When the Charlotte Hornets unveiled their new home floor at Time Warner Cable Arena as part of the NBA draft late last month, it capped a yearlong process to de-Bobcat the NBA franchise.

It’s early, but there’s no doubt it has been a successful campaign — in part because of the popularity of the Hornets brand in Charlotte as well as the general lack of interest in all things Bobcats. But what is most important, the transition has shown that the team surely knows how to market its product — now that it has a product to market.

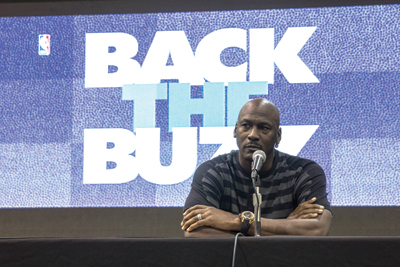

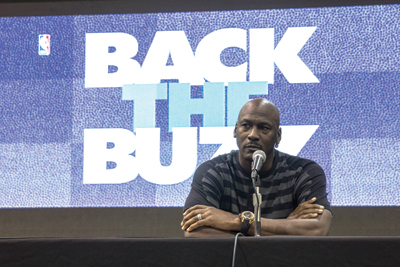

The team formerly known as the Charlotte Bobcats, a loser on and off the court for much of its 10-year history, now looks like a franchise with a future. Michael Jordan, the Hall of Fame player who bought majority interest in 2010, last spring asked the NBA for permission to reclaim the Hornets nickname, used by Charlotte’s original expansion franchise between 1988 and 2002.

|

|

Since owner Michael Jordan reclaimed the Hornets nickname, the team has used an analytics-driven transition plan to rebrand.

Photo by: GRANT BALDWIN PHOTOGRAPHY (2)

|

It was a move that won widespread local approval and jump-started fan interest in the club. But the transition required a strategy of its own for the period from when the league approved the name change, in July 2013, to when the Hornets name could be used, after the 2013-14 season.

The transition came with both the benefits of the original franchise’s arrival (including 364 straight sellouts and a nationally popular logo) and the weight of nostalgia (fans called for the exact same logo and colors as the first version of the Hornets, down to designer Alexander Julian).

Jordan’s top executives, Fred Whitfield, team president and COO, and Pete Guelli, chief sales and marketing officer, steered the planning with a select number of other executives in the front office. They also called on Jordan’s connections, tapping the ultimate pitchman (and Jumpman, per his own logo) and his Jordan Brand division of Nike to develop the new Hornets brand identity.

The rebranding was further bolstered by research, with team executives relying on data compiled by Harris Interactive that showed that 80 percent of fans polled were in favor of a return to the Hornets name.

“We wanted the analytics to drive every single decision we made during the process,” Guelli said.

But no big league sports franchise has ever left a city and taken the team’s nickname with it only to see a successor come in with a separate identity before reclaiming the original moniker. So, as Whitfield said, few examples could be found for the sake of comparison and strategy since “this had never happened before.”

Help from the league office and one team in a recent and similar situation gave the Bobcats some guidance. The Brooklyn Nets relocated from nearby New Jersey in 2012, adopting their new hometown in their identity while overhauling team colors, logos, uniforms and their home court.

Unlike the Nets and others with name changes, the Bobcats used the surge in interest to bring in sponsors — of the name change itself. Mercedes-Benz signed on last November as a team sponsor, an agreement including the lead role in milestone events tied to the return of the Hornets. Those events included throwback nights at the arena with former Charlotte players from the 1980s and 1990s, the introduction of the revamped logo, and ties to the Buzz City campaign created to push the return of the old team name at a time when the team couldn’t officially make use of it. Blue Cross and Blue Shield signed as the presenting sponsor of team mascot Hugo, and even the newly designed hardwood ultimately became a source of business, as the team last month locked up a lucrative apron signage deal with Novant Health: a multiyear agreement worth between $750,000 and $1 million annually.

Hornets executives declined to disclose specific, total sales figures for the business done related to the rebrand to date. They did say that several more sponsorship deals will close later this summer and that the arrival of Mercedes-Benz, as well as McDonald’s and others that came aboard when the name change was announced, brought more than additional revenue. Those companies brought credibility and marketing power to a franchise that long lacked both.

