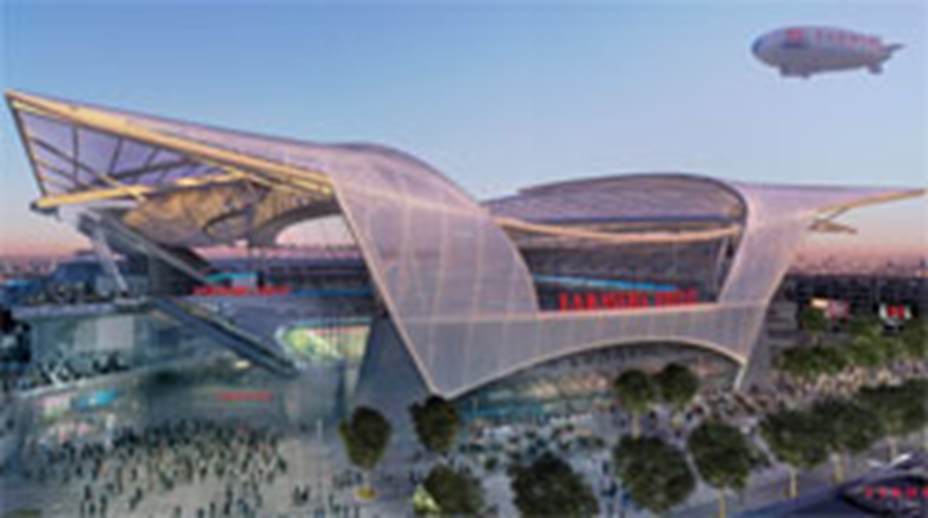

Anschutz Co.'s plan to sell AEG has “thrown a new curve in the two-decade quest to bring professional football back” to L.A., “leaving some allies at City Hall blindsided and forcing Mayor Antonio Villaraigosa to explain why he did not divulge the information sooner,” according to Zahniser & Linthicum of the L.A. TIMES. Villaraigosa and other city leaders yesterday insisted that AEG's plan to build the $1.2B Farmers Field in downtown L.A. is “still on track, with the proposal expected to sail through” the city council next week. Officials said that the "only potential hangup” is if new owners "seek to change the complex and carefully negotiated financial agreements.” Community members yesterday argued that a key vote on the stadium deal “should be delayed until taxpayers know who is going to run AEG.” But Villaraigosa said, “Whoever is buying this team is going to live by the deal that we negotiated.” A “combative Villaraigosa defended his decision to keep the information secret.” He said that AEG “did not request he do so.” If the council acts next week, the stadium financing agreements still “won't be executed until AEG shows that it has acquired a team.” That process “could take at least until next spring, when NFL owners meet and could consider possible franchise moves” (L.A. TIMES, 9/20). L.A. City Council member Jan Perry said that she “did not know about a pending sale, but agreed that it wouldn't have adverse effects on courting a team.” Perry added that the move "'arguably is very positive’ because she suspected it could lead to an enthusiastic new partner anxious to get in on the city’s NFL prospects” (AP, 9/19).

STORMY WEATHER? YAHOO SPORTS’ Jason Cole wrote “this bit of news clouds the situation once again." The NFL "badly wanted [AEG Chair Phil] Anschutz to be part of the deal, whether he just built the downtown stadium or bought the team." The "rule of thumb in the NFL is that the league doesn't go to anyone. It has people come to the league. That wasn't the case with Anschutz. Thus, removing him from the process is not a positive” (SPORTS.YAHOO.com, 9/19). In L.A., Vincent Bonsignore in a front-page piece writes the AEG sale is “a good thing” for Farmers Field. Bonsignore: "Better to find out now, rather than later, Anschutz wasn't fully prepared to emotionally and financially march down the aisle with the NFL” (L.A. DAILY NEWS, 9/20).

