The Pac-12 Networks’ first three years have been defined by distribution difficulties and revenue shortcomings that have conference leaders wondering whether they should stick with the unusual structure of one national channel and six regional channels.

Within the last few weeks, conference athletic directors created three committees that will examine cost-cutting measures, game start times and how the Pac-12’s media revenue stacks up against other college conferences.

Also, the Pac-12 hired investment banking firm Lazard this year to determine a valuation for the networks and study alternative business models, sources said, including the potential for taking on equity investors.

|

The networks pay each conference school $1 million to $1.5 million annually.

Photo by: Pac-12 |

These are the clearest signs yet that the Pac-12 Networks, which are wholly owned by the conference, could look different in the future.

When asked if the collection of channels is doing its job for the conference, networks president Lydia Murphy-Stephans emphatically replied, “Absolutely, and then some.”

“It’s an exciting time,” she added. “We’ve built a business from the ground up. … We’re positioned perfectly to move forward.”

Pac-12 Commissioner Larry Scott, who was unavailable for this story, identified three primary goals when the networks launched in 2012:

■ Provide an unprecedented amount of exposure for the Pac-12’s teams;

■ Build a business that the conference would own and control; and

■ Return a surplus to each of the 12 schools.

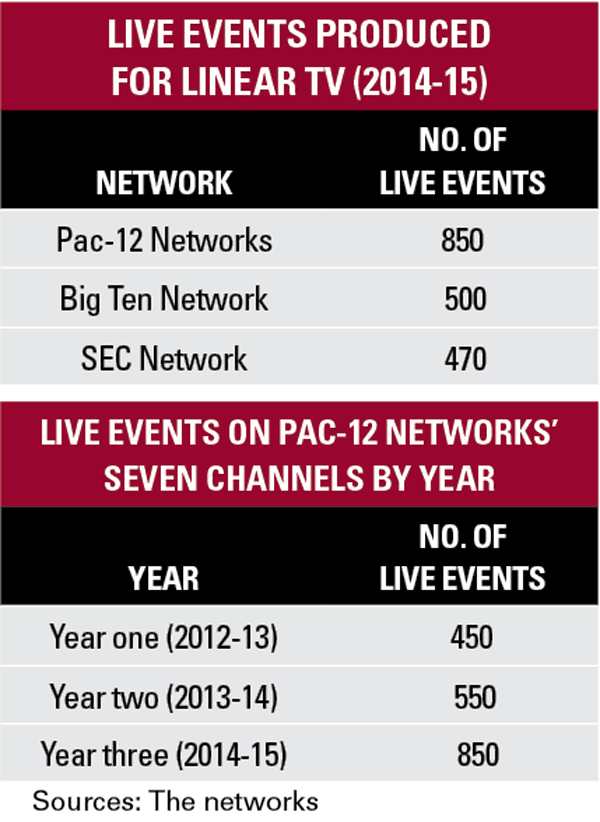

The networks have met each of those goals. It televised 850 live events on its linear channels last academic year, far more than the number of events on conference channels for the Big Ten or SEC (see chart). A majority of these Olympic sports events had never been on television before the Pac-12 Networks began televising them.

From a business standpoint, the networks, which employ 180 people, have operated in the black, paying each school $1 million to $1.5 million annually. That’s not taking into account the 12-year, $3 billion media rights deals the conference has with ESPN and Fox Sports.

The SEC, by comparison, paid its schools $7.5 million each in 2014-15 from its network, and the Big Ten Network’s number is believed to be even higher.

“You have to remember where we came from,” said Rob Mullens, Oregon’s athletic director. “The current Pac-12

deal has closed a significant resource and distribution gap with our power five (conference) peers that existed under the previous agreement. Similar to our competitors, we continually monitor the landscape to ensure we are positioned for both short-term and long-term success.”

Still, the networks cannot escape the two most glaring shortcomings: distribution and revenue back to its members.

The Pac-12 Networks are in about 12 million households, sources said, a figure that is well shy of the 60 million-plus households for both the Big Ten and SEC networks.

While the conference has never made promises about revenue, many of the Pac-12’s athletic directors worry about a revenue gap between their conference and the other power five leagues.

That’s why ADs have begun their own studies into the Pac-12 Networks’ revenue and expenses.

“I’m a big fan of the networks, but we all had projected that we’d be seeing a larger annual payday than we’re currently seeing,” Washington State AD Bill Moos said. “We’ve seen some increases, but it’s not where we hoped it would be.”

