The U.S. men’s soccer team suffered perhaps the biggest loss in its history when it fell 2-1 to Trinidad and Tobago last week and failed to qualify for the 2018 World Cup in Russia.

That puts the U.S. out of soccer’s biggest event for the first time since 1986, even as soccer enjoys growing success at the major league level here and groups compete to pay a $150 million fee for an MLS expansion franchise, up 36 percent from the fee the Los Angeles Football Club paid to join the league in 2014.

While this is a rough moment — and criticism of U.S. Soccer had begun before the final whistle was blown at Tuesday’s upset loss — it is not a full-fledged disaster for all the stakeholders in the sport. Here’s a look at how each of them stands to be affected by a World Cup without the U.S. men.

U.S. SOCCER

For U.S. Soccer, this was the worst possible scenario.

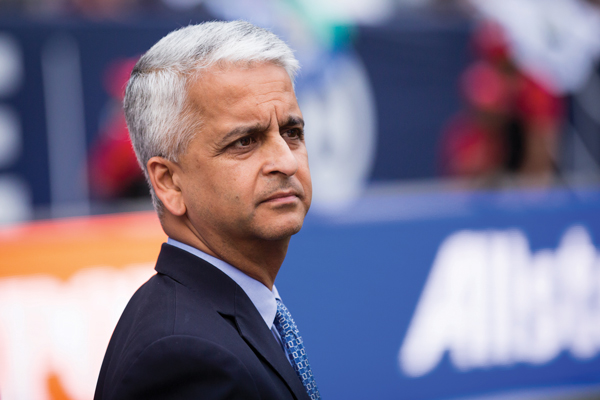

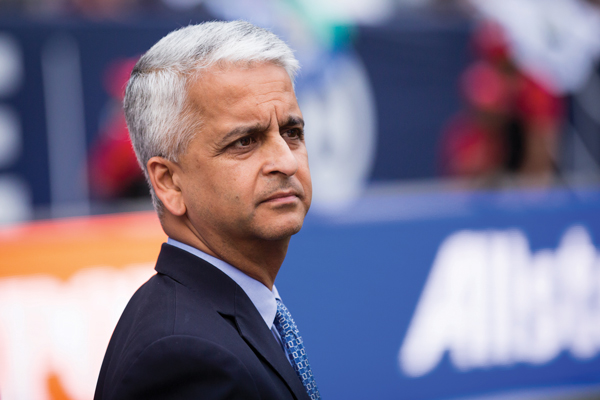

Sunil Gulati, president of U.S. Soccer, will be forced to shoulder the blame for the failure and for perceptions that the sport has not progressed in the country for a variety of reasons, among them a lack of quality coaching, cost concerns around youth soccer and a relatively weak pipeline for talent.

|

The large crowds in red, white and blue that gathered for U.S. World Cup games in 2014 will not be available to marketers in 2018.

GETTY IMAGES |

Gulati has been president since being elected in 2006, winning subsequent re-elections in 2010 and 2014. His current term will end in February, when the federation will hold a scheduled election at its annual general meeting. He has not stated that he will seek another term — recently enacted term limits would allow for him to serve only for four more years — but if he does, he is expected to have competition. Lawyer Steve Gans and indoor soccer team owner Paul Lapointe have both announced their candidacies, though neither appears to have the track record to appeal to a wide swath of voters, who range from 291 youth club delegates to a professional council that includes MLS. It is expected other candidates may emerge as the election nears.

Sources with knowledge of U.S. Soccer said that even if Gulati were not the sitting president of U.S. Soccer, he could continue as a member of the FIFA Council — his term runs through 2021 — as well as in his position leading the World Cup bid for 2026 for the U.S., Mexico and Canada. Neither Gulati’s influence in global soccer, which swelled during the 2016 election of FIFA President Gianni Infantino, nor the unified 2026 World Cup bid, will be affected.

That 2026 World Cup decision, which FIFA will vote on June 13, may provide a moment for U.S. Soccer to present a detailed road map on changes it will make to grow the game in the U.S., similar to what it did in 1994 and the push for MLS after that, according to soccer sources.

