The deal ESPN cut for rights to El Tri — Mexico’s national soccer team — wasn’t particularly long or lucrative. It hasn’t delivered big audiences for ESPN.

But the January deal provides a glimpse behind ESPN’s growth strategy for the next decade or so: cut relatively small rights deals that support other programming on its channels. ESPN holds the rights to next year’s World Cup, and the Mexican soccer deal lasts through that event.

{podcast}

SBJ Podcast:

John Ourand & Abraham Madkour on the current media landscape, ESPN's dominance and expected topics for this week's SMT conference

|

ESPN saw the rights to the Mexican national soccer team as a good asset leading up to next year’s World Cup.

Photo by: Scott Clarke / ESPN

|

As the market for big, live sports rights largely is set into the next decade, sports networks are looking for other ways to grow. With the exception of the NBA, which is negotiating its next deal, and the Big Ten Conference, which is up in 2017, the biggest U.S. sports rights deals are locked up for years with their current channels.

While the prospects of a new eight-game NFL package would certainly be popular and bring out a lot of bidders, television executives believe the chances of a truly game-changing deal, along the lines of when the NFL went to Fox in 1994, can’t happen for the foreseeable future.

“We are transitioning from significant growth in pay-TV revenue to much slower growth in the more mature pay-TV infrastructure,” said Fox Networks Group President and COO Randy Freer. “The last decade saw a significant increase in rights fees paid and content provided to the market. There will be a more moderate growth curve in rights fees going forward.”

The most recent batch of rights to hit the market over the past several years has been much longer term than previous deals. The NFL’s deal ends in 2022. MLB’s runs until 2021. NBC has the NHL sewed up until 2021. And NASCAR’s deal runs until 2024.

That has left the current slate of sports channels looking to develop the rights they have and pondering new ways to grow, from expanding their digital slates to negotiating higher license fees from distributors.

ESPN will be active in trying to secure NBA and Big Ten rights — it is considered a front-runner to keep at least

part of both. But ESPN also sees an opening to buy rights to events that historically have not been on English-speaking television. That includes the Mexican national soccer team games.

“We’re focused on whether there’s going to be another NFL Thursday night package and on the NBA deal that’s up in three years and the Big Ten that’s up in three years. Those are unbelievably important,” said Norby Williamson, ESPN’s executive vice president of programming and acquisitions. “But there are also other tactics and strategies that you can use to bolster your networks and programs.”

ESPN used essentially the same strategy to buy a series of college football bowl games — from the Famous Idaho Potato Bowl to the Heart of Dallas Bowl. The idea is to create relatively low-cost programming the company can own to support other programming. ESPN views the bowls as a way to support its investment in college football.

“I’m not trying to say that you can build an entire network around one thing like you could with the NFL or NBA or MLB or a significant college football package,” Williamson said. “But there’s a lot of stuff, if you do your homework and look at it differently, that’s available and out there that … has helped us to continue to grow our different platforms.”

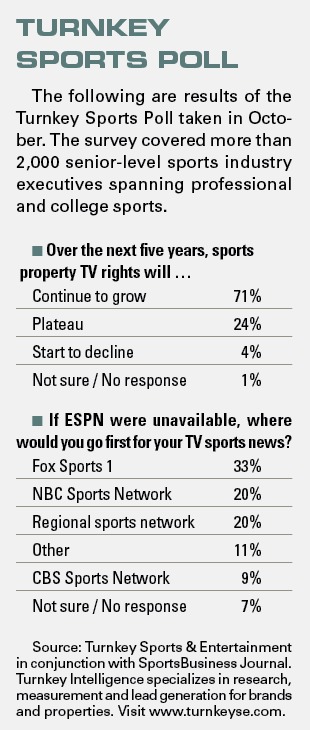

Sports rights are as valuable as ever for television network executives, providing live programming and good demographics. But because most rights are tied up for so long, they believe they are nearing the end of the era of wild rights fee increases.

The pay-TV puzzler

For decades, the surest way for sports networks to grow has been through affiliate fees paid by cable, satellite and telecommunications operators.

That’s the main way ESPN grew in the late 1990s, when it increased its affiliate revenue by 20 percent a year. The channel now makes $5.47 per subscriber per month from cable, satellite and telecommunications operators, according to SNL Kagan. With a distribution of 97.37 million homes, that means ESPN pulls down nearly $6.4 billion per year from affiliate fees alone.

|

Golfer Rickie Fowler chats with Trevor Pryce on the “Crowd Goes Wild” set at Fox Sports 1.

Photo by: Getty Images |

That’s well above TNT, which earns $1.27 per subscriber per month in 98 million homes, and NFL Network, which earns $1.13 in 72 million homes. And it’s in a different stratosphere than Fox Sports 1, which earns 23 cents in 89 million homes, and NBC Sports Network, which gets 33 cents in 78 million homes, according to SNL Kagan.

Network executives don’t expect to make as much as ESPN, which has such a big head start. But they believe they can create a nice business at a fraction of the cost. That’s one of the main reasons why Fox rebranded Speed into Fox Sports 1 and its Fuel action sports channel to Fox Sports 2 in August. Its executives saw more potential to grow as a multisport channel rather than a motorsports channel.

