The domestic violence scandals that rocked the NFL last year not only did not dent the league’s revenue, which is projected to hit a record high of more than $12 billion in 2015, they also did not hurt corporate America’s demand for players.

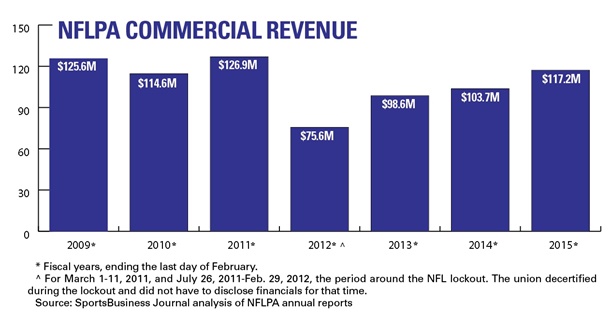

The NFL Players Association’s licensing, marketing and sponsorship revenue jumped 13 percent in the 12 months ending Feb. 28, 2015, compared to the prior year, according to a review of the union’s annual reports filed with the U.S. Department of Labor. The most recent of those reports was filed May 29.

While the NFLPA figures reflect only licensing deals involving six or more players — known in the industry as group-licensing deals — experts in player marketing said the totals underscore the overall demand for NFL athletes, whether in groups or individually.

“While the events of the last year certainly created a reputational hit to the NFL, the reality is … the majority of players are good,” said Matt Hill, senior vice president of global sports and entertainment consulting at GMR Marketing. “As long as the league continues its dominance, U.S. brands will continue to take some minor risks in aligning with NFL players.”

Hill cited companies, some of which are GMR clients — like Visa, Comcast, SAP, and Procter & Gamble — that continued to use NFL players.

The most recent increase in commercial income for the NFLPA follows gains from past years, too, but the resulting sum still trails the $126.9 million the union posted in the 12 months ending Feb. 28, 2011, prior to that year’s NFL lockout.

The annual report uses cash and not accrual accounting, meaning it only reflects cash that came in during the 12-month period. The money represents licensing deals such as those for jerseys and trading cards, as well as from marketing appearances arranged for players through the union.

According to the most recent annual report, two principal areas drove the $13.5 million increase over the past 12 months: trading cards and the NFL itself. The league accounts for 45 percent of the union’s commercial revenue as part of a marketing agreement between the two sides. The union agrees as part of the deal not to solicit companies that might compete with NFL sponsors.

Aside from the NFL’s $53.3 million payment, a $6 million annual bump, the next largest contributors are trading card companies Panini ($23.3 million) and Topps ($13 million).

The union next year begins an exclusive deal with Panini in the card category.

The NFLPA also signed 46 companies to new licensing arrangements and sponsorships in the past year, deals totaling $2.8 million in revenue.

|

Russell Wilson topped $3M in group-licensing income.

Photo by: GETTY IMAGES

|

Meanwhile, Nike’s payments to the NFLPA, nearly all of which stem from royalties, dipped to $10 million from $14 million.

The union, citing policy not to comment on its annual report, declined to speak about the figures.

Other notable results in the 2014 report include having the first NFL player, Seattle quarterback Russell Wilson, to collect more than $3 million in NFLPA group-licensing income.

Also notable is a deal with the U.S. Army for $106,843. NFL teams recently came under scrutiny for taking sponsorship money from the military. The Army paid the union $33,000 the year before, and there is no record of a business relationship prior.

Pentagon officials have said publicly they are reviewing their marketing arrangements with the NFL.

As expected, the player in the middle of the domestic violence controversy, Ray Rice, has suffered a significant drop in his commercial income received through the NFLPA. After earning $221,162 in marketing and licensing income from the NFLPA in the 12 months ending Feb. 28, 2014, Rice’s sum dipped to $11,364 in licensing income only for the most recent year.

Adrian Peterson’s group-licensing and marketing income dipped from $967,298 to $484,969. Unlike Rice, whose altercation with his then-fiancée first made headlines in February 2014, Peterson’s child abuse allegations did not come to light until September.

Peterson and Rice, however, were not the norm, with NFLPA income rising overall.

“A few bad apples don’t rotten the whole barrel,” said sports marketing executive John Tatum, whose company, Genesco Sports Enterprises, represents NFL sponsors Pepsi and Verizon, among others, that use players in marketing.

The extra income over the past year helped the NFLPA pad its asset level, which hit a record $365 million as of Feb. 28, 2015, up from $329 million 12 months earlier.