The FedEx Cup tees off for the 10th time this year, with golf stakeholders saying the format has achieved its goal of keeping the sport relevant late in the year when all eyes turn to football.

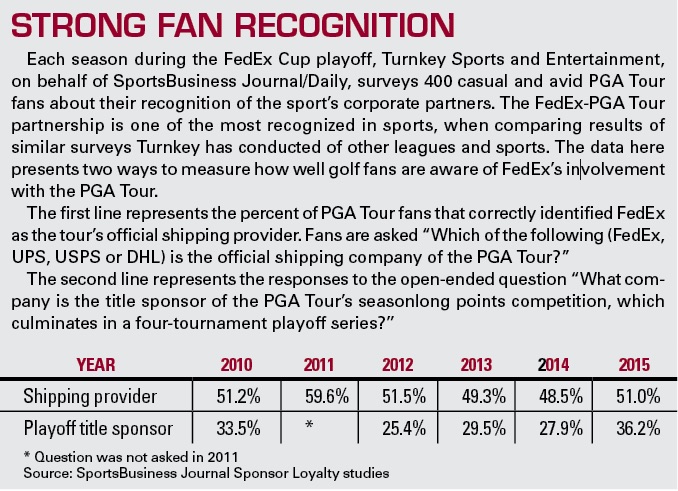

The FedEx Cup not only has transformed the PGA Tour by igniting a seasonlong competition capped by a whopping $10 million prize, it has brought FedEx a rare return: brand recognition deeply embedded within a major American sport.

Now, as PGA Tour players this month head into the heart of the FedEx Cup season, PGA Tour and FedEx marketers will soon begin negotiating a new title sponsorship deal to replace the one now set to end after 2017.

While serious talks won’t begin until this summer, both sides see their decade-long partnership of the FedEx Cup as

|

| Photo by: Getty Images |

a mutually beneficial relationship that has accomplished what both set out to achieve.

Consider that the FedEx Cup is the only championship format that golf’s current generation of stars has known.

Last year’s winner in Jordan Spieth was only 14 years old when Tiger Woods won the inaugural FedEx Cup in 2007.

Players now look at the FedEx Cup playoffs as marquee events on their schedule along with golf’s four majors and The Players Championship.

“We look at it and think that in only 10 years it has become so woven into the fabric of golf,” said Patrick Fitzgerald, senior vice president of integrated marketing and communications for FedEx. “In many ways it was an ideal opportunity for us and it has exceeded our expectations and it has become central to the golf world. A lot of it relates to the advancement of golf’s youth movement and it has been ideal in terms of capturing the attention of customers and consumers in focusing on golf and the brand.”

For the PGA Tour, the FedEx Cup has fulfilled one of its major missions: getting people to pay attention to their sport after the last of golf’s four majors in the PGA Championship concludes mid-August. Prior to the first FedEx Cup in 2007, interest in the PGA Tour would virtually disappear after August as many of the top players called it a season.

“What we wanted to do was to create a lot more momentum and extension for the golf season in a time of the year which the focus shortly after the PGA Championship had fallen off even though our season continued through November,” said Ty Votaw, chief marketing officer of the PGA Tour. “We still had a number of events, but the other events went lacking in terms of ratings and media coverage. We wanted to create a seasonlong competition that would connect all the events throughout the entire season much like other sports that leads to a playoff and provides a more climatic experience. Ten years later, it has become fully ingrained in the PGA culture and those objectives have been reached. We feel gratified.”

|

Today, the race for the FedEx Cup heats up in late summer with the four tournaments that comprise the FedEx Cup playoffs, beginning first with The Barclays, followed by the Deutsche Bank Championship, the BMW Championship and the final Tour Championship played in late September. This is the final year of Barclays’ sponsorship of its FedEx Cup playoff event, with Northern Trust set to take over in 2017.

The playoff format begins with the top 125 golfers who have collected the most FedEx Cup points throughout the season competing in The Barclays. The field is then reduced to the top 100 for the Deutsche Bank Championship, the top 70 point leaders advance to the BMW Championship and the top 30 golfers with the most FedEx Cup points play in the Tour Championship.

The Cup is then awarded to the player who earns the most points from all four FedEx Cup events.

