What determines loyalty across pro sports? That’s one of the principal things consultancy Deloitte’s nascent sports division looked to assess in an April survey of 4,000 sports fans in the U.S.

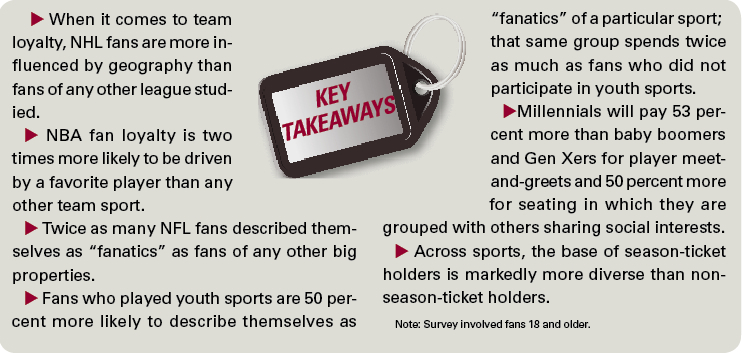

Some of the findings were garden variety. For example, hometown was the biggest factor in determining team loyalty (40 percent). However, it’s interesting that NHL fans in the study were more influenced by geography than any others. The range went 44 percent for the NHL, 42 percent for MLB, 39 percent for the NFL, 36 percent for the NBA and 35 percent for MLS.

|

The NHL leads the way in the percentage of fans who say hometown was the biggest factor in determining who they pull for.

Photo by: Getty Images |

NHL Chief Operating Officer John Collins said the league’s strong local roots have been a blessing and a challenge.

“All sports fans are tribal and the NHL’s more than any,” Collins said. “For years, the media deals with this league stressed local over national exposure, so that’s the way our fans were conditioned. Now, with more national TV exposure, including the [Stanley Cup] Final on nationally, that’s been changing and we’ve been transforming more fans of their local teams into followers of the sport as a whole.”

Another “no-brainer” discovery by the survey was that the second most important factor in team loyalty among all leagues surveyed was current residency (22 percent). Then family influence came into play: 14 percent of those surveyed picked their favorite team based on “family history,” while 10 percent said their team loyalty was primarily based on team performance.

Since the fortunes of an NBA team can be affected by the addition of one or two players, it’s interesting that among those surveyed, NBA fan loyalty was two times more likely to be driven by a favorite player than any other team sport.

“Look at the lists of most marketable players around the world and there are more NBA players on those lists than players from any other league,” said NBA Chief Marketing Officer Pam El. “The NBA game is just more intimate; fans are closer and you get to see their faces and their expressions. That creates more of a bond with individual players, in person and on TV.”

The NFL gets bigger and more pervasive within American pop culture every season. Still, is there a reason other than sheer size and popularity behind the study’s finding that twice as many NFL fans described themselves as “fanatics” as fans of any other big properties? Some of that might be skewed by the size of the NFL schedule, since the survey question described “fanatics” as those who “never miss a game.”

“You have to respect the NFL’s sheer size and reach, but another big factor in its popularity is that it’s easily consumable by its fan base,” said Elizabeth Lindsey, who heads Wasserman Media Group’s corporate consulting practice. WMG Consulting counsels NFL league sponsors Lenovo, Microsoft, Nationwide Insurance, Pepsi and Verizon.

“Fantasy has drawn more people and you can’t ignore the place it has in pop culture,” Lindsey said. “If you can’t come into the office Monday and talk about what happened Sunday, you are out of the loop. So for a lot of people, the NFL is a social obligation. All those factors are fertile ground for producing more NFL fanatics, and fans in general. Still, what we’ve found in America is that while soccer fans are far smaller in total, they are the most avid.”

While it seems intuitive that playing youth sports will turn some of those participants into fans of the elite levels of those games, the value of those connections has now been quantified. According to the survey, fans who played in youth sports leagues are 50 percent more likely to describe themselves as “fanatics” of a particular sport; that same group spends twice as much as fans who did not participate in youth sports leagues.

Declining enrollment in youth leagues is thus seen as an ominous trend “due to the relationship between fan engagement/intensity and youth participation,” the study said.

Pro teams traditionally have linked with youth sports in their markets, but these two data points suggest further investment would be wise.

By now, marketers targeting millennials know of their preference for experiences over material goods. Accordingly, the survey showed that millennials will pay 53 percent more than baby boomers and Gen Xers for player meet-and-greets and 50 percent more for seating in which they were grouped with others sharing social interests.

Millennials “view sports as a good way to invest their time and money; still, winning their business will likely require investment in creating relevant, authentic experiences,” the study said.

Any number of demographic studies shows America becoming a more diverse nation. Who would have guessed that across sports, the base of season-ticket holders is markedly more diverse than non-season-ticket holders? For example, 18 percent of season-ticket holders in the survey were African-American, compared to 12 percent of those surveyed without season tickets. Around 20 percent of season-ticket holders were Hispanic; only 14 percent of non-season-ticket holders surveyed were Hispanic.

Team marketers know season-ticket holders are valuable; the survey attempts to quantify their worth as being five times more than non-season-ticket holders when it comes to non-ticket, team-related purchases. Further, it encourages more offseason activities, with the revelation that season-ticket holders engaging in those kinds of events spend 2.2 times more on non-ticket, team-related purchases.