The NFL ad sales market is being driven by a category that did not even exist a couple of years ago, one that is dominated by two companies that have yet to show a profit.

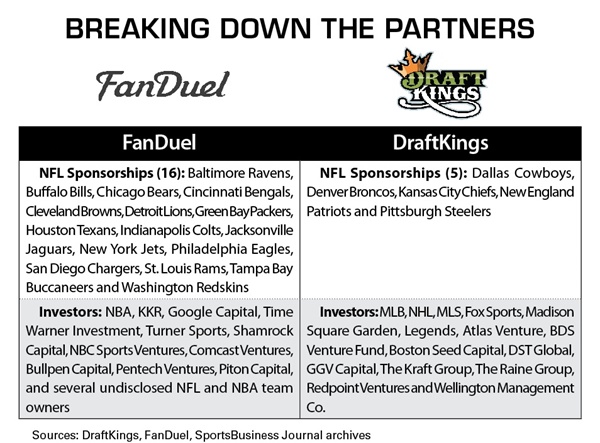

Daily fantasy companies DraftKings and FanDuel have created the fastest-growing ad sales category in sports TV by far and one that has added more than $200 million in ad sales revenue for the NFL’s network partners: CBS, ESPN, Fox, NBC and NFL Network.

Thanks primarily to this huge influx of cash, the league’s TV partners are reporting a high single-digit percentage sales increase for their NFL games this season.

One network source pegged the two daily fantasy companies’ total advertising investment across sports on all networks at a massive $500 million so far this year.

“It really has been the category fueling any growth in sports, especially across the NFL,” said Tom McGovern, president of Optimum

Sports. “This category is just on fire.”

Networks have bought into daily fantasy as a business, with Fox Sports investing in DraftKings and NBC Sports and Turner Sports investing in FanDuel. Outside of those equity investments, network executives are even more bullish about the money the two companies are spending on advertising. Executives with each of the networks say daily fantasy is close to becoming a top-five category, behind much more established categories like automotive, insurance, telecommunications, quick-service restaurants and beer.

That is dramatic growth from a category that barely existed just two years ago and comes amid a television landscape that increasingly is seeing advertisers flee linear television for digital schedules.

Still, sports ad sales are faring better than ad sales associated with other TV genres. John Bogusz, CBS’s executive vice president of sports sales and marketing, said that the auto category, in particular, was spending more on the NFL across the board this season. But all TV executives agree that new spending from the two daily fantasy companies has fueled the market.

“They have been a bright star for us, certainly starting last year and continuing this year,” said Seth Winter, NBC Sports Group’s executive vice president of sales and marketing. “It’s been a really robust influx of cash investment in the NFL.”

According to executives running daily fantasy businesses, that advertising spend is not likely to end any time soon.

“It’s a new category and the industry keeps getting bigger,” said FanDuel CEO Nigel Eccles. “There will still be plenty of market share available next year, so I expect this to continue into the 2016 football season and get even bigger.”

The huge advertising payout has helped create more awareness around the FanDuel brand so far, Eccles said.

“There are more than 50 million fantasy sports players in America, and we only have about 1.5 million playing daily fantasy,” he said.

While the market is so hot, ad sales executives are keen to sell as much inventory as possible to daily fantasy companies, and hope the two companies continue to spend against sports.

But executives also warn that they have seen these trends before, as TV sports are littered with advertising categories that became red-hot overnight only to fall back after a year or two. All one has to do is look at the dot-com craze at the turn of the century or the online poker boom 10 years ago.

For John Turner, vice president at ZenithOptimedia’s Sponsorship Intelligence unit, DraftKings and FanDuel’s ad spending is reminiscent of the big push online poker companies made years ago. “Online poker was aimed at the right demo, and it was a pure branding play, so you saw a lot of it for a while,” he said.

The spend reminds NBC’s Winter of the tech push a couple of years ago, albeit with much more established companies. “The last big category to burst onto the scene was technology — the explosion of digital devices that Samsung and Apple and Microsoft helped fuel,” he said. “That’s the nearest chronologically and nearest practical comparison that I could make.”

But the huge amount of ad buys Draft-Kings and FanDuel are making takes Ed Erhardt, ESPN’s president of global marketing and sales, back a few years earlier. “Back in the day when they were called dot-coms and were technology, that was one that had that kind of velocity,” he said.

While TV networks are getting fat with the increase in daily fantasy advertising, there’s still a question about how long the category will remain vibrant. The category will have to avoid several potential roadblocks.

Daily fantasy companies, and the media companies that invest in them, constantly have to battle comparisons to gambling — an association that networks want to avoid at all costs. Still, the potential for legalized gambling, which some in sports are pushing for, could hurt daily fantasy’s growth prospects.

Plus, if the sector remains popular, other companies may get involved.

“Some of the biggest questions I have is how long this lasts and who’s actually winning the money from these [pay] fantasy games,” McGovern said. “The perception is you are competing with your buddies; the reality is you are competing with guys that went to Stanford and MIT.”

Several people interviewed for this story raised the question of whether either daily company would pay the $5 million per 30-second spot price tag necessary to advertise in the Super Bowl this season, a coming-of-age rite for any brand. CBS would not reveal any specific advertiser that has bought time for the game.

Chris Weil, chairman and CEO of Momentum Worldwide, agreed.

“If I were counseling the two brands, I would tell them to make money as fast as they can, because the business model is going to change, the dynamics are going to change and the definition of what’s gambling is going to change,” he said.