Distribution challenges

The schools expected to see some additional revenue prior to the current football season when the conference was deep into discussions on a carriage deal with DirecTV. All sides were optimistic that a deal finally would be reached by the start of the season, ending three years of rancorous negotiations.

The reason for the optimism was simple: AT&T had taken control of DirecTV earlier in the summer, and the conference had a more established relationship with AT&T. After all, AT&T carried Pac-12 Networks on its U-verse system almost from the start, and AT&T is one of the conference’s official corporate sponsors.

The two sides largely agreed on price and tier level, adding to the optimism conference officials felt. DirecTV, with close to 6 million subscribers in the Pac-12 footprint, conference sources said, would have brought a significant distribution boost to the channels.

But two deal points — not associated with the networks — proved too difficult to overcome and negotiations ended in September without a deal.

AT&T wanted a commitment that would allow it to wire every campus in the Pac-12 with its own video service, sources said. It was a way for AT&T to leverage DirecTV carriage.

The plan was similar to AT&T’s 2013 carriage deal between Pac-12 Networks and U-verse, which included a commitment to upgrade all of the Pac-12’s football stadiums and basketball arenas with wireless systems. As part of that 2013 arrangement, AT&T became the conference’s official wireless provider.

AT&T also asked for expanded rights around its wireless sponsorship as part of any DirecTV deal this year, sources said. It’s unclear what rights AT&T specifically wanted.

This time, AT&T’s request for additional campus rights proved to be a deal breaker for the Pac-12.

Scott went to the conference’s 12 university presidents with DirecTV’s proposal. They rejected it unanimously, in part because many of the state schools simply couldn’t surrender those rights without a formal bid process.

The two sides have not had meaningful carriage discussions since September. DirecTV will not feel much pressure to do a deal until at least the 2016 football season kicks off. Even then, DirecTV will have gone through four academic years without the Pac-12 Networks, demonstrating that they can exist just fine without the conference’s programming.

“We always leave the door open, but we are not actively negotiating right now,” Murphy-Stephans said. “I wouldn’t categorize it as though we need DirecTV to be successful. We have been successful without DirecTV, and we will continue to be.”

Distribution wasn’t supposed to be such a challenge by this point. The Pac-12 Networks launched in 2012 with the help of a cable consortium of Comcast, Time Warner Cable, Cox Communications and Bright House Networks that seemingly assured a successful distribution plan.

The model of one national channel and six hyper-local RSNs was unique and perfectly situated for cable. The idea was conceived by the conference, in consultation with media advisers and the four cable operators. In fact, at the launch press conference, Scott gave the distributors much of the credit for the multi-channel concept.

But the distribution deals put the networks at a disadvantage when compared to other conferences’ offerings. That’s because the cable operators placed the national network on poorly distributed tiers outside of the Pac-12 footprint, and in some cases inside the footprint. Both the Big Ten Network and SEC Network have better distribution — and more paying homes — outside their respective footprints.

Some media executives, however, say that too much weight is being given to the networks’ distribution deals. The Pac-12 saw a huge payday from ESPN and Fox Sports starting in 2011, and its networks are available to anyone, anywhere in the country, who wants to see them.

“It’s easy to pile on and call it a failure, but I don’t think it’s a failure,” said Desser Sports Media President Ed Desser, a Los Angeles-based media consultant who was not part of these negotiations. “Where was all this programming before? The conference and its schools now have a promotional platform they haven’t had before. It is progress. It is unique.”

Studying the numbers

When the Pac-12 hired Lazard this year, it set off questions about the conference’s intent. Lazard, a 167-year-old financial advisory firm, specializes in mergers, acquisitions and restructuring.

The conference said it hired Lazard to determine the value of the networks after spending three years pumping millions into infrastructure and technology. When news of Lazard’s hiring began to spread over the summer, speculation centered on whether the Pac-12 was looking to sell all or part of the networks or possibly take on equity partners. Sources said that Fox and ESPN executives looked at the networks’ books, but neither made a move. Fox is already a partner in the Big Ten Network, while ESPN owns the SEC Network.

The Pac-12 and Lazard have an ongoing relationship, the conference said.

“After year three, which was our ramp-up, it was important for the business and the board to understand the value of the entity we created,” Murphy-Stephans said. “Lazard was engaged to assess the value. Like any business owner, you want to know where we are. At this stage, we have a very predictable business. We know the costs, and we know the surplus. We have a three-year record.”

