The NBA is on the verge of setting an all-time attendance mark and scoring its biggest average annual increase at the gate in two decades.

Those gains add to a year of business highs that include the sale of a record number of season tickets, a $24 billion TV deal being secured, and the lucrative fantasy sports sponsorship category getting tapped. A new apparel deal is expected for the league as soon as this month, as well.

The question is, how might all that success, and the additional revenue, be viewed by the players and their union, with a possible opt-out of the league’s current labor deal coming in the years ahead?

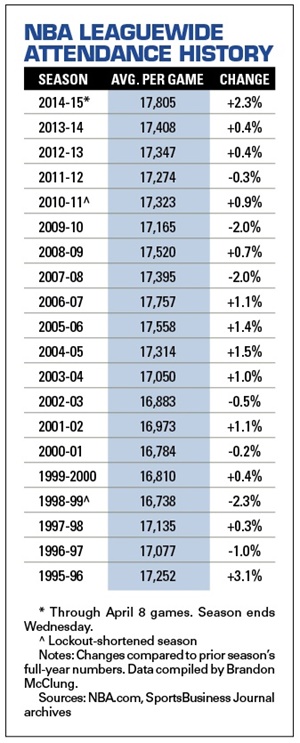

Entering the final days of the regular season, the NBA last week was averaging 17,805 fans per game, better than the record 17,757 mark set in the 2006-07 season. The league confirmed that with presold tickets this year’s attendance will finish higher than what was seen in 2006-07.

This year’s average also stands to provide the highest year-over-year increase (up more than 2 percent from last season) since the league saw a 3 percent gain in 1995-96, the season that featured Michael Jordan’s first full year back in the league after his 1993 retirement announcement.

“Overall, there is tremendous fan interest in the league,” said Amy Brooks, executive vice president of team marketing and business operations for the NBA. “We are also on track to break our 20-year-old record of sellouts.”

That sellout record, 676, was set in the 1994-95 season. Brooks said the NBA will have more than 700 sellouts this season by the time the regular season ends Wednesday night.

The NBA sold more than 280,000 full-season tickets this year, the most in league history. This season’s attendance increase also means the NBA will have a new high for ticket revenue this year, although the league wouldn’t disclose specific financial details in that regard.

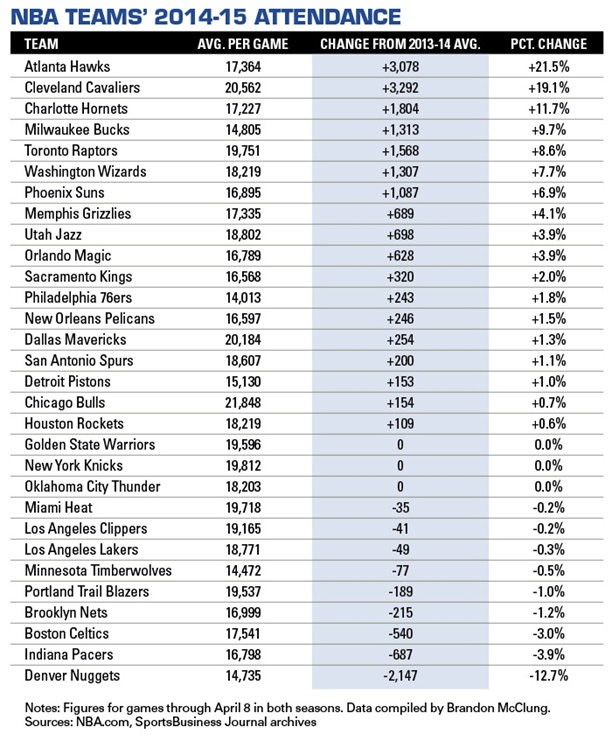

Fueling the league’s record-setting numbers are gains from some of the league’s less traditional winners. Specifically, seven teams have seen their average attendance grow by more than 1,000 fans per game this season: Atlanta, Charlotte, Cleveland, Milwaukee, Phoenix, Toronto and Washington. Each of those teams is either in the playoffs or has made a push for the postseason through the year.

There haven’t been comparable drop-offs in markets with teams bound for the lottery, either. Most notably, in New York and Los Angeles, fans haven’t stayed away while the Knicks and Lakers plummet in the standings. The Knicks have played to 100 percent capacity at Madison Square Garden again this year, and the Lakers are playing to 98 percent capacity at Staples Center.

The Eastern Conference-leading Atlanta Hawks boast the league’s largest gain in average attendance, up more than 21 percent from last year to an average of 17,364 fans per game. Cleveland ranks just behind the Hawks, with a 19 percent increase thanks largely to the return of LeBron James to the Cavs.

“The league is on a forward trajectory, and in the case of our team, we’ve been on the path for awhile,” said Tracy Marek, chief marketing officer for the Cavs.

At 20,562 fans per game this season, the Cavs trail only Chicago for the highest attendance leaguewide. Chicago was averaging 21,848 fans per game as of last week.

Chicago has led the league in attendance the past five seasons.

The NBA’s recent run of business headlines began before this season even started, when the league last summer lifted its ban against teams selling sponsorships to fantasy sports gaming companies. That’s led to 15 teams doing such deals this season, along with the NBA itself having a deal with FanDuel.

|

LeBron James’ return helped spur a 19 percent attendance increase in Cleveland.

Photo by: GETTY IMAGES

|

In October, the NBA announced its nine-year, $24 billion media rights deal with ESPN/ABC and Turner, a nearly threefold increase in average annual value compared with the league’s current eight-year, $7.44 billion pact. Those new contracts take effect with the 2016-17 season.

As for apparel, Adidas announced last month that it would not be returning as the league’s official apparel sponsor when its deal expires in 2017. That current 11-year deal is reportedly worth $400 million, and that figure is likely to increase significantly as the likes of Nike, Under Armour and others vie for the business. An announcement of a new partner could come as soon this week, when the league’s owners gather in New York for their annual mid-April board of governors meeting.

But 2017 is also when the National Basketball Players Association, per the current collective-bargaining agreement, could opt out of the existing labor deal. (Both the league and union have opt-out provisions available to them, effective after the 2016-17 season.) The current deal gives the players a 50 percent share of league revenue. Given the new money lining the NBA’s pockets, the union could see an opportunity for a renegotiation.

NBPA Executive Director Michele Roberts has already rejected a league proposal to “smooth in” the increased revenue from the new TV deals as it would pertain to the salary cap. Instead of seeing the cap make a big jump from 2015 to 2016 fueled by the new TV dollars, the league wanted to spread that cap increase across several seasons to avoid a sudden huge increase in salaries available for free agents in the summer of 2016. The union rejected that request.

Notice of an opt-out by either side must be given by Dec. 15, 2016. Either party doing so would start the clock ticking on getting a new deal in place ahead of the 2017-18 season.