BIG PRICE, SMALL POOL: In L.A., Vincent, Hamilton & Tangel in a front-page piece write that news of the sale “sent potential buyers scrambling to launch bids that insiders say could reach” $7B or more. The big question is, “Who can pony up enough cash to buy such marquee properties as Staples Center, L.A. Live and the Los Angeles Kings?” A “likely scenario is a group of investors similar to the consortium that bought the Dodgers.” AEG has “indicated privately that it expects to sell” for $5-7B, but “no official price has been set.” Lakers investor Patrick Soon-Shiong has “already expressed interest,” and Mavericks Owner Mark Cuban and investment firm Colony Capital are “seen in the running.” Real estate brokerage firm Cushman & Wakefield Chair John Cushman said that “a ‘healthy number’ of potential bidders already have expressed interest since the sale was announced.” Vincent, Hamilton & Tangel note another "logical contender” is MSG. Meanwhile, Dodgers Owner Guggenheim Partners could be “a wild card.” Dodgers President Stan Kasten yesterday “declined to say whether Guggenheim executives had asked him about the feasibility of owning and operating multiple sports franchises” (L.A. TIMES, 9/20).

HOT PROPERTIES: Concert business publication Pollstar Editor Gary Bongiovanni said, "The $6 billion or $7 billion figure I've seen floating around out there actually seems kind of low.” Bongiovanni added, "The marquee assets are going to bring strong valuation” (VARIETY.com, 9/20). In L.A., Fritz & Verrier report the sale “excludes two key entertainment assets: Family film company Walden Media and a controlling stake in theater chain Regal Entertainment Group" (L.A. TIMES, 9/20). SportsCorp President Marc Ganis said that AEG “will likely attract a diverse group of buyers,” as the company has assets in London, Brazil, Malaysia, Australia and Qatar, plus “a thriving concert ticket business.” Ganis added that a real estate investment trust “could partner with a live entertainment company to buy AEG” and that the company’s L.A. holdings “may be considered the most lucrative.” However, in L.A., Dakota Smith in a front-page piece notes that “selling some of the real-estate holdings may prove more difficult.” The "timing of the sale is a bit awkward for city officials, who now find themselves bombarded with questions." Meanwhile, AEG President & CEO Tim Leiweke said that the L.A. "football project isn't a major asset in the portfolio." Leiweke: "This isn't driving the (sale) process or the valuation of AEG" (L.A. DAILY NEWS, 9/20). The FINANCIAL TIMES’ Andrew Hill wrote, “Where Mr. Anschutz scores points is in his willingness to sell even high-profile investments.” Hill: “He has chosen his moment -- rather than having it dictated by creditors or other third parties -- and the fact he seems prepared to allow business to override sentiment is a lesson other investors in high-profile assets might well wish to learn” (FT.com, 9/19).

SLOW YOUR ROLL: In San Diego, Nick Canepa notes NFL Commissioner Roger Goodell has "announced that any franchise interested in relocating to L.A. must file its intentions to the league by January." Chargers Special Counsel Mark Fabiani said, “We want to work with the new mayor and get something done here (and hopefully get it on the November 2013 ballot). I would be shocked if we filed an application in January.” Fabiani added, “This isn’t like selling a car. It will take months and months to sell it.” Fabiani: “No. 1, they assume Anschutz will sell, and he’s a tough negotiator. No. 2, there’s the assumption the NFL will want it to happen. These are huge assumptions. To tell you the truth, I should be saying this is a grave threat to San Diego, but it isn’t. If and when somebody buys AEG, that new person may not like the agreement with the city. A long time ago Tim Leiweke said they’d break ground in June 2012. Here we are in September and they still don’t have a certified EIR and now they may not even have an owner” (SAN DIEGO UNION-TRIBUNE, 9/20).

STEADY AS SHE GOES: Nets and Barclays Center CEO Brett Yormark noted the sale of AEG “won’t affect its partnership with the Barclays Center ... even as one expert identified rival Madison Square Garden as the ideal buyer." Yormark: “We have no concerns. We’re confident after speaking with (AEG) that it’s business as usual regardless of who buys them and when.” In N.Y., Bondy & O’Keeffe note AEG Facilities was “hired by the Barclays Center last year to ‘provide operational support’” (N.Y. DAILY NEWS, 9/20). In Germany, Jörg Lubrich wrote the news generated an "uneasy feeling" with hockey club Eisbären Berlin, one of two German hockey clibs owned by AEG. Eisbären Berlin Managing Dir Peter Lee "tried to calm the situation." He said, "O2 World and Eisbären belong together. We provide the arena with about 30 events, our home games, every year. We are an important renter" (BILD, 9/19).