David Raith still remembers the day in 2007 that he learned ABC planned to end its 43-year relationship with figure skating. U.S. Figure Skating had anticipated it, cutting its expenses drastically in the final two years of ABC’s media contract, but the decision still hurt.

|

Gracie Gold has secured deals with Visa and Smucker’s that help the sport’s exposure.

Photo by: GETTY IMAGES

|

“It changed our business,” said Raith, U.S. Figure Skating’s executive director. “We went from guaranteed [revenue] overnight to what we had to generate.”

ABC had propped up U.S. Figure Skating for years. Its $12 million-a-year TV rights deal covered more than half the organization’s expenses. The media money also meant the organization didn’t have to sell sponsorships or need a commercial division. But without it, revenue plunged from nearly $20 million in 2007 to just over $9 million the next year.

{podcast}

SBJ Podcast:

From Sochi: SBJ Olympics writer Tripp Mickle and Tom Shepard, former Visa marketer and current 21 Marketing partner, discuss the Sochi Games and how partners are faring on the ground.

The organization, which traditionally fields the most popular team in the Winter Olympics, has spent the past seven years rebuilding its business. It has cut costs, developed its own sponsorship program, acquired media rights to figure skating events and overhauled the selection process for its marquee events.

The result is a stable governing body that has increased its corporate revenue by $4.5 million over seven years and increased total revenue to about $15 million annually.

“We’re pushing it back up with the successes we’ve had,” Raith said, “and we’re looking forward to growing it more.”

Jay Ogden, senior vice president at IMG, who oversees the company’s figure skating events, said the organization has done “A-plus work” developing new talent, improving its TV coverage and landing sponsors.

“We’re seeing a resurgence [of figure skating] in the U.S. on a number of levels over the last two years, and particularly the last 12 months,” Ogden said. “That’s a reflection of how U.S. Figure Skating has operated.”

U.S. Figure Skating signed its lucrative TV agreement with ABC following the Nancy Kerrigan-Tonya Harding soap opera in Lillehammer in 1994. The sport was at its peak, regularly delivering more than a 10.0 rating for events. But ratings peaked in 1998 and began to steadily decline.

The 1998 U.S. Figure Skating Championships ladies’ free skate competition, the sport’s most popular event, pulled an 11.5 rating, more than 60 percent greater than the 4.7 rating the same event delivered in 2006.

Two things triggered the decline in interest. First, few female stars surfaced to replace 1990s stars Kerrigan, Kristi Yamaguchi, Michelle Kwan and Tara Lipinski. Then a voting scandal at the 2002 Salt Lake City Games caused the International Skating Union to overhaul the judging system. It did away with the 6.0 scoring system.

“Hearing a score of a ‘6’ is theater; hearing he got a score of 294.5 is not,” said Dick Button, an Olympic gold medalist and longtime figure skating promoter.

The sport’s struggles didn’t bode well for U.S. Figure Skating. The organization’s board doubted ABC would renew its $12 million-a-year contract and worried it might exit the sport altogether. It hired Raith, a former executive with USA Track & Field and Turner Broadcasting System, as executive director in 2005 and tasked him with coming up with a plan for the organization’s survival.

“We were almost starting at ground zero,” said Ramsey Baker, U.S. Figure Skating’s chief marketer.

Raith replaced the ABC deal with a revenue-sharing agreement with NBC that gave the sport nine hours on the network. He also worked with Baker to establish figure skating’s first commercial division.

ABC had held U.S. Figure Skating’s marketing rights for a decade. As a result, the organization had never sold or serviced sponsorships, and few of the sponsors that ABC had signed stuck with figure skating.

In 2008, U.S. Figure Skating hired Van Wagner to help with sales. But the agency started too late to find title sponsors for that year’s marquee events, Skate America and the U.S. championships, so they went unsold.