“A point system that is real over the course of the year brings a greater cause to each and every week,” said Sarah Hirshland, senior managing director of business affairs for the USGA.

The format’s point system initially faced criticism as a work in progress, but the PGA Tour reset the system for the Tour Championship to create a more compelling competition.

“The points make every event more meaningful,” said Golf Channel President Mike McCarley. “It gives connective tissue to the events.”

Don’t look for many more major changes in the points format. As for the playoff tournaments, however, the tour has discussed the possibility of reducing the playoff format from four to three events. The tour said such a review is a normal evaluation of how to improve the system.

“We feel good where we are at and there are no tweaks this year,” Votaw said.

A deal driven by familiarity

For FedEx, the deal is the company’s largest and most expensive in its broad sports sponsorship portfolio, although the company and the tour would not disclose the deal’s value. FedEx also has deals with the NFL and NASCAR, naming rights of FedEx Field and FedEx Forum, and sponsorship of the FedEx St. Jude Classic, a longtime PGA Tour stop in the company’s home city of Memphis.

FedEx isn’t just the PGA Tour’s most lucrative sponsor, it is also one of the tour’s oldest partners given the

|

PGA Tour Commissioner Tim Finchem outlines the points structure in New York City in 2006, one year after first announcing plans for the FedEx Cup.

Photo by: Getty Images |

company’s sponsorship of the St. Jude Classic since 1986.

It was that familiarity between the company and the tour that was critical in creating the FedEx Cup as well as allowing the company to activate quickly and effectively around the event.

“FedEx was the ideal partner for a number of reasons,” said David Grant, founding partner and principal at Team Epic, which counts FedEx as a client. Grant also was part of the negotiating team for the FedEx Cup sponsorship.

“Everyone knew each other and that had a lot to do with it,” he said. “If the tour was going to change the nature of the sport and begin a new era, you do it with people you trust.”

But there was one other major factor that proved critical in the deal: There were no category conflicts with FedEx on the tour.

“FedEx already had shown that they were very effective marketers to the tour and they represented a much easier path,” Grant said. “That is a fancy way of saying there were no conflicts. If it were a car company or a bank, you would have had all these tournament sponsors saying, ‘Hold on.’ They kept it very clean.”

The timing was also right for FedEx. The company had been title sponsor of the open-wheel FedEx Championship Series sanctioned by CART from 1998 to 2002 and was open to new title sponsorship deals.

“When you go back to the original opportunity to have our brand bring forward golf’s first-ever playoff system, that was exciting,” Fitzgerald said.

Evolving activation

The broad goal of FedEx’s steep investment in the sponsorship always will be to put boxes on belts. But in the early years of the deal, the short-term goal was to make the FedEx Cup part of the golf industry’s vernacular.

“It was about promoting the new era of golf,” Grant said. “Then we could go back to promoting shipping.”

Now, it is much more digitally focused and much more globally focused.

Over the past decade, FedEx has gained notice within the industry in how the company has activated around the property, but the profile of the FedEx Cup also is benefiting from a resurgence of the PGA Tour thanks to a new generation of star players in Jordan Spieth, Rickie Fowler, Rory McIlroy and Jason Day.

“FedEx has done a nice job of leveraging the FedEx Cup with a visual presence everywhere,” said Jason Langwell, senior vice president of sponsorships for Intersport, which represents CareerBuilder and Quicken Loans in their PGA Tour tournament sponsor deals. “But the FedEx Cup is not what anyone is thinking about early in the season.

Overall, I want it to pull in the fringe viewer more. The good news is that the PGA Tour has the guys to do that. It is Rickie Fowler, Spieth and Jason Day who are the ones who are going to do that. It is not the format, it is the players.”

FedEx would not disclose specific data on how the FedEx Cup has affected its business, but Fitzgerald said that sponsorship includes broad activation throughout the year through hospitality, pro-ams, on-course signage, and broadcast and digital exposure.

“We measure it closely on a variety of metrics, revenue generation and business drivers,” he said. “We host thousands of customers at PGA tournaments throughout the year. We provide very strong and unique customer experiences. This past year, the ratings were up significantly and that drives significant brand awareness for us that way.”

