At 8 a.m. Nov. 9, less than five hours after Donald Trump was elected president, the leaders of the Momentum Sports Marketing Symposium were sitting around a table asking “Now what?” Now what for our country? Now what for our industry? Now what for this conference? I had the honor to be the keynote at the start of the conference. Days before I thought the conference might be canceled or that few would attend from concerns over the aftermath of a result that would be unsettling regardless of the outcome.

Nearly 500 attended. I will never forget what I saw from the stage. I asked how much they slept and the average was less than three hours. I got two. Then I had to tell them that reality in sports had caught up with the trends we were seeing, that sports in America, and the world, is in systemic decline. But what I saw in their eyes was not fear. I saw calm attentiveness. And I saw the kind of resilience that moves forward in the face of change.

SOMETHING WORSE

The headline in The New York Times read: “TV Viewership Falls in NFL and Premier League: A Blip, or Something Worse?” Less than a week later, the top of the banner for the Financial Times (London) read: “Early-season TV viewing has dipped. Is it merely a blip or something more serious for broadcasters?”

The blip myth: The elections, protests or the Olympics being aired in the same time zone as core American sports are causing these declines and once those blips are gone, everything will return to normal. It isn’t a blip or something serious, it is both.

|

Luker’s presentation came the morning after the presidential election.

Photo by: MARC BRYAN-BROWN PHOTOGRAPHY

|

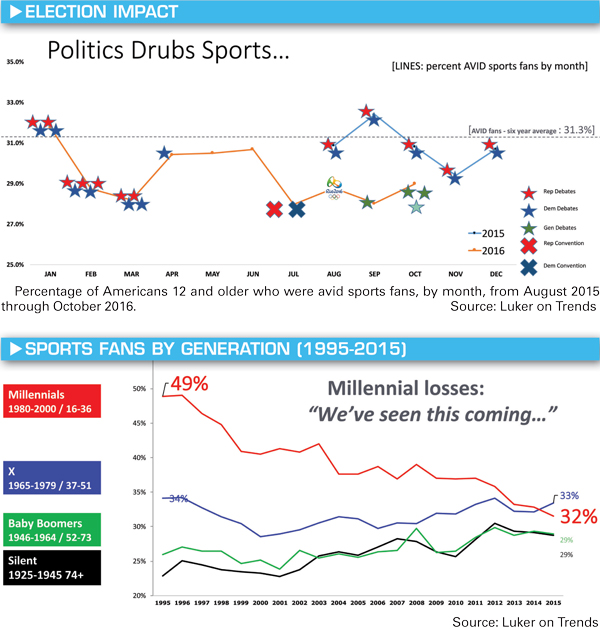

The election chart below shows the percentage of Americans ages 12 and older who were avid sports fans, by month, from August 2015 through October 2016. It would be a phenomenal coincidence that sports avidity declined to a two-decade low in March 2016 at the same time there were nine debates in a two-month period. Or that the numbers would rise the next three months in the lull between the debates and the conventions and decline again going into the conventions and the first Trump-Clinton debate. It is also likely that the August Olympics drew away some of the interest in the NFL, MLB and other sports and programming because the Games were aired in prime time. There was definitely a blip.

But there is something much worse: Interest and engagement in sports has been declining for more than 10 years, powerfully in the last five. This year is the first year the impact of those declines is being realized. These declines will not, cannot, go away. They are not caused by blips. They are caused mostly by an onslaught of options made possible by new technologies that will only grow in number and quality of experience over time.

KEVIN MCNULTY

PRESIDENT AND CHIEF MARKETING OFFICER,

MOMENTUM WORLDWIDE

■ Are the declines in sports viewership the beginning of a bigger competitive threat, or a short-term problem?

It’s only a short-term problem if we believe the drawn-out election campaign and the Summer Olympics upended typical viewing patterns. And while it’s true that live sports consistently draw the biggest audiences, we indeed have a bigger problem. Our industry was built to serve a different master, and our age is showing. Millennials have changed the game, and the question is can we adapt?

Millennials view what they want, when they want. Even the concept of cord-cutting is from the wrong perspective, because it’s not theirs. Subscription streaming platforms are the go-to choices for content consumption, not television. If we can’t adapt to their needs and reflect their habits, we will have missed our chance to stem the declines.

Sports must experiment with new technologies and different methods of delivery. Working against us are traditional long-term deal structures and the need to monetize new initiatives immediately. If we learned anything from the recent election, it’s that the pollsters and the media forgot to listen to the voters. It’s our industry. If we are not listening to the fans, how can we get it right?

The generations chart paints a dire picture. Twenty years ago 49 of 100 millennials were avid sports fans in general. Today it is 32 of 100, a loss of roughly one-third of all millennial avid fans. We have seen this coming. The reason it took this long for reality to catch up with interest is that, at the same time millennials were declining, older generations were uncharacteristically increasing in interest, and women, in general, were getting more engaged with sports. Their behaviors masked the declines of younger fans so sports saw increasing revenue from year to year. The “something worse” is that this is only the start of this decline because it is being led by the next generation, not the aging generations.

FACING REALITY

U.S. marketing, and American sports, are addicted to millennials, the very people we are losing. The reality is, if you want to benefit from the marketing value of millennials in sports, they have to be fans in the first place. The industry — the properties, teams, players, media and others — are responsible for making sports a more compelling option at a time when there are now more than a million other options for what they can do in their free time.

Being a sports fan can become part of a lifetime identity. At its best, the love of a team extends for generations of families. That bond is not the instant gratification that comes with new technology options. It is built with time, dedication, commitment and relationship. These fans built sports. Sports have not built these fans. How can we expect millennials and the next generation to engage in sports if we are not as fully engaged with them as generations of fans have been invested in us? What are we doing to invest in each fan to earn their belonging to a team or favorite sport?

If we want to keep the fans we have and encourage them to maintain the love of sports for generations to come, we need to stop making excuses about blips and face the reality sports is no longer an uncontested growth industry.

As shocking as this election was, for Republicans and Democrats alike, it was a reality check for every American asking a fundamental question “Who are we?” At 9:30 a.m. on Nov. 9, I asked 500 industry leaders that same question about sports. I saw weary resilience in the eyes looking back at me. This is tough. We are tougher. But only if we accept reality.

Rich Luker (rich@lukerco.com) is the founder of Luker on Trends and the ESPN Sports Poll.