Editor’s note: This story is revised from the print edition.

For visitors to Houston this week, the Final Four and its ancillary events will largely look and feel like they did last year in Indianapolis. Or the year before in Dallas. Or in 2011, when the NCAA’s marquee event last visited Houston.

The NCAA and its partners, Turner Sports and CBS Sports, have found an on-site formula that works: three days of concerts, a mega fan fest and a Texas-size tailgate on the day of the championship game.

That means there will be little that qualifies as new or different on the ground. But that doesn’t mean things aren’t going to be bigger this year.

Much of the growth in March Madness sponsor activation is coming from the digital and content side, where concerts are being simulcast and new sponsorship inventory is being created via the March Madness Live app and its new forms of distribution.

AT&T, for example, sponsors the Friday night concert at the Final Four (Fall Out Boy, Panic! At The Disco), and for the first time the NCAA corporate champion plans to telecast it live across dedicated channels on DirecTV and U-verse.

AT&T’s Ryan Luckey, the assistant vice president for corporate sponsorships, said broadcasting the Friday night concert to 26 million subscribers on DirecTV and U-verse “gives us a way to take the excitement from Houston and share it. This is really the first time we’ve taken the power of the merger [AT&T with DirecTV] and put it to work with an existing event.”

|

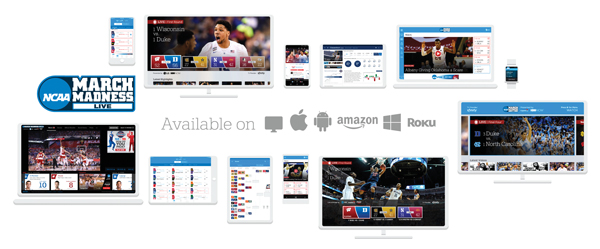

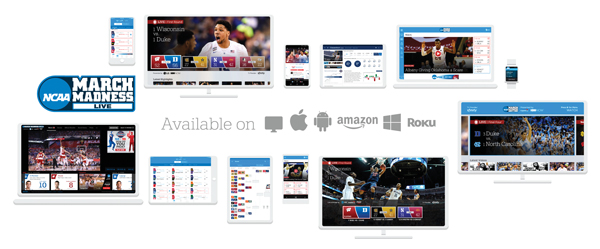

Turner and CBS sell March Madness Live across 10 distribution formats, up from two in 2011.

|

Turner is taking its own bite into musical content by simulcasting a Maroon 5 song from Capital One’s Sunday night concert into the iHeartRadio music awards, which will be televised on TBS, TNT and truTV. Maroon 5 is playing in the Capital One Jamfest that evening in Houston.

On the digital and social front, Allstate joined LG as a presenting sponsor of the NCAA’s Snapchat stories, which are new this year. That two-year deal, brokered with Turner Sports, calls for the digital team to create at least 14 Snapchat stories from regional and Final Four sites. It marks the first time there have been March Madness sponsorships for the social application.

Turner and CBS also gained extensive new advertising inventory to sell with the growth of the March Madness Live app into connected devices like Apple TV, Roku and Amazon Fire TV. LG, an NCAA partner, and HBO Now, not a partner, are presenting the March Madness Live app, on Apple TV.

These new streaming platforms have helped Turner and CBS sell across more than 10 distribution platforms this year, up from two (desktop, mobile) when CBS and Turner first took over the rights in 2011.

“There probably aren’t too many properties made for digital like March Madness and we’re seeing partners move that way,” said Dan Keats, director of sponsorship marketing and integrated marketing at Allstate, an NCAA partner.

Allstate’s digital and social extensions using the ubiquitous Mayhem character played by Dean Winters have focused much of its messaging on the “March mayhem” created by broken brackets and upsets. When a top seed went down, Allstate’s Twitter account sent out sympathy cards from the Mayhem character.

|

Allstate’s Mayhem character tweeted condolences after bracket disasters.

|

Keats said that type of social interaction has helped drive new business for Allstate.

“As we’ve seen digital consumption go up, we’re also seeing huge increases in our number of leads generated,” Keats added.

Turner and CBS said earlier this month they had sold out advertising across TV and digital.

Digital sales have been so strong that the networks have seen a 20 percent increase in their overall digital revenue.

Traffic has supported those gains, especially on mobile, where live hours viewed are up 33 percent and MML live hours across all platforms are up 12 percent. That’s on top of year-over-year growth every year since CBS and Turner began jointly managing the rights in 2011.

“We think of mobile as the first screen now,” AT&T’s Luckey said. “So sponsoring the MML app, to us, makes more sense than branding inside the stadium. … As long as the new generation consumes content — by that, I mean watch live games this way — we want to be on the forefront of that revolution.”

Only on desktops are viewership numbers for MML flat.

“What we’ve seen is that our partner activation is at an all-time high,” said Will Funk, Turner’s senior vice president of sponsorship integration and business development. “We’ve got a lot of thematic campaigns ongoing and every partner has significant activation that goes across digital and social.

“Partners understand the more thematic the creative is, the more engagement from the viewer, and the more it moves their business forward.”

In addition to the new ad inventory across March Madness Live platforms, Turner and CBS have focused with brands on content creation.

The most notable example has been the “Team Confidential” series of videos that run on Turner-run NCAA.com and on TV during studio shows between the games. These vignettes show exclusive inside-the-ropes footage of teams before, during and after their NCAA tournament games.

Turner and CBS cameras have captured this type of insider footage before, but never to this extent. By the end of the tournament, they figure to have produced 30 video vignettes that run three to four minutes long.

Unilever’s Dove Men+Care, an NCAA partner, jumped on as presenting sponsor of the video series and even created its own themed commercial, featuring Connecticut coach Kevin Ollie and ex-UConn coach Jim Calhoun.

“The way many of these deals are structured, they’re heavy with media, so it’s only natural that CBS and Turner lean that way,” said Tyson Webber, president of GMR Marketing, which consults with NCAA partners Lowe’s and Hershey. “It’s a credit to them that they’ve provided outlets to reach fans in a bunch of cool ways — concerts, experiential, fan fests — but a lot of the focus is on media and digital. If you’re a national brand just trying to activate in Houston, it’s not really an efficient buy.”

Staff writer John Ourand contributed to this report.