|

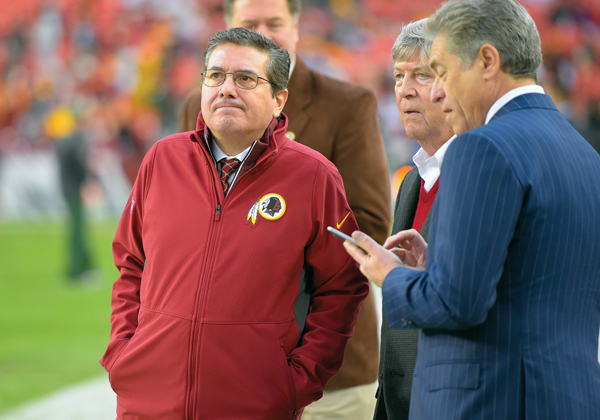

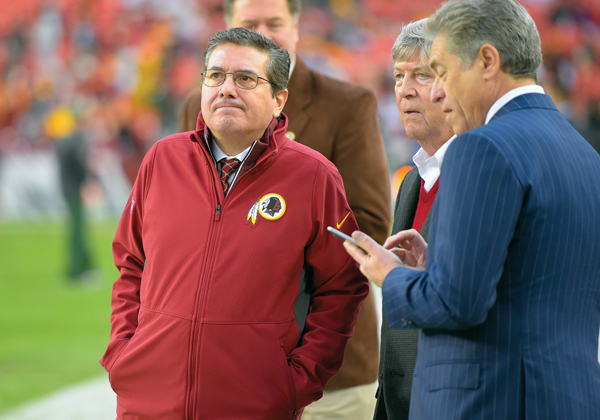

Redskins limited partner Dwight Schar (center) controls the fund at the center of the lawsuit.

GETTY IMAGES |

It has been 2,572 days, or seven years and half a month, since the owners of the Boston Red Sox bought Liverpool FC in a controversial sale. Yet today, the only surviving litigation stemming from the deal is scheduled to go to trial in a state court in lower Manhattan, after more than 1,650 court filings.

That the case lives is in part testament to the creaky wheels of the judicial system, but also to a well-funded litigant: a fund controlled by Dwight Schar, a limited partner in the Washington Redskins. The lawsuit also made its way to a trial because of some troubling circumstances surrounding the sale that were at one point raised by the former owners, Tom Hicks and George Gillett.

Schar’s Mill Financial lost the $70 million it lent to Gillett. Schar, who is scheduled to testify this week, was turned away by British courts after the 2010 sale with the argument that, at 295 million pounds, the sale resided far below market value and was designed only to pay back lender Royal Bank of Scotland, which had taken control of the club. Mill’s expert argues the true value should have been 455 million pounds.

Mill sued Gillett soon after the Oct. 15, 2010, sale, but the next year turned its attention to RBS with the allegation that as the club’s top creditor, it had secretly orchestrated the sale with the intention of getting back only enough to pay back its own loan.

That position found some backing earlier this year by a New York state appeals court, which ruled, “An issue of fact exists regarding whether the April side letters contributed to diminution in the value of the Club.” The side letters refer to the RBS documents that started the sales process in April 2010 without Mill’s knowledge.

Mill’s core contention is it could have refinanced the debt that Hicks and Gillett defaulted on had it known about the process, and stopped what is termed a fire sale.

If Mill succeeds, the sum will be far greater than $70 million because the state of New York adds a 9 percent interest charge for each succeeding year, said John Goldman, a New York lawyer formerly with Herrick Feinstein, who has argued cases in the state Supreme Court, where Mill v. RBS is filed.

Though getting to trial after seven years is an accomplishment, the hurdles remain high. The judge presiding over the case, Eileen Bransten, already once dismissed the entire case, before a state appeals panel in April overturned her.

At a pretrial hearing last month she expressed skepticism Mill could prove that just because it lost the ability to refinance Liverpool’s debt, the team would have been sold for a lot more.

“It’s just not good enough to say I would have refinanced,” she told lawyers at the Sept. 8 hearing. “You will have to go one step further, which is to tell me if you had refinanced, you would have not been damaged by X amount. That is something you are going to have to come up with.”

RBS’s lawyer, Marshall Fishman, was more succinct, predicting “there is no way they are going to be able to prove this.”