The problem is that distributors appear more willing than ever to dig in their heels on rising affiliate fees. They say the increased number of sports channels — in addition to the fees they charge — is resulting in shrinking profits from their video businesses. Distribution executives call this trend “unsustainable.”

“It’s really put a spotlight on the unsustainable trend lines on sports costs as well as the tax that sports rights holders hope to place on all consumers, whether they’re sports fans or not,” said Dan York, DirecTV’s executive vice president and chief content officer. “The oversaturation of distinct sports networks, and the prices associated with them, has reached a breaking point. Distributors and consumers have come to realize that a lot of content, especially sports content, can be incredibly overpriced and can be gone if the price is too high.”

For decades, distributors have made similar claims during negotiations before paying out increases.

Today, however, distributors can point to several successes over the past year, including Fox Sports 1’s August launch, when they refused to increase the channel’s license fee to around 80 cents per subscriber per month. On a local level, DirecTV has not cut a deal for Comcast’s regional sports networks in Houston or Portland, and it has kept Pac-12 Networks off its system since the channels’ August 2012 launch.

The next two months will test whether distributors will continue to pay big increases for sports channels. Time Warner Cable’s deal with YES Network is ending, Fox is negotiating Fox Sports 1 with Cox and Charter, Turner is looking to renew its DirecTV deal, the Dodgers are preparing to launch a new channel in Los Angeles, ESPN still hasn’t finalized its Dish Network deal, and MLB Network is coming up on its renewals.

Distributors say the environment has changed and they don’t make enough money from their video services to support big increases. Plus, they resent having to pay more for the same programming that is being repackaged on new channels.

“What you’ve got is the same games that existed last year, five years, even 10 years ago being more thinly sliced for unsustainably higher prices for each slice of the sports content rights marketplace,” York said. “There’s no new must-have games on these new networks that we didn’t have yesterday.”

NFL Network President and CEO Steve Bornstein went through these types of high-profile public battles with distributors when he launched NFL Network 10 years ago. Last September, the country’s second-biggest cable operator, Time Warner Cable, became the last big holdout to sign a deal.

Bornstein said that channels launching today would have an even tougher time than when NFL Network went live. “The business is more mature. There’s more choice out there,” he said. “It’s not for the faint of heart — going out there with only a single channel.”

Bornstein said distributors changed their business model, focusing more on broadband and telephony revenue rather than programming.

“The industry changed. The industry became much more of a triple play bundle of services than just a video provider. That probably was one of the reasons why we had some friction at the beginning,” he said. “When they were primarily video providers, it was a different dynamic than when they were a triple play provider.”

Competing with ESPN

A dominant story line when NBC rebranded Versus into NBC Sports Network at the beginning of 2012 was that ESPN finally was going to see a competitor in the cable space. Fox had the same story line when it launched Fox Sports 1 this August.

For Bornstein, that story line is naïve.

“They aren’t just competing against ESPN. They’re competing against hundreds of other channels for people’s attention,” he said. “If you put good content out there and you have critical mass, which they achieved, you can compete.”

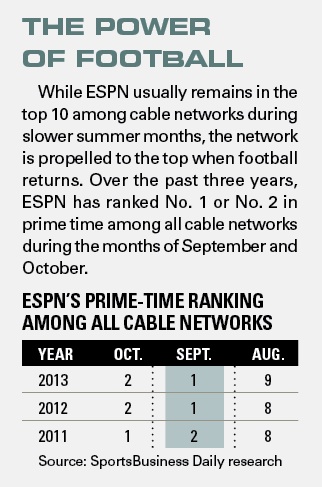

Early results show that neither channel is competing with ESPN, or even ESPN2. In October 2013, ESPN averaged 2.9 million viewers in prime time, and ESPN2 averaged 633,000 viewers.

By comparison, prime-time audiences for Fox Sports 1 and NBC Sports Network are about a third of ESPN2’s. Fox Sports 1 (which was Speed for the first eight months of the year) has averaged 234,000 viewers in prime time so far this year, and NBC Sports Network has averaged 203,000 viewers.

Both Fox Sports 1 and NBC Sports Network expect those ratings to grow as they market around the sports rights they already own. Both channels should see ratings grow when they carry NASCAR races starting in 2015. Fox also expects to see ratings growth from popular sports such as U.S. Open golf, the World Cup, college sports and UFC. NBC Sports Network holds rights to English Premier League soccer and the NHL.

“Live ratings is one of the true values of the pay-TV business,” Freer said.

But compete with ESPN? That’s not likely.

Some networks, like CBS Sports Network, are carving out a nice business irrespective of the Bristol-based sports media giant. CBS Sports Network is not rated. But it is in 53 million homes and serves as a complement to its broadcast network.

“We’re not in the business right now of trying to chase ESPN — they are what they are,” said CBS Sports Chairman

Sean McManus. “They are the biggest, and they generate the most revenue.”

Under McManus, CBS has taken a more measured approach to rights deals. Rather than bidding to bring new events to the network, it has focused on keeping the events it already has and producing profits from them.