The federation, which has nearly a $100 million surplus, will not suffer a massive revenue drop. It will not receive prize money from FIFA, for which it received $1.5 million for participation in the 2014 World Cup in Brazil and $9 million more for advancing past the group stage, according to its financial statements. However, offsetting that revenue was the added expense that the federation spent on sending the team to Brazil.

While U.S. Soccer does not individually break out World Cup travel expenses, during its 2015 fiscal year, which included the 2014 World Cup, the men’s national team had $31.1 million in expenses. In the 2016 and 2014 fiscal years, it had $19.9 and $18.7 million, respectively. The federation had begun discussions with lodging and training sites in Russia, including setting up its training home in St. Petersburg. However, those arrangements were not complete.

MEDIA

Fox Sports’ World Cup ad sales revenue is expected to be $30 million to $40 million lower than originally projected as a result of the U.S. team’s failure to qualify, sources said.

But the network is expected to make up much of that figure by cutting costs in some places, adding advertising units elsewhere in World Cup coverage like some of its studio shows, and putting more World Cup games on the broadcast network. Half the games already were scheduled for the broadcast network, and sources said they expect that number to increase to give Fox a chance to sell ads at higher rates.

All told, revenue is expected to come in about $20 million lower than expected, sources said.

While the $20 million hit is disappointing for Fox’s first World Cup, its executives privately said it’s not as significant a downswing as some would believe. For example, Fox Sports would make that much more in revenue if the big-market Yankees were to make the World Series this year, and the Series were to last at least six games. Another example is the 2016 Women’s World Cup, won by the United States. Ad sales outperformed expectations by nearly $20 million on the strength of the U.S. showing, sources said.

ESPN brought in $530 million in ad revenue with its coverage of the 2014 World Cup in Brazil, sources said. Fox has not given any projections for 2018 World Cup revenue.

No decisions have been made on where Fox will cut costs, but most of the cutting would not be noticed by viewers, according to sources both inside and outside of the network. Fox will move forward with building a set in Moscow’s Red Square, where it will produce daytime and late-night studio coverage. Fox channels still will carry 350 hours of World Cup programming.

|

Sunil Gulati was first elected as U.S. Soccer’s president in 2006.

GETTY IMAGES |

Fox almost certainly will cut travel and send fewer staffers and employees to Russia, or pare down travel for employees who make the trip. For example, Fox had plans to embed reporter Jenny Taft to follow the U.S. team, said a source who asked not to be identified because Fox Sports was not prepared to announce any changes. That expense can be pared back now, though Taft still is expected to be involved with Fox’s World Cup telecasts.

TV ratings are certain to take a hit without the U.S. team. During the 2014 World Cup in Brazil, the four U.S. matches accounted for 20 percent of ESPN’s total viewers for the World Cup, sources said.

It’s almost impossible for Fox to make up those numbers during this World Cup.

But Fox executives are trying to take a bigger view of the World Cup and not focus on the disappointment of the U.S. defeat.

“Fox made a 15-year strategic investment in international soccer,” said one source. “That investment continues.”

Beyond the fact that its World Cup rights deal lasts through 2026 — a tournament that is expected to be held in North America — Fox executives believe the World Cup has played a big part in growing FS1. Fox signed a deal for the 2018 and 2022 World Cup in 2011, two years before FS1 launched. Fox executives credit big-ticket rights like the World Cup for helping to grow FS1, which is in 85 million homes and gets a license fee of $1.30 per subscriber per month.

“FIFA is responsible for a lot of that,” a source said.

SPONSORSHIP

The U.S. team has perhaps been viewed as the one of the easiest bets for a brand wanting to connect with U.S. soccer fans. With the team not playing in the World Cup, it is expected that the interest from casual fans and millennial consumers will drop off significantly, said Michael Neuman, executive vice president and managing partner of Scout Sports and Entertainment. “In a country deeply divided by our politics, the World Cup was to be a beacon of unity, bringing together avid and casual soccer fans,” he said.

