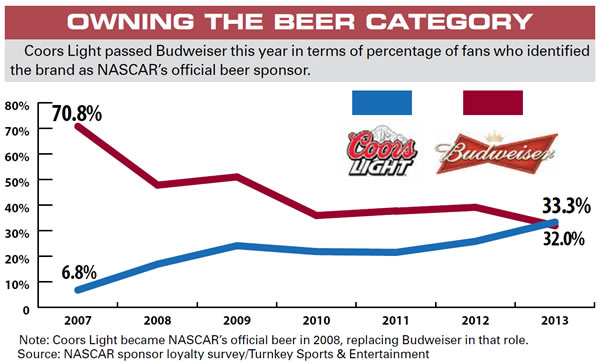

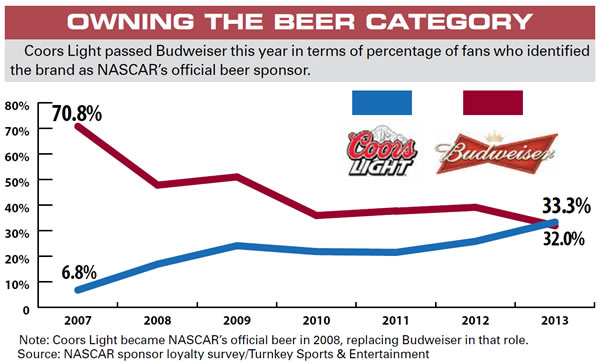

Budweiser is the self-proclaimed King of Beers, but Coors Light is No. 1 in the minds of NASCAR fans.

One-third of NASCAR fans correctly identified Coors Light as the sport’s official beer this year, according to the seventh annual NASCAR sponsor loyalty survey completed this fall for SportsBusiness Journal/Daily by Turnkey Sports & Entertainment. That continues the fan-recognition gains that have been made by the brand in recent years, and shoots Coors Light past rival Budweiser in the survey’s beer category for the first time.

Coors Light signed on in 2008 as NASCAR’s beer category sponsor, replacing Budweiser in that role. At the time of our inaugural survey, in 2007, 71 percent of NASCAR fans correctly identified Budweiser’s decade-long sponsorship, a rate that back then was 10 times greater than Coors Light’s rate.

Adam Dettman, director of sports and entertainment marketing for MillerCoors, attributes the growth of Coors Light to a combination of factors.

“We’ve seen incredible work from our distributors and local field teams, with a 360-degree approach using packaging, digital and media to activate the sponsorship,” he said.

The beer’s increased activity in NASCAR’s digital space, for example, came as a result of NASCAR’s restructured partnership with Turner Digital Media. NASCAR took back operational control on Jan. 1 of its interactive, digital and social media rights, while Turner remained the exclusive sales agent across those platforms through 2016. Shortly afterward, NASCAR launched new mobile apps sponsored by Coors Light, Sprint and Toyota, all NASCAR corporate partners. Through October, there were 2.3 million downloads worldwide, according to NASCAR. The apps, free to Sprint customers and $2.99 per month to fans on all other carriers, allow users to access live race data, news and video, as well as NASCAR Fantasy Live across all three national NASCAR series.

“Bringing our rights back was a big step toward letting our partners customize and be more targeted with their message,” said Brian Moyer, NASCAR’s managing director of market and media research.

Within the apps, Coors Light integrated its Cold Hard Facts campaign, driving fans to a Coors Light site of information that included NASCAR facts and videos. The beermaker also joined fellow NASCAR partners Coca-Cola and Mobil 1 as exclusive sponsors of RaceBuddy, a free second screen available on NASCAR.com that gives fans views from alternate camera angles as well as in-car audio during races.

In addition, the brand is visible to fans via its promotion of Miss Coors Light and the Coors Light Pole Award, presented to the driver with the fastest qualifying time of each race. In that sense, the brand benefited from a number of popular drivers sitting on the pole this season, including Danica Patrick at the Daytona 500 and Dale Earnhardt Jr. twice. Additionally, Miss Coors Light has been traveling to every track and race market since 2011, spending time with fans at retail and restaurants, promoting the brand.

Last week, Miss Coors Light had more than 33,000 Facebook “likes,” more than drivers Kurt Busch, Greg Biffle and Clint Bowyer, all of whom finished in the top 10 of this year’s Sprint Cup standings.