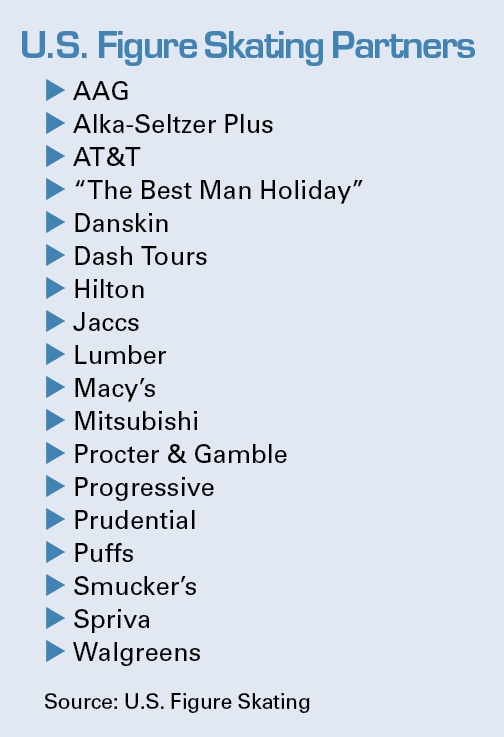

It wasn’t until 2010 when figure skating signed a deal with AT&T to take over title sponsorship of the U.S. championships that the organization began to make some headway. It added Prudential, Hilton and Alka-Seltzer the next year in deals that ranged from the mid-six to low seven figures. It then closed out its last presenting sponsorship last year when it signed Procter & Gamble’s Puffs brand as the sponsor of the “kiss and cry” area where figure skaters wait for their scores, in a deal valued in the high six figures.

“That was a big deal for us,” said Chris Pearlman, Van Wagner Sports senior vice president. “It gave us a feeling of, ‘Hey, we’ve arrived. We’ve sold every big position that we wanted to sell and we sold out of our inventory, too.’”

The sellout gave Van Wagner and U.S. Figure Skating confidence that the corporate appetite for figure skating had returned. Since they were out of inventory on NBC, they last year partnered to buy the rights from the ISU to the World Championships and Grand Prix events.

Sponsorship and advertising sales for the current fiscal year, which ends this summer, have surpassed $4.5 million, according to the organization. Baker said that’s a 70 percent increase over 2012-13, a quarter of which was due to the new inventory it picked up from the ISU.

“We’re starting to get to the point where we’re going to maximize the revenue we can get off our events,” Baker said.

U.S. Figure Skating also overhauled the way it awards its marquee events in order to boost event revenue. Before Raith arrived, it rotated its championships from the East Coast to the West Coast to the Midwest. It now holds an open bidding process with a minimum site fee. The changes have made the process more competitive and helped deliver $500,000 to $1 million to its bottom line annually, Raith said.

The organization continues to look for other ways to boost revenue. It partnered with IMG this year on a post-Olympics tour. USA Gymnastics ran a similar tour after the London Games and raised more than $15 million. Baker hopes U.S. Figure Skating has similar success.

Raith also is focused on increasing membership from 170,000, where it’s been flat for years, to more than 200,000.

All of that will help U.S. Figure Skating continue to boost its bottom line, but nothing will drive interest in the sport more than competitive success. Figure skating experts like Ogden say the sport has fielded one of its more competitive teams in years.

|

Meryl Davis and Charlie White are considered gold-medal contenders.

Photo by: GETTY IMAGES

|

This week its ice dancing pair, Meryl Davis and Charlie White, are expected to contend for gold, and Ashley Wagner and Gracie Gold are considered to be the first podium contenders in female figure skating since Sasha Cohen won silver in 2006.

Particularly encouraging is the recognition this year’s star female figure skaters have received. Gold, who has deals with Visa and Smucker’s, was one of a half-dozen Olympians featured on the cover of Sports Illustrated, and Wagner signed deals with Nike and CoverGirl.

Exposure like that won’t help the sport return to the height of popularity it enjoyed during the Kerrigan-Harding years, but it should help it recapture lapsed fans.

“You won’t have another Nancy-Tonya thing, but it would help to have some female success in the Olympics,” said Steve Disson, who organizes figure skating events. “The biggest impact comes when a female skater wins the Olympics.”

Raith understands the value of success. Now that the organization has stabilized its finances, he feels like it’s in a position to focus on that.

“We want to grow this organization in a structured way,” Raith said. “We want to achieve podium placements in all disciplines. When we structure our finances, we may push more money in certain places to achieve that.”