Luck helps, too. Dreadful teams, an even worse relationship between original team owner Robert Johnson and fans and local companies, and utter indifference to the Bobcats name and logo made the NBA an afterthought in a city once revered for its basketball passion. Heading into the final season of the Bobcats, Charlotte had won 28 games in the 2011-12 and 2012-13 seasons combined.

|

|

Fan favorites Dell Curry (left) and Muggsy Bogues, helped reintroduce the brand.

Photo by: NANCY PIERCE

|

Expectations for 2013-14 were moderately better, but new coach Steve Clifford and free agent center Al Jefferson led the Bobcats to 43 victories and the playoffs, the second winning season for the team since its 2004 debut. Despite a four-game sweep at the hands of LeBron James and the Miami Heat, the hard-fought series nudged local sports fans. Combined with the return of the Hornets name, logo and merchandise, all rolled out over the course of last season as part of splashy events featuring popular former players and Jordan, an also-ran managed to push its way into the No. 1 ranking in the league for new season-ticket sales.

Finally, after years of financial losses and mediocre ticket sales, fan support seems to be building.

NBA teams use the benchmark of full-season equivalents — the number of season tickets sold plus the combined season total for mini-season plans — to gauge financial health. Teams with 10,000 seats sold in full-season equivalents are considered stable. Charlotte, under Johnson and then Jordan, never has reached 10,000. For the coming season, Guelli said the Hornets will eclipse that total.

The Hornets also have sold 2,500 new full-season-ticket packages for the coming season, a league best and the most the team has ever sold, and team executives expect record new full-season-ticket revenue in the year ahead, though they would not disclose specifics.

“It will be the place to be this fall,” said Mike Boykin, a former executive at GMR Marketing in Charlotte and veteran sports industry consultant. “It was smart to go back into one of the more fascinating and successful times of Charlotte sports history. Go back and look at the Charlotte Hornets: passion, merchandise, celebrity.”

The array of details in the design process proved lengthy.

“We worked closely with the Hornets to ensure we listened to their fans and made sure the team’s brand pays homage to [the original franchise],” said Keith Crawford, Jordan Brand vice president of design.

|

|

Team execs studied traits of real-life hornets to create a new logo (above) distinct from the old one.

Photo by: Enter Name Here

|

Whitfield mentioned studying characteristics of real-life hornets, from eyes and tails to their behavior. Then, too, the new logo and uniform, in the minds of Jordan’s executives, needed to connect Charlotte’s NBA past and present. The new identity also needed to look modern without being trendy.

The NBA and the Hornets sell shirts and other merchandise through a legacy line, so too close of a match in the new iteration would make new and retro indistinguishable. Since the league prevents teams from bringing back an exact old logo as a main logo, a duplicate look from yesteryear was impossible.

Christopher Arena, NBA vice president of identity, outfitting and equipment, lined up secret scrimmages in the New York area to test the new uniforms and

court design for TV. How legible are the numbers and letters when the uniforms are seen on TV? How does the court look on TV? For TV graphics and souvenir companies, how do the logos translate, and how consistent are the designated colors? What should the secondary logos look like? Should the former designer, Julian, be involved? (He wasn’t, as Jordan opted for Nike alone.)

All the while, the Bobcats remained in business as the transition campaign continued.

At one point, Whitfield and other executives gathered the players to explain the elements of the Hornets rollout. They wanted to assure the team of their commitment while also avoiding surprises as announcements occurred.

Beyond sales, the Hornets have also used the return of the name as a chance to improve their own marketing. Social media, the team concedes, had been neglected.

With renewed interest in the franchise, combined Facebook, Twitter and other social media followers have quadrupled during the past six months, the team says. Twitter followers now total 234,000, comparable to the Atlanta Hawks (227,000) and the NFL’s Carolina Panthers (281,000), if still far behind popular NBA teams such as the Chicago Bulls (1.6 million) and Miami Heat (2.6 million).

“It has exceeded every goal,” Guelli said. “The momentum continues to grow.”

Erik Spanberg writes for the Charlotte Business Journal, an affiliated publication. Staff writer John Lombardo contributed to this report.