Other survey notables:

■ The 46.5 percent of avid fans who correctly identified Chevrolet’s official status with NASCAR represents that brand’s best mark since garnering 51.1 percent in 2007. Ford and Toyota, fellow NASCAR sponsors, saw record highs this year, as just under one-third of the 400 fans surveyed correctly identified at least one of those companies as a NASCAR partner.

■ 42 percent of fans knew that Nationwide was an official sponsor, the company’s highest overall rate ever and more than all other insurance competitors received for their scores combined.

■ Among brands active in the sport that are not official NASCAR partners, Anheuser-Busch/Budweiser and FedEx have by far the highest fan awareness. Each brand was selected by nearly one-third of the respondents when asked to name the official partner in their respective categories. Budweiser, however, saw one of the biggest overall year-over-year declines of the 70 brands measured, dropping 7.1 percentage points.

Methodology

For this project, Turnkey Sports & Entertainment, through its Turnkey Intelligence operation, conducted national consumer research surveys among a sample of more than 400 members of the Toluna online panel who were at least 18 years old.

This year’s survey was conducted Oct. 29-Nov. 1, in the middle of the 10-race Chase for the Sprint Cup. The 2012 and 2011 surveys were similarly conducted, with polling Oct. 25-Nov. 1, 2012, and Nov. 4-13, 2011.

Respondents were screened and analyzed based on general avidity levels. Fans categorized as “avid” were ones who responded “4” or “5” to the question “How big a fan are you of NASCAR?” and then claimed to “look up news, scores and standings several times a week or more often,” “watch/listen/attend at least 21 races per season” and “have a favorite driver.” Fans categorized as “casual” responded “3” to the same initial question, then claimed to “look up news, scores and standings several times a month or more often,” “watch/listen/attend at least five races per season” and “have a favorite driver.”

When asked to identify official sponsors, respondents selected from a field of companies and brands that was provided to them for each business sector. The percentage responses listed have been rounded. The margin of error for each survey is +/- 4.9 percent.

Turnkey works with more than 70 retainer-based clients across the major professional leagues in North America, including several tracks, teams and brands involved in motorsports.

IMPACT ON SAMPLING AND SUPPORT

| Are you more or less likely to consider trying a product/service if that product/service is an official sponsor of NASCAR? |

| |

Avid |

|

Casual |

| More likely |

76% |

73% |

73% |

|

50% |

52% |

46% |

| Unaffected / less likely |

24% |

27% |

30% |

|

51% |

48% |

54% |

| |

| Are you more or less likely to consciously support a company by purchasing its

products/services if the company is an official sponsor of NASCAR? |

| |

Avid |

|

Casual |

| More likely |

78% |

74% |

74% |

|

51% |

50% |

50% |

| Unaffected / less likely |

23% |

26% |

26% |

|

50% |

50% |

50% |

| |

| Are you more or less likely to recommend a product/service to a friend or family

member if that product/service is an official sponsor of NASCAR? |

| |

Avid |

|

Casual |

| More likely |

75% |

71% |

72% |

|

49% |

44% |

47% |

| Unaffected / less likely |

25% |

29% |

28% |

|

52% |

56% |

53% |

Which of the following is an official sponsor of the NASCAR?

| |

Avid |

|

Casual |

|

Coca-Cola* |

53.5% |

62.5% |

50.3% |

|

44.0% |

44.2% |

37.4% |

| Pepsi |

16.5% |

14.0% |

21.4% |

|

13.0% |

14.6% |

25.1% |

| Mountain Dew |

11.5% |

10.0% |

7.5% |

|

15.0% |

8.5% |

9.7% |

| I’m not sure |

11.5% |

8.0% |

10.0% |

|

22.0% |

23.6% |

16.9% |

The Coca-Cola racing family of drivers accounted for five Sprint Cup victories and 10 pole positions in 2013. One of the more popular NASCAR-related ads of the year, though, was from Pepsi Max. The ad featured driver Jeff Gordon in disguise taking a test drive of a new General Motors (NASCAR partner) Chevy Camaro. The video has more than 39 million views on YouTube since its debut in March.

