The sports rights bubble may be starting to leak air, with some smaller sports properties feeling the brunt of it.

While the NFL negotiated a 50 percent increase in TV rights fees for its “Thursday Night Football” package in February, Tennis Channel was unable to sublicense a French Open package to any of the major TV networks.

Where the NCAA tournament extended its deal with CBS and Turner with a healthy 40 percent increase last month, Conference USA is putting the finishing touches on a new deal with CBS and ESPN that will pay it much less than its previous deal.

As the Big Ten Conference doubled its annual payout (and still has one significant package left to sell) last month,

|

The International Champions Cup’s new deal with ESPN brought a reduction in rights fees.

Photo by: Getty Images |

the International Champions Cup saw its rights fee drop, especially for this summer, amid an atmosphere of belt-tightening from several big-time networks.

Interviews with nearly a dozen league and network executives painted a picture of networks that are becoming more judicious about where they spend their money, sometimes opting to produce cheaper studio programming over carrying live sporting events.

Live sports rights still are critically important to television networks. Live sports is the most advertiser-friendly genre on television. The programming is DVR-proof, meaning that viewers can’t fast-forward through the commercials. And it generally caters to younger demographics that advertisers seek. Live sports programming also generally commands bigger television ratings than nonsports programs.

But networks have started questioning the theory that all live sports matter, and they have been negotiating tougher deals with smaller properties that they feel will not help affiliate sales or ad sales. The French Open, for example, is not the type of sports event that would cause cable operators to do a deal for ESPN. Fox Sports 1 will not lose any standing with distributors because it passed on the rights to the International Champions Cup.

“Those properties are not game changers for cable channels,” said one network executive who asked for anonymity to speak frankly about existing sports rights deals. “They are not driving affiliate conversations. This is a market where the true litmus test is how does it help our affiliates and add value to advertisers.”

The networks have secured the biggest sports rights into the next decade (like the NFL, NBA and MLB) at huge increases. That has caused them to cut costs on smaller properties.

But the sky is not falling for all the smaller properties. Some still can earn rights fees if they figure out how they fit in with networks’ programming strategies. But the market for live sports has become much more difficult for smaller leagues than it was three years ago when ESPN, Fox and NBC Sports Network engaged in bidding wars for almost any property that came forward, creating the most robust sports rights marketplace that leagues and conferences have ever seen.

“There are so many big properties that are tied up for many years,” said Doug Perlman, founder and CEO of Sports Media Advisors. “Networks still are anxious to find the next big thing. NBC found it with the English Premier League. The next one could be something like rugby or cricket.”

To illustrate his point, Perlman pointed to England’s Aviva Premiership Rugby league. In March, NBC agreed to pay a small fee for the media rights to the rugby league as part of a multiyear deal. NBC cut the deal because it fits in with the company’s larger programming strategy, which is how smaller leagues can move forward in the current climate. It’s perfect for NBCSN’s schedule, which carries other European sports such as the EPL and Formula One racing. It also can help NBC market rugby as a new sport in the Olympics, which the network will produce from Rio this summer.

Cost-cutting mode

It’s easy to blame the changing cable landscape as the reason for the networks’ tighter purse strings. The market was different in 2013 when FS1 launched, creating a sports media arms race where ESPN, Fox and NBCSN spent lavishly on sports media rights. The high-water mark appeared to come in the fall of 2014 when ESPN and Turner Sports struck a breathtaking nine-year, $24 billion deal for the NBA.

But cable networks, like ESPN and FS1, have been in a cost-cutting mode for months, as they have seen their

|

Tennis Channel found no buyers for a third package of rights to the French Open.

Photo by: Getty Images |

subscriber counts drop. The smaller distribution footprints have eaten into cable networks’ biggest revenue stream: Distributors pay networks a set rate each month based on the number of subscribers that have access to the channels.

Nielsen estimates say ESPN has lost more than 7 million subscribers since the summer of 2013. FS1 has lost nearly 2 million subscribers in that time.

The networks’ belt-tightening became public last fall, when ESPN fired about 300 employees in a cost-cutting move. Fox Sports is in the process of accepting buyouts from longtime employees and further layoffs are possible, as it also cuts costs.

But network executives pushed back on the idea that cord cutting and cord shaving is causing this new fiscal responsibility. They say that so much more of their money now is tied up in big rights deals that it can’t afford smaller deals with smaller properties that bring in smaller ratings.

“This is not cord cutting,” said another network executive, who also asked for anonymity to discuss specifics of media rights deals. “Networks have made their bets and signed long-term deals with the bigger leagues.”

Take ESPN, for example. It is paying the NFL an average of $1.9 billion per year. It pays the NBA an average of $1.4 billion per year. And it pays MLB an average of $700 million per year. That doesn’t include all the money it spends on college sports, tennis and MLS.

