Many of the readers of this column will have never heard of Haight-Ashbury and the Summer of Love. That’s a shame.

Haight-Ashbury is an actual intersection of two streets — Haight and Ashbury — in a small area in San Francisco that became synonymous with the free love and drugs culture of the 1960s. In 1966, the Psychedelic Shop opened, offering hippies the opportunity to purchase marijuana and LSD. Famous performers like the Grateful Dead and Janis Joplin lived nearby.

What does this have to do with sports investments?

Sports investments can be a form of “summer love.” They are attractive, alluring and in many ways addictive. However, just like the summer of love, it is not sustainable. Alas, it’s time to leave love behind, close the shop and move back into the real world.

How should sponsors and individuals analyze potential sports and entertainment investments? If I were a company looking to sponsor a property, I would be concerned about its financial health and its ability to deliver the assets we have negotiated. If I was an individual, I would be as concerned, as this would be my source of either work income or investment income if I were investing in public companies.

There are few publicly traded sports enterprises that you could consider if you choose to invest in the sports sector. This is a traditionally private sector, with sports properties held by a small group of people.

In the public sector are only a few companies most would recognize, such as SeaWorld Entertainment Inc. (trading symbol SEAS), International Speedway Corp. (ISCA), and Speedway Motorsports Inc. (TRK).

Complicating this, data on many sports enterprises is confidential. These data would not be beneficial to the sports enterprise owners to have publicly known to the athletes/employees that make up that enterprise. Where it is known, you see continued pressure, particularly by athlete unions, to “share the wealth.” This is not the objective of most affluent sports team owners.

This topic of financial analysis and financial health is still vitally important for all of us working and living in the sports world. Just because the data is not public for most enterprises doesn’t mean the financial health of the organization you are in is not important — for both the enterprise’s future and, as importantly, for your own.

To help understand the broad implications of the financial health of an organization, we will explore one of the three public enterprises. This is not to be seen as a recommendation to buy or sell any of their securities (stocks, options, bonds, etc.), but rather as an impartial look into what any informed investor would consider. This will be the Investors 101 approach, so don’t be intimidated by accounting principles.

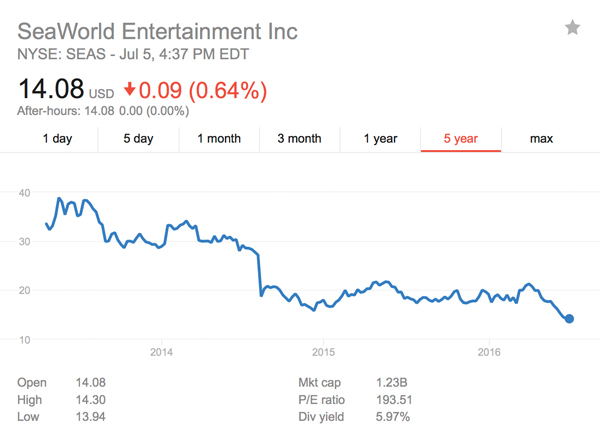

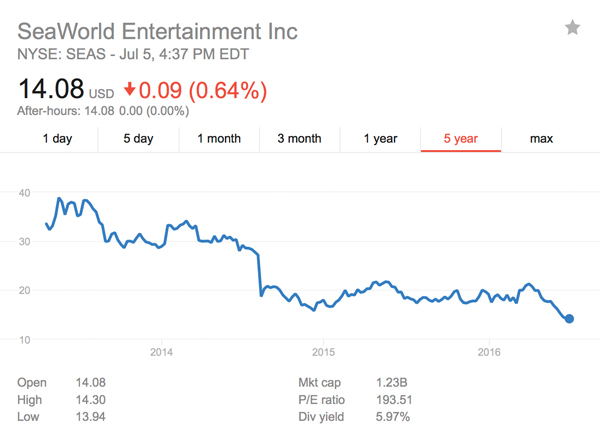

We’ll start with SeaWorld. Perhaps the most fundamental thing we can do is look at multiple time frame analysis of the stock performance. We’ll start with a look at the past year. A year ago, SEAS traded around $18 and last week it traded for about $14 per share. In between were some periods where it sold for as high as $21.63 per share but mostly hovered around $20. So for the period of a year, the stock has traded between $14 and $21 per share — that’s a huge range. If you had bought the stock at its high, you would have lost a third of your investment in a year, not something investors like to experience. There are many news events connected with those drops but for now let’s just focus on the stock price.

|

Image by: GOOGLE FINANCE — YAHOO FINANCE — MSN MONEY

|

Looking at the past two years, there’s a cliff in the stock price drop from $30 down to $20, a drop of about a third in value in share price (preceding the recent one-third drop we just discussed). Again, let’s delay looking into what prompted that drop and look at the next time frame, say five years: Another significant drop from $38 per share. The time period is not five years because SEAS wasn’t traded on the stock exchange prior to 2013. It was a private company held by a group of investors.

So the first basic takeaway is that multiple time-frame analysis of stock performance will reveal a lot of valuable points in time to try and figure out what happened to affect the performance or public valuation of the company.

SEAS started out as a $38-per-share stock and has dropped to $14 per share. That’s a downward trend and not something most investors are looking for in a stock unless they really believe in the rebound potential of the company or that the stock price is severely undervaluing the true performance.

This would make most investors pause prior to further analysis, likely looking at alternative opportunities, such as ISCA or TRK in our example.

So for those of you sponsoring or working in large and diverse companies, such as SEAS main competitors Disney and Universal Parks, the challenge is that the stock price does not reflect solely the value of the competitive property. For instance, Disney theme parks are a part of a very large and diverse corporation that includes ESPN, movie and production studios, etc.

What then is a good substitute if the sports/entertainment company is not publicly traded?

Here are a few I would consider:

■

Sales: Are sales increasing over the past year? Five years? How would you know? If management doesn’t share these figures, you might want to ask. They might not share exact numbers but you will get an idea of the trend.

■

Employees: Are the number of employees increasing? Decreasing? Staying constant? This is significant indicator of performance health. When the financial metrics of an enterprise are healthy there is rarely a push to reduce headcount. Reduction is an indication of performance concern, real or perceived, by the ownership. And decreasing employment is not a good sign.

■

Investment activity: Is the company investing in new activities, infrastructure, facilities, geographies? Lack of investment is a sign of “harvesting” the value of a company. Harvesting is not a good sign for anyone other than the owners.

■

Talent: Refers to the good performers that are either staying or leaving. My experience has been that poorly performing companies nearly always lose the best performers the quickest. The best performers know the best career opportunities do not lie with poorly performing companies.

Lots to consider. But this is critical and requires an investigative type of approach that you have to believe you are entitled to complete.

Raymond Bednar (raymondbednar@hyperion-marketing.com) specializes in advising and implementing optimization strategies for investments in marketing channels at Hyperion Marketing Returns — Rockefeller Consulting.