However, Gilt Edge Soccer Marketing founder John Guppy said the idea that any brand would shy away from the World Cup just because the U.S. is out is like “throwing the baby out with the bathwater.”

“There’s no question a World Cup without the U.S. is not the same, and we’re not going to see the scenes of 20,000 people clad in red, white and blue at viewing parties in big cities, or Beyoncé on ‘Entertainment Tonight’ in a jersey,” he said. “But none of the strategic reasons on why a brand would invest in soccer has changed. It’s just how tactically they will tap into that opportunity.”

Guppy said he expects to see several different approaches, such as celebrating the multiculturalism of the event or focusing on the stars from around the world.

“The most popular soccer player in America is Lionel Messi. He’s still going to be there,” he said.

|

Nike may turn to international stars like Cristiano Ronaldo.

GETTY IMAGES |

The national team’s failure to punch its ticket to Russia will cause Nike, U.S. Soccer’s chief sponsor and licensee, to miss perhaps its biggest chance to monetize the partnership, said Neuman, noting how rampant jerseys were at the 2014 World Cup and around qualifying games. Nike was scheduled to roll out a comprehensive marketing campaign around the U.S. team, which it will now have to shelve.

Guppy said it is likely that Nike will pivot to its global campaign here in the U.S., which will highlight its key players such as Cristiano Ronaldo and Neymar, whose names carry more cachet in the U.S. than any national team player.

U.S. Soccer’s only other direct sponsor agreement is with Soccer United Marketing, which handles the vast majority of the federation’s sponsorship, television, licensing and royalty revenue. Most of the federation’s deals through SUM, which include AT&T, Anheuser-Busch, Coca-Cola and Continental Tire, are in the middle of long-term agreements.

Though Guppy said he expects many of the sponsor agreements the federation signs in the future will include clauses related to qualifying for the World Cup, the value of a sponsorship with the national team has not changed much, especially with the expected arrival of the 2026 World Cup in the U.S.

Perhaps the most affected party on the U.S. side will be 19-year-old Christian Pulisic, who was perhaps the lone American player to impress during the qualifiers. Pulisic, who plays in Germany’s Bundesliga for Borussia Dortmund and was recently profiled on “60 Minutes,” has shown signs of breaking out as a star.

“His ticket to crash the party around soccer’s biggest stage is now on hold,” Neuman said. “Aside from the missed touches against the world’s best, he will also miss out on endearing himself to inflated U.S. audiences and to brand marketers stateside.”

For FIFA global partners such as Coca-Cola and Visa, it is unclear how their marketing strategy around the event may change with the U.S. not participating. Both have run campaigns with an international focus in the past.

MLS

No organization ties itself as closely to U.S. Soccer every World Cup as MLS. With the bulk of the U.S. national team also playing in the league, those matches every four years are perhaps MLS’s best chance to make household names out of some of its players. During the 2014 World Cup, MLS launched a specific marketing campaign titled “Here,” which aimed to showcase how that same excitement — and players — from the World Cup could be found in MLS matches when the league returned from its break during the tournament.

MLS was working on a campaign for next year’s World Cup that would have heavily focused on the U.S. team and its players; now that strategy will have to be re-evaluated. The league, which was in talks to contract an agency to start working on that campaign, is looking at how it will reshape that message, still with a focus on the World Cup.

The league is also determining how it will stop play for the World Cup. In iterations past, MLS has taken up to two weeks off during the group stages. Dan Courtemanche, MLS executive vice president of communications, said the league’s product strategy committee — the group of owners that evaluates all aspects of the league’s competition — has not yet determined what length of break the league might take, or if it may consider other options based upon which teams qualify.

In 2014, 21 MLS players played in the World Cup, a league record. While it’s unclear how many will participate in 2018, MLS expects there may be players from up to 12 countries representing the league, up from six in the previous edition.

Much like the NHL, MLS has seen loose correlation between a rise in attendance and television ratings coming out of an international event. While it is likely that the league receives a bump in popularity and interest, MLS annually has an increase in ticket sales in late summer into the fall regardless of whether it’s a World Cup year, Courtemanche said.