| |

Avid |

|

Casual |

|

Sprint* |

54.0% |

55.5% |

55.7% |

|

40.5% |

40.2% |

51.8% |

| AT&T |

11.0% |

13.5% |

9.5% |

|

10.5% |

9.5% |

6.7% |

| Verizon |

11.0% |

8.0% |

11.4% |

|

10.0% |

17.6% |

12.3% |

| I’m not sure |

12.5% |

13.5% |

9.5% |

|

27.5% |

26.6% |

19.5% |

In addition to being title sponsor of NASCAR’s prime series, Sprint early this year signed a multiyear deal to sponsor the season-opening event at Daytona International Speedway. The newly named Sprint Unlimited race, formerly known as the Budweiser Shootout, aired on Fox, and fans were able to vote via NASCAR’s mobile app and website for the number of laps in each segment, the type of pit stop after the first segment, how many cars were eliminated after the second segment, and which fire suit Miss Sprint Cup would wear in Victory Lane. The company also teamed with the sport’s most popular driver, Dale Earnhardt Jr., for a 30-second ad to promote Sprint’s Drive First app that can block and send automatic replies to text messages while you drive.

| |

Avid |

|

Casual |

|

Nationwide* |

48.5% |

54.0% |

24.9% |

|

35.0% |

29.1% |

22.6% |

| Allstate |

12.5% |

8.0% |

16.4% |

|

6.5% |

8.0% |

12.8% |

| Geico |

7.0% |

9.0% |

19.4% |

|

6.5% |

11.6% |

14.9% |

| Aflac |

8.0% |

4.0% |

14.4% |

|

5.5% |

0.5% |

10.3% |

| State Farm |

5.0% |

4.5% |

4.0% |

|

3.0% |

6.5% |

3.6% |

| I’m not sure |

12.5% |

16.0% |

14.4% |

|

35.5% |

39.7% |

29.7% |

Nationwide saw its awareness numbers stay relatively flat this season compared with 2012 despite announcing this year that it will shift its focus (and dollars) in 2015 from its seven-year title sponsorship of the second-tier Nationwide Series to, instead, the prime Sprint Cup Series. The company extended its deal as NASCAR’s official auto, home, life and business insurance partner through 2017, and added sponsorship of the 2013 NASCAR Rookie of the Year, Ricky Stenhouse Jr., to its portfolio. Nationwide served as Stenhouse’s primary sponsor for three races in 2013 and as an associate sponsor for his team’s other Sprint Cup races.

| |

Avid |

|

Casual |

|

Visa* |

41.5% |

39.0% |

46.8% |

|

34.5% |

35.7% |

33.3% |

| MasterCard |

15.5% |

9.5% |

12.9% |

|

13.5% |

10.1% |

11.3% |

| American Express |

7.0% |

9.0% |

9.0% |

|

5.5% |

8.5% |

6.7% |

| Discover |

6.0% |

6.0% |

10.0% |

|

5.0% |

7.0% |

12.8% |

| I’m not sure |

29.5% |

35.5% |

17.9% |

|

40.5% |

37.7% |

32.8% |

Visa remained the distinct leader in this category, with increased marks in 2013 among avid fans. Jeff Gordon displayed an AARP/Chase credit card paint scheme on his Hendrick Motorsports No. 24 Chevrolet at Dover’s June race, a design that featured an image of an AARP Visa card from Chase on the hood of the car.

| |

Avid |

|

Casual |

|

UPS* |

38.5% |

45.0% |

41.8% |

|

36.0% |

38.2% |

34.9% |

| FedEx |

34.5% |

30.5% |

29.4% |

|

30.0% |

25.6% |

34.4% |

| I’m not sure |

17.5% |

18.5% |

14.4% |

|

28.5% |

26.1% |

24.1% |

UPS, a NASCAR sponsor since 2000, saw a 4.4 percentage-point drop among all NASCAR fans in this year’s survey, while rival FedEx received a 4.2 percentage-point increase from last season. UPS activated as an associate sponsor of the Roush Fenway No. 99, driven by Carl Edwards, but the UPS paint scheme was seen as a primary sponsor for just one race this season. The company also featured the “UPS Game Changers,” a series of videos and articles through NASCAR.com, Yahoo.com and Facebook that showcase the ideas and moments that changed NASCAR throughout its history. FedEx, meanwhile, sponsored driver Denny Hamlin and gave one fan a month the opportunity to have a tweet posted on Hamlin’s dashboard for a race by using the hashtag #DennysDash to enter the contest.

