As the NFL lurches toward another season of disappointing TV ratings, media executives once again are questioning whether there’s simply too much football.

There seem to be dozens of reasons for the ratings downturn, from protests during the national anthem and the continued ratings strength of cable news networks to the concussion issue and weather-related problems.

But one reason increasingly being discussed in media circles deals with NFL oversaturation, a topic that has irked network executives since the league launched NFL Network in 2003.

So far this season, fans have been able to watch games on Thursday nights, Sunday mornings, Sunday afternoons, Sunday nights and Monday nights. Later in the season, games will be available on Saturdays.

In-game highlights are a touch of a button away on a large variety of websites and mobile apps. The league heavily markets the ability to watch condensed versions of games almost as soon as they conclude.

And don’t forget the NFL-owned RedZone channel, which offers viewers an ad-free way to watch NFL games on Sundays.

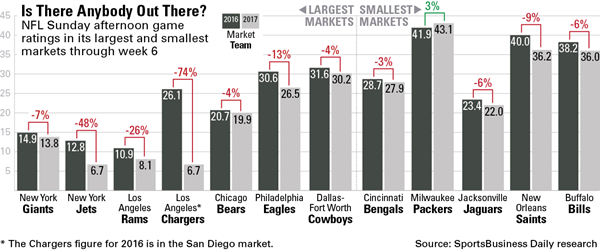

Overall, NFL game viewership this season is down about 7 percent from the same point last season and 18 percent compared with the same point in the 2015 season. More concerning for network executives is the 11 percent across-the-board ratings drop in the 18- to 34-year-old demographic, the biggest drop of any demo.

Network executives were reluctant to discuss NFL oversaturation on the record. But one of the reasons many of them are focused on the perceived oversaturation of NFL content is because they believe the problem has a couple of easy answers, unlike many of the other reasons, over which the NFL has little control.

Network executives never have warmed to the expansion of “Thursday Night Football” from eight NFL Network-only games to 18 over NFL Network, CBS and NBC. Media executives and some sponsors informally have lobbied the NFL to move back to an eight-game, NFL Network-only package that would return 10 games to the Sunday afternoon packages.

Network executives also want to kill the four early morning games from London, time slots that may work well in Britain but do not bring big ratings to U.S. networks.

Media executives would like to move those games into the 1 p.m. ET time slot, or 6 p.m. locally in London. The league’s international executives have resisted making that move because they do not think the later time slot would work as well in London.

Those two moves would return 14 games to Sunday afternoons, strengthen the core product and potentially keep fans from suffering from football fatigue by Sunday and Monday night.

First Look podcast, with wide-ranging discussion on NFL issues:

Ten years ago, the NFL had 32 game windows through week six. This year, it is up to 39, a 22 percent increase. It’s even more crowded in college, where the 2007 windows to this point added up to 105. This year, it’s at 179, up a whopping 71 percent.

“It’s not just an NFL issue or a college issue; it’s a football issue,” said Mike Mulvihill, executive vice president of research, league operations and strategy at Fox Sports. “The rise in football availability is pretty dramatic. This is what drives fragmentation in every area of television. … You can argue whether there’s greater or lesser interest in the game of football than there was 10 years ago. But clearly whatever that interest is, it’s being spread out over quite a few more windows than it was 10 years ago.”

NFL games on Fox are down 7 percent from the same point last year and 8 percent from two years ago.

It’s not just the number of game windows. The ready availability of NFL content — especially in-game highlights and score updates — could be a reason why ratings have dropped so sharply with the youngest demographic.

“I do believe that there is a lot of football on and by the time you get to Sunday, there could be a fatigue,” said Mark Lazarus, chairman of NBC Broadcasting and Sports. “Much of the loss of viewers is coming from 18- to 34-year-olds. They more and more are getting satisfied by the alternatives of highlights and scores that are available during the game. That continues to train young viewers to follow our sports, not watch our sports. That is concerning for all sports television.”

NBC’s “Sunday Night Football” viewership is down 4 percent through week six compared with last year and down 21 percent from two seasons ago.

Despite the ratings drops, network executives describe the NFL as the most reliable programming on television, which has seen prime-time ratings drop steeply.

“There is a small decline for the NFL,” Lazarus said. “What we’re seeing is that prime time for the rest of television is declining more than that. Sports is still dominated by live viewing.”

That was a message that CBS Sports Chairman Sean McManus echoed. NFL games make up 17 of TV’s top-20 telecasts since the start of the season, including nine of the top 10. Plus, since the start of the fall TV season Sept. 25, NFL game viewership is 2.5 times bigger than broadcast prime-time viewership.

“What’s clear across the board is that the NFL remains the strongest property in all of television,” McManus said. “As we move forward, we will continue to work with the league to make the television product as compelling as possible and to grow our audience.”

CBS Sports’ Sunday afternoon games are down 14 percent compared with the same time last year and down 20 percent compared with 2015.

ESPN’s “Monday Night Football” posted a 6 percent increase this season compared with the same point last year. Compared with two years ago, though, “Monday Night Football” is down 17 percent. Burke Magnus, executive vice president of programming and scheduling, said he was happy with “Monday Night Football’s” schedule and does not get too worked up over its fluctuations.

“Although we spend a lot of time talking about year-over-year ratings, and drawing conclusions from them, that is not how the business works,” Magnus said. “It is not a referendum for success or failure.”