Similarly, Fox pays the NFL $1.1 billion per year, MLB $525 million per year and NASCAR $380 million annually.

Those ever-increasing payouts for the country’s biggest sports rights are not leaving a lot of money left over for something like the International Champions Cup. The summer series, which includes matches between well-known soccer clubs, launched in the summer of 2013 when the sports rights marketplace was near its highest point.

The ICC was a success in terms of attendance. In 2014, Real Madrid and Manchester United played a match in front of 109,318 fans at Michigan Stadium. Last July, the ICC drew 93,226 fans to the Rose Bowl for a game between FC Barcelona and the LA Galaxy. A week later, 78,914 fans crammed into Maryland’s FedEx Field for a game between Paris Saint-Germain and Chelsea.

The ICC’s TV viewership was decent, too. Last year, it saw a high of 693,000 viewers for Manchester United versus FC Barcelona on the Fox broadcast channel. Most of the other matches generated between 200,000 and 300,000 viewers on FS1, which are relatively good numbers for the down summer months.

The series’ three-year deal with Fox ended last season, and the event’s organizers were looking forward to negotiating a new deal. After all, during the previous 10 years, sports properties had seen wild increases, and they figured to get some increase. The ICC’s rights holder, Relevent Sports, expected to see a significant bump from its original three-year deal worth more than $2.2 million in total.

Those hopes, however, ran into the realities of the sports rights marketplace in 2016.

In its initial Fox meetings, the ICC sought to more than triple its rights fee, sources said. Fox declined, leading the property to go to other networks to try to drum up interest. Other sports networks expressed interest, but not at the prices the event was seeking. ESPN said no. NBC Sports passed on it, too.

The following are results of the Turnkey Sports Poll taken in April. The survey covered more than 2,000 senior-level sports industry executives spanning professional and college sports.

In the next five years, sports TV media rights fees …

| Will continue to rise |

54% |

| Will plateau |

35% |

| Will be lower than they are today |

9% |

| Not sure / No response |

2% |

Does the average viewer differentiate between official sponsors and unaffiliated TV advertisers when a game or event is being broadcast on TV?

| Yes |

25% |

| No |

74% |

| Not sure / No response |

1% |

Does your household subscribe to any of the following services?

| |

April 2016 |

April 2015 |

| Pay TV (cable or satellite) |

80% |

77% |

| Netflix |

79% |

73% |

| Amazon Prime |

50% |

38% |

| Hulu Plus |

10% |

8% |

| Sling TV |

5% |

2% |

| None of these |

3% |

6% |

(Note: Respondents could select all that apply.)

Source: Turnkey Sports & Entertainment in conjunction with SportsBusiness Journal. Turnkey Intelligence specializes in research, measurement and lead generation for brands and properties. Visit www.turnkeyse.com.

Eventually, the ICC went back to Fox and said it would re-up at the same rate — with no rights fee increase.

Stunningly, Fox again said no and countered with an offer well below market value.

The property ended up signing a three-year deal with ESPN at terms well below its initial ask, according to several sources who added that ESPN is paying less than $500,000 in the deal’s first year for the series, a figure that includes a lot of marketing and promotion. The price increases in the next two years.

Still, it was a blow to a group that featured hugely popular teams like Manchester United, Atlético Madrid and AC Milan.

“We found strong interest with multiple bids in the market,” a Relevent Sports spokesperson said.

The French Open ran into similar roadblocks, sources said, as Tennis Channel tried to sublicense a third package of the tournament to the various sports networks.

ESPN had been paying Tennis Channel around $4 million to sublicense the rights for tennis’ fourth major, sources said. ESPN was a natural to renew the deal, especially since it holds the rights to the sport’s three other majors: the Australian Open, U.S. Open and Wimbledon.

ESPN told Tennis Channel last summer that it was not renewing its package, citing ratings for the event that fell below ESPN2’s weekday morning studio programming. ESPN also did not like its position as the French Open’s third rights holder behind NBC and Tennis Channel.

NBC could have been considered a natural to carry the package, given the fact that it carries the French Open championship matches. But NBC also passed on it. Tennis Channel ended up keeping the package for itself.

Conference USA, too, is expected to see its annual rights fee drop from the $7 million per year range to just around $1 million per year, sources said, as the conference replaced bigger college brands like Central Florida, Houston and Memphis with smaller ones like Louisiana Tech, Middle Tennessee State and Western Kentucky. The deal with CBS and ESPN still has not been announced formally, but the conference says it will soon make an announcement.

Conference USA’s current deals with Fox and CBS expire in June. Fox opted not to renew.

Still, some media consultants say it’s too early to declare the boom times over for sports leagues, even the smaller ones.

