Former Monumental Sports & Entertainment executive Greg Bibb has launched a venture capital fund targeting sports and lifestyle properties, with backing from veteran sports investor Fred Schaufeld’s SWaN and Legend Venture Partners.

|

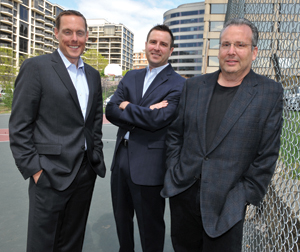

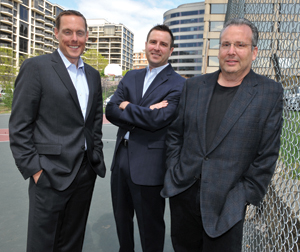

Capital Sports Ventures’ leadership (from left): Greg Bibb, Christopher Browne and Fred Shaufeld

Photo by: JOANNE S. LAWTON

|

Bibb’s new fund, Capital Sports Ventures, is pursuing deals with several businesses that are looking for money to expand. He recruited Christopher Browne, former vice president of the Greater Washington Sports Alliance, as managing director of the Arlington, Va.-headquartered fund.

Bibb, who left Monumental in December, sees opportunity in the world of minor league and participatory sports organizations. That sector, he said, is dominated by driven, passionate entrepreneurs with a narrow expertise in their field. He believes Capital Sports Ventures can provide money, expertise or both.

“If you add up all of the major league professional athletes, you’re talking about numbers in the low thousands,” Bibb said. “But there are 300 million people in the United States, and the vast majority touch sports in some shape or fashion.”

The SWaN and Legend entity is the primary backer; Bibb and Browne also put up personal investments. SWaN and Legend managing partner David Bosserman is also on board as a board member and adviser.

SWaN is already an investor in the Washington Nationals and Monumental, where Schaufeld and Bibb began talking about an entrepreneurial track, with approval and encouragement from CEO Ted Leonsis.

In 2012, Bibb and Schaufeld tested their idea by bidding to buy a majority stake in D.C. United from previous owner Will Chang, a previously undisclosed play. Chang ultimately struck a deal with an ownership group led by Indonesian media magnate Erick Thohir, but the seeds of a partnership were planted.

“It could have been the end of the day, and that would have been it,” Bibb said. “But [Schaufeld] proactively said, ‘Listen, Greg, I’m willing to listen to ideas so come to me and talk.’”

The new fund will also offer advisory services to sports and lifestyle companies.

The new firm could probably execute two major deals in its first year, Schaufeld said, and they will be looking for investors in particular limited-purpose funds as opportunities arise. They declined to disclose the overall size of the fund but said they are in talks with a target that would be comparable to buying a controlling stake in D.C. United, had that deal materialized.

Ben Fischer writes for the Washington Business Journal, an affiliated publication.