NFL teams are expressing concern that the league’s recently announced broadband network, NFL Now, could compete with the clubs’ own efforts by cannibalizing content and siphoning viewers.

NFL Now, which was announced Super Bowl week in a rare appearance by Commissioner Roger Goodell and other league executives, will create customized, team-specific digital content, in many cases by taking what the clubs offer digitally, on the Web and through shoulder TV programming. It’s designed to create a central online hub of news, information and video across the entire league and was presented as another platform for advertisers to be around NFL content.

But early on a few teams have raised concerns about the initiative, and while many of the details are still being worked out, it’s hardly the first time an NFL leaguewide business initiative ostensibly conflicts with individual clubs.

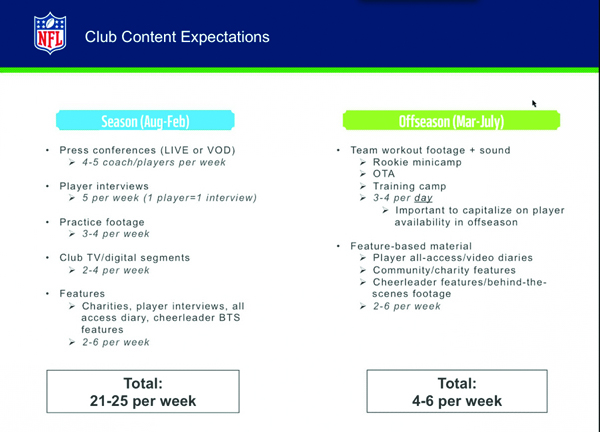

It’s unclear how much content will be required to populate the site, but NFL Media showed several clubs a week before the Super Bowl a list of “expectations” (see chart).

Expectations, according to the slide presented to the teams and obtained by SportsBusiness Journal, include: Four to five press conferences weekly during the season; five player interviews a week; practice footage three to four times a week; specific club TV digital segments up to four times a week; and features such as all-access diaries or cheerleader interviews up to six times a week.

In all, the memo cited 21 to 25 pieces of content weekly during the season, and four to six a week in the offseason.

“I’ve heard that it has caused quite a bit of a hue and cry on the part of clubs, for several reasons,” said Amy Trask, the former Raiders president who keeps in regular touch with her former peers. She cited the apparent competition clubs would face from NFL Now, and whether content produced by clubs has to be handed over.

Trask’s comments were seconded by several teams sources, who requested they not be named for fear of speaking out against the league.

One team official said it is not just the NFL seeking content produced by clubs to lure viewers to their media properties, but NFL Now could draw eyeballs and ad dollars from those efforts.

NFL Media urged anyone concerned to take more of a wait and see approach.

“The product isn’t going to launch for another six to seven months,” said Alex Riethmiller, the spokesman for NFL Media. “A lot of details are getting worked out, like how we are going to get content from the clubs, what type of revenue model.”

In a further statement, he added, “we’re confident NFL Now will prove to be additive in terms of viewership and revenue generation to all our partners, especially the clubs.”

A team source supportive of NFL Now did not agree with critics of the plan, saying only a handful of teams, maybe five, truly have advanced digital and mobile content offerings. Advertisers, this source said, are seeking wide-ranging, valuable content customized to mobile.

Alec Scheiner, Browns team president, said he looked forward to the wider platform NFL Now would offer the Browns, which in the past year invested significantly in digital and Web. “More people will find NFL N[ow] than our team website,” he said.

NFL Now content would be available on a variety of devices, and as a link on Yahoo. There will also be a premium channel that carries a subscriber fee.

If teams do not have to turn over their own content, and choose not to, the league would then rely on NFL Films and NFL Network footage to fill in the gaps.

The issue for the league is balancing what clubs are doing on the local level, with the apparent knowledge that many are not fully reaping the benefits. The league expects to create a much greater platform that will generate proportionately more revenue than the clubs create on their own.

The NFL is clearly throwing its full weight behind the new plan, which was underscored by having Goodell speak at the introductory press conference. The commissioner rarely speaks about league business issues during Super Bowl week outside of his state of the league address.