The prospect still exists for digital bidders to enter the market and drive up sports rights, which is what all the leagues are hoping for in the early 2020s when many of the biggest sports rights hit the market again. The leagues believe that TV network wallets will open wider if big digital media companies like Google or Facebook make a play for their rights. There’s nothing like competition to spark a bidding war.

That’s one of the reasons why the NFL cut a streaming deal with Yahoo last year and another one with Twitter for the upcoming season. These deals are designed to whet the appetite of digital companies so they can become serious bidders in five or six years.

Today, though, smaller sports leagues have a couple of options. They can invest in broad television distribution like Premier Boxing Champions, which bought time to get several networks to run its programming. Or they can do a digital deal in the hopes of getting distribution and growing an audience, like World Surf League, which has its own YouTube channel. Or they can wait for the current round of cost cutting to run its course in the hopes that the networks will open their pocketbooks once again.

Money used to flow freely as TV networks raced to secure buckets of rights. But now, smaller properties are having to get accustomed to a much tighter marketplace.

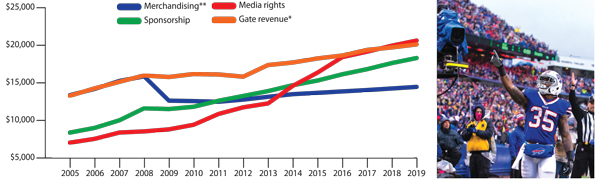

PricewaterhouseCoopers projects that the North American sports market will grow to $73.5 billion in 2019, and in 2018 the media rights segment will become the industry's most lucrative revenue stream.

| |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

| Gate revenue* |

$13,284 |

$14,261 |

$15,139 |

$15,984 |

$15,778 |

$16,176 |

$16,116 |

$15,821 |

| Media rights |

$7,041 |

$7,546 |

$8,388 |

$8,540 |

$8,809 |

$9,423 |

$10,858 |

$11,743 |

| Sponsorship |

$8,380 |

$9,003 |

$10,016 |

$11,616 |

$11,514 |

$11,820 |

$12,615 |

$13,257 |

| Merchandising** |

$13,358 |

$14,191 |

$15,255 |

$15,860 |

$12,631 |

$12,571 |

$12,482 |

$12,771 |

| Total |

$42,063 |

$45,001 |

$48,798 |

$52,000 |

$48,732 |

$49,990 |

$52,071 |

$53,592 |

| |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

| Gate revenue* |

$17,372 |

$17,707 |

$18,251 |

$18,637 |

$19,385 |

$19,717 |

$20,122 |

| Media rights |

$12,262 |

$14,595 |

$16,366 |

$18,427 |

$19,150 |

$19,949 |

$20,630 |

| Sponsorship |

$13,900 |

$14,689 |

$15,309 |

$16,140 |

$16,822 |

$17,635 |

$18,306 |

| Merchandising** |

$13,144 |

$13,493 |

$13,672 |

$13,861 |

$14,042 |

$14,252 |

$14,464 |

| Total |

$56,678 |

$60,484 |

$63,598 |

$67,065 |

$69,399 |

$71,553 |

$73,522 |

* Does not include the cost to lease premium seats or licensing fees for PSLs; includes only the face value of the ticket.

** Food and beverage concession sales are not included.

Source: PricewaterhouseCoopers

SportsBusiness Journal research indicates that between now and 2019, new deals will be negotiated for Conference USA (currently held by ESPN, CBS Sports Network and Fox), IndyCar (ESPN) and UEFA (Fox), as well as rights for the NFL's Thursday night package (CBS and NBC). Additionally, about a dozen NFL clubs' regional preseason agreements will expire.

| Property |

Current rights holder |

Length of current deal |

Average annual value |

Total value |

Year deal expires |

| Conference USA football championship |

ESPN |

5 years |

$4.4 million |

$22 million |

2015 |

| Conference USA |

CBS Sports Network |

6 years |

$7 million-$7.5 million |

$42 million-$45 million |

2016 |

| Conference USA |

Fox |

5 years |

$8.6 million |

$43 million |

2016 |

| NFL Thursday night |

CBS and NBC* |

2 years |

$225 million |

$450 million |

2017 |

| MLS |

Sky Sports |

4 years |

DND |

DND |

2018 |

| Verizon IndyCar Series |

ESPN, NBC |

6 years |

DND |

DND |

2018 |

| UEFA Champions League |

Fox |

3 years |

DND |

DND |

2018 |

| PGA Championship |

CBS, Turner |

10 years |

DND |

DND |

2019 |

| Mid-American Conference |

CBS Sports Network** |

4 years |

DND |

DND |

2019 |

| UFC |

Fox Sports |

7 years |

DND |

DND |

2018 |

* Each network will air five games and produce four games each for NFL Network.

** CBS has a sublicensing deal with ESPN to televise Mid-American Conference basketball and football games through the 2018-19 season.

DND: Did not disclose.

Source: SportsBusiness Journal research