Over those three years, the Pac-12 Networks have returned between $1 million and $1.5 million annually back to the schools. While any surplus the first year was considered a bonus, several school leaders said they hoped to see revenue grow more substantially.

The revenue equation is one issue the Pac-12 ADs hope to learn more about through these new committees. If the networks’ distribution does not grow significantly, the ADs want to know what kind of long-term revenue deficit schools would face compared to their power five counterparts.

The ADs are calling this the benchmarking committee. The conference says it regularly reviews ways to optimize

|

Conference leaders want to make sure the Pac-12 keeps pace financially with other conferences.

Photo by: Pac-12 |

its operations, and these committees are part of that process.

A revenue gap “creates separation,” Colorado AD Rick George said. “Let’s face it, we compete against those other conferences. I’m glad we’re taking a step back and looking to develop a strategy that makes sense.”

Murphy-Stephans cited 73 distribution deals the conference currently has signed, which represents the networks’ primary source of revenue. Similar to most sports channels, the majority of revenue comes from affiliate fees. She also said the conference could look into over-the-top distribution as a way to grow the networks’ subscriber base.

A separate AD committee will look at the expense side. The Pac-12 Networks reached their goal of producing 850 live events for its linear channels in 2014-15. Some ADs are asking if the networks really need to produce so many events. By comparison, Big Ten Network produced 500 live events and the SEC Network did 470 last year, although neither has multiple local channels to program like the Pac-12.

Most Olympic sporting events cost $15,000 to $25,000 to produce in HD for linear TV, Murphy-Stephans said.

“Maybe we need to consider cutting back,” Washington State’s Moos said. “Doing 850 events … that’s not cheap.”

Cutting production costs certainly would enhance the bottom line. But such a move carries complications elsewhere. The Pac-12 has contracts with its distribution partners that mandate 850 live events each year. Those distribution deals, sources say, go out 12 years with very little flexibility.

“If we just cut events, sure, there is a cost-savings, but there’s also an exposure loss,” Murphy-Stephans said. “A cutback would trigger serious thoughts about our model. Our distribution partners have been offered 850 events, so it’s a challenging assumption that we’d reduce events and the net would return to universities. That wasn’t the original mission.”

While the broad schedule is intended to maximize exposure, there also are restrictions. Multiple Pac-12 schools say they were approached by Showtime to participate in a behind-the-scenes football special, but they were not permitted. Pac-12 Networks has its own “insider” show called “The Drive,” so it limits such access from other networks.

Keeping up in power five

In his seventh season as the Pac-12’s commissioner, Scott has been a progressive game-changer in every sense.

The former professional tennis player and WTA chief added two universities to the conference and persuaded school leaders to share TV revenue equally, effectively restructuring the caste system of haves and have-nots within the conference. Revenue from the 12-year, $3 billion TV deals with Fox and ESPN, negotiated by Scott, has led to a surge in facility construction and coaches’ salaries.

Scott re-imagined the multimedia rights business by offering schools a method to control their own rights. Earlier this month, Scott led a delegation to Shanghai to watch Washington and Texas play the first college basketball game in China, a game organized by the Pac-12 (see story).

While school officials are more openly questioning his model for the Pac-12 Networks, conference ADs agree that they are much better positioned now than five years ago. The groundbreaking networks represent a huge leap forward — the first time a conference has built and wholly owned a major media company.

In only three years, the networks’ programming has been honored with numerous awards, including four Sports Emmy nominations and an IBC Innovation award.

But conference leaders want to make sure that the Pac-12 keeps pace financially, especially with the Big Ten and SEC networks flourishing, and the ACC contemplating its own channel with ESPN.

Despite the grumbles on some campuses and the DirecTV disappointment, Scott has made it clear that he wants to stay the course.

“In this world with the rapidly changing media landscape, and over-the-top options, technology companies getting involved, owning your own content will give us great advantages going forward,” Scott said last month on a visit to Colorado’s campus. “I think we’ll be sitting here five years from now with us having many more options than the traditional cable, satellite or telco companies. … It will open up more options for our fans to be able to access the Pac-12 Networks on whatever device they want.

“It’s one of the reasons I like owning our own network. We’ll be nimble, we’ll be flexible, we’ll have the ability to adapt.”