| |

Avid |

|

Casual |

|

GM (Chevrolet)* |

46.5% |

40.5% |

28.9% |

|

27.5% |

39.7% |

24.1% |

| Toyota* |

40.5% |

36.0% |

14.4% |

|

24.0% |

18.1% |

10.3% |

| Ford |

35.0% |

36.5% |

22.4% |

|

28.0% |

25.6% |

23.6% |

| Dodge |

16.0% |

27.5% |

4.0% |

|

14.5% |

18.1% |

6.7% |

| I’m not sure |

20.0% |

27.5% |

19.4% |

|

35.5% |

28.6% |

30.3% |

Chevrolet’s awareness numbers among avid fans jumped 6 percentage points this season, helping the brand maintain its lead in this category over NASCAR’s other official automobile, Toyota. Chevrolet sponsored a sweepstakes that gave the winner a 2014 Camaro SS and a trip to Las Vegas for the NASCAR Victory Lap and Sprint Cup Series Awards Ceremony. Toyota has title sponsorship of two Sprint Cup races, while Ford (which has the official passenger truck designation) titles the season-finale events in South Florida.

| |

Avid |

|

Casual |

|

Coors Light* |

34.5% |

25.5% |

18.9% |

|

32.0% |

26.1% |

24.1% |

| Anheuser-Busch |

35.5% |

40.5% |

37.3% |

|

28.5% |

37.7% |

38.0% |

| Miller |

11.5% |

13.5% |

14.9% |

|

9.0% |

7.0% |

12.8% |

| I’m not sure |

11.0% |

13.0% |

11.4% |

|

22.5% |

25.1% |

20.0% |

Coors Light, NASCAR’s official beer, scored its highest recognition marks ever in 2013 and topped Anheuser-Busch/Budweiser for the first time in our survey. Coors Light joined Sprint and Toyota as founding sponsors of NASCAR’s new mobile apps, which have drawn more than 2.3 million downloads since launching in February. The brand also gained exposure at every race via its lead sponsorship of the pole award.

| |

Avid |

|

Casual |

|

Bank of America* |

36.0% |

39.7% |

28.4% |

|

35.5% |

35.2% |

25.6% |

| Citibank |

9.5% |

7.5% |

9.5% |

|

7.5% |

8.0% |

9.2% |

| Wells Fargo |

7.5% |

5.0% |

14.4% |

|

2.5% |

5.5% |

9.2% |

| I’m not sure |

33.5% |

38.7% |

22.9% |

|

43.0% |

47.2% |

37.4% |

Bank of America has been NASCAR’s official bank since 2007 and the lead sponsor of the fall race at Charlotte Motor Speedway since 2006. That fall race is the only ABC telecast and only night race during the Chase for the Sprint Cup, and this year’s race scored a 3.4 rating/5.6 million viewers, the event’s best audience since 2008. BofA also is presenting sponsor of the NASCAR Business Series, which aims to support small-business owners in local NASCAR race markets.

| |

Avid |

|

Casual |

|

Goodyear* |

70.0% |

74.0% |

NA |

|

56.5% |

60.3% |

NA |

| Firestone |

10.0% |

8.0% |

NA |

|

11.0% |

8.0% |

NA |

| Bridgestone |

8.5% |

6.0% |

NA |

|

7.0% |

6.5% |

NA |

| I’m not sure |

4.5% |

7.0% |

NA |

|

18.5% |

18.1% |

NA |

For the second consecutive year, Goodyear earned the highest recognition scores of any sponsor in our survey. The company debuted new race-themed advertising during NASCAR Speedweeks with TV, radio, print and online spots. Later in the year, to kick off the fourth annual Goodyear Gives Back campaign, Goodyear unveiled commemorative tires that read “Support Our Troops” during the Memorial Day weekend races at Charlotte Motor Speedway.

| |

Avid |

|

Casual |

|

Mobil (Mobil 1)* |

41.0% |

32.0% |

NA |

|

29.5% |

25.1% |

NA |

| Pennzoil (Pennzoil Ultra) |

14.0% |

15.5% |

NA |

|

13.5% |

16.1% |

NA |

| Quaker State |

11.0% |

10.0% |

NA |

|

10.0% |

9.5% |

NA |

| Valvoline |

8.0% |

13.0% |

NA |

|

13.0% |

12.6% |

NA |

| I’m not sure |

14.5% |

19.0% |

NA |

|

23.5% |

23.6% |

NA |

Mobil 1 in January renewed its sponsorship with NASCAR, a partnership that started in 2003. The brand also is a sponsor of Stewart-Haas Racing and Tony Stewart’s No. 14 car, along with presenting sponsor of both the Mobil 1 Driver of the Race Award and the NASCAR Canadian Tire Series.