The rise of digital activation also has helped pave the way for international branding exposure for the company.

“One of the interesting points is that more than 60 percent of the brand exposure comes from outside the U.S., and as we grow internationally, that is significant,” Fitzgerald said.

Votaw sees the company’s media activation as one of the keys to the partnership given that last year, ratings across the four FedEx Cup tournament rose 22 percent while social media reach rose by 50 percent from 2014.

“The kinds of things they have done from a media placement across all of our platforms has raised the profile of the competition,” he said.

FedEx’s future?

While it is unlikely that the FedEx Cup format will change, what about the future of FedEx’s sponsorship of the event? The deal was last renewed in 2012, for five years.

“I think the tour has created something powerful and it will only get better,” said Pete Bevacqua, CEO of the PGA

of America. “It has been great for the tour players, but anything to shine the spotlight on the game is wonderful for golf at all levels. It has to continue to evolve.”

Both the tour and FedEx executives say they are happy with their partnership. But such title sponsorships do hit roadblocks. In NASCAR, for example, Sprint is walking away from its title deal with NASCAR’s top racing series.

Grant would not speculate on the future of FedEx’s involvement, but count on the long and trusted relationship to play a big factor in the renewal talks.

“As the world gets smaller and our business gets more global and the tour gets more global, who knows what this thing looks like,” Grant said. “But the partnership with the tour has been very strong.”

Yet, even now that the FedEx Cup is an established property, the tour is taking nothing for granted.

“The biggest challenge is how you improve it,” Votaw said. “When you have a year like we had in 2015, you have high benchmarks. No matter how good we do in one year, we have a list of things we have to do to do it better.”

What they said in 2005

Opinions were plentiful in 2005 when the PGA Tour announced plans to start the FedEx Cup. Here’s a sampling:

“This will create more value for sponsors, more compelling TV and more financial benefits to the players. … Every one of our events is going to be strengthened. Players will be motivated to play more. The television will be more impactful and more balanced. We think fan interest will be strong. The entire platform is going to be elevated.”

— Tim Finchem, PGA Tour commissioner

“So many sports are now in their season or in the finishing part of their seasons, and here we are trying to get some TV time, and it’s just not working out.”

— Tiger Woods

“What’s wrong with the golf season focus the way it is? … Does (Tim) Finchem, or anyone else, think a made-up event, with a points chase and a playoff system, is going to rank up there with a major championship?”

— Dave Perkins, Toronto Star columnist

“(Tim Finchem) made it sound as if fans breathlessly will follow the points race from January through September. … Sorry, Tim, but that’s a stretch. Many people tune in only for the majors — history matters — and for the final round of tournaments in which big-name players are chasing victory.”

— Ron Kroichick, San Francisco Chronicle sportswriter

“It seems it’s stacking up where the top players get all the benefit of it, the rich get richer.”

— Greg Norman

“You can’t make (Tiger Woods) care about something called the FedEx Cup if he doesn’t want to. That doesn’t mean he won’t show up. It just means he has far more interest in winning something Ben Hogan once won than sticking another $3 million in his portfolio.”

— Gary Peterson, Contra Costa Times columnist

“This is going to bring the whole game of golf to a different level. All the top guys are going to be there toward the end of the year. I think this is going to do very well for the spectators and for the tour.”

— Vijay Singh

“How will this points race help the Honda Classic get better fields, if at all? It’s too early to comment because the details haven’t been developed yet. The object is to make the tour stronger overall, but I don’t know yet.”

— Cliff Danley, Honda Classic executive director

“(Finchem) is saying a week-to-week PGA Tour event by itself can’t compete necessarily against football, but if that one event is part of an ongoing series — you’ve built interest, you’ve built fan base — then you can go ahead and compete against football.”

— Mike Ritz, Golf Channel reporter

“Professional golf is defined by its major championships. It always has been, and hopefully, always will be.”

— Tod Leonard, San Diego Union-Tribune sportswriter

“This is going to be good for Tim Finchem and the tour in television negotiations upcoming, because there will be people who would want to televise those last four events.”

— Andy North, ESPN golf analyst

Source: SportsBusiness Daily archives