“I work for a man who doesn’t like losing money on sports properties,” McManus said of Les Moonves, CBS’s president and CEO. “We’ve been pretty consistent about that and kept all the events we wanted to keep, and we’ve made a profit on all those events.”

With rights tied up, the biggest path to growth could be in the digital arena. Turner, which is negotiating to keep its NBA package and is interested in an NFL package, if it comes to market, views the second screen as an area of focus.

“Television is not going to go away,” said Turner Broadcasting President David Levy. “But new platforms and new mediums that have emerged will enhance the whole consumer experience. The next generation of sports fans is using two screens. My job is to make sure those two screens somehow connect and provide information within those two screens.”

Levy pointed to his MLB deal last October as evidence, as it included more digital rights than TBS previously had.

“We started investing into NASCAR.com and probably at the time overpaid for certain things. But we learned from that deal, went on to the next deal with the PGA Tour, and we went on to the next deal with NBA.com,” he said.

“You learn from every deal. You learn how to produce. You learn what works and what doesn’t work and where the connection is. You apply those learnings to the next broadcast or next website or next mobile opportunity.”

NBC Sports Group Chairman Mark Lazarus sounded an almost identical theme of focusing on digital, saying that he didn’t realize that digital video consumption would become as widespread so quickly.

The Olympics offer a perfect example. In London, NBC found success carrying every event live online. It plans to do the same in Sochi next year. “We’re all trying to maintain the elusive audience, and the audience is fragmenting across various platforms and mediums,” he said. “Television is still by and far king, but we all have to be mindful of the new digital platforms.”

At least until 2022, which is when the NFL’s packages are up again.

| |

2013 |

2012 |

2011 |

| Network |

Aug. |

Sept. |

Oct. |

Aug. |

Sept. |

Oct. |

Aug. |

Sept. |

Oct. |

| ESPN |

1,473 |

3,242 |

2,895 |

1,298 |

2,923 |

3,120 |

1,298 |

2,937 |

3,070 |

| ESPN2 |

414 |

723 |

633 |

374 |

770 |

461 |

374 |

809 |

648 |

| ESPNews |

102 |

140 |

91 |

93 |

116 |

78 |

93 |

121 |

95 |

| Fox Sports 1* |

212 |

294 |

234 |

153 |

185 |

120 |

153 |

214 |

192 |

| Fox Sports 2* |

28 |

22 |

18 |

38 |

41 |

36 |

38 |

12 |

14 |

| Golf Channel |

160 |

114 |

99 |

116 |

151 |

74 |

116 |

102 |

106 |

| MLB Network |

221 |

205 |

40 |

147 |

174 |

77 |

147 |

226 |

62 |

| NBA TV |

48 |

49 |

102 |

36 |

40 |

97 |

36 |

30 |

29 |

| NBCSN |

81 |

85 |

203 |

158 |

95 |

74 |

158 |

153 |

189 |

| NFL Network |

515 |

976 |

973 |

459 |

906 |

937 |

402 |

345 |

152 |

* Speed switched to Fox Sports 1 and Fuel switched to Fox Sports 2 on Aug. 17 of this year.

Source: SportsBusiness Daily research

The Crystal Ball

Envisioning the sports media landscape in 2023

— Compiled by John Ourand

“I suspect that I won’t be able to recognize where sports media is going to be in 10 years. This whole convergence that we talked about happening in 1999 and 2001 is actually now happening. There’s true convergence of all these platforms, content and devices. How you best serve them will be the challenge of the guys that are going to run this business after I leave it.”

— Steve Bornstein, president and CEO, NFL Network

“Television for sports is still going to be the centerpiece, if you have access to it. That doesn’t mean that it will be the only device that you’ll be with. There will be other devices that are part of that experience and will be more one-on-one related. I don’t say that about entertainment. Sports is the last destination appointment viewing genre. If you don’t have access to that 70-inch flat screen monitor, you’re going to find other ways to watch it live. Then it’s that second screen experience while you’re watching it, if you have access to that second screen. It’s my job to make sure I fill those video screens with relevant content.”

— David Levy, president, TBS

“The NFL-to-Fox deal launched that network. That groundbreaking move, I don’t know if it exists anymore. It used to be that one bold move could do something. We’re beyond that. Look at what’s happened over the last five years with the Olympics and how its strategy has evolved in terms of streaming everything. Consumers demand that. Consumers are going to be less tolerant as time goes by. The stuff is going to have to be sharper and more accessible than it is today. Technology has got to continue to be simpler.”

— Norby Williamson, executive vice president, programming and acquisitions, ESPN

“Over time, consumers will continue to understand the unsustainable tax that’s imposed on them for content that they may not consume. Either through market or regulatory forces, consumers should and will be offered a choice over what content they will have to pay for. You’ll see contraction in the market, whether it is complete disconnecting from subscription television or downgrading packages. You’ll see, increasingly, distributors taking a stance and saying no to things where the price-value relationship is out of balance.”

— Dan York, executive vice president, chief content officer, DirecTV