I have spent much of the last 18 months since renewing my association with The ESPN Sports Poll doing analysis to better identify and understand the characteristics of those sports fans who bring the greatest economic value to the sports industry.

Working with nearly 20 years of data, half a million interviews, and 2,000 variables in the ESPN Sports Poll, we examined the broadest of demographic characteristics and diversity of sports interests and compared that with the amount and variety of sports activities to identify the most engaged fans. We examined how fan characteristics changed over time, paying particular attention to the impact of technology and a changing economy. The more promising discovery was the changing landscape of sports involvement among older Americans.

To begin, our analysis verified the value of an avid sports fan. The higher the self-rating on an 11-point fan scale, the greater the involvement in sports fan activity. Anyone between an 8 and a 10, statistically, was significantly more engaged in sports activity than the overall population. These are the avid fans. And while most of our industry’s attention is focused on fans between the ages of 18 and 34, 58 percent of avid fans are 35 and older.

Are we as a sports industry less focused on 35 and older because we assume their interest and engagement in sports is waning by then?

FORWARD THINKING

With …

CB WISMARVICE PRESIDENT,

AARP EVENTS

■

AARP has invested in sports without much fanfare and at a time when older fans are often ignored in the industry. What do you see?"NASCAR’s 50-plus fan base is engaged with the sport, the drivers and the sponsors. Drive to End Hunger is the AARP Foundation’s intervention to help the 8.8 million Americans 50 and older who are facing hunger on a daily basis. We believed those NASCAR fans could make a dramatic difference in reducing that number. The No. 24 Drive To End Hunger Chevrolet driven by Jeff Gordon and Rick Hendrick’s team have gotten that message out to millions of fans. The result? Millions of dollars raised and millions of meals donated. Others might see an older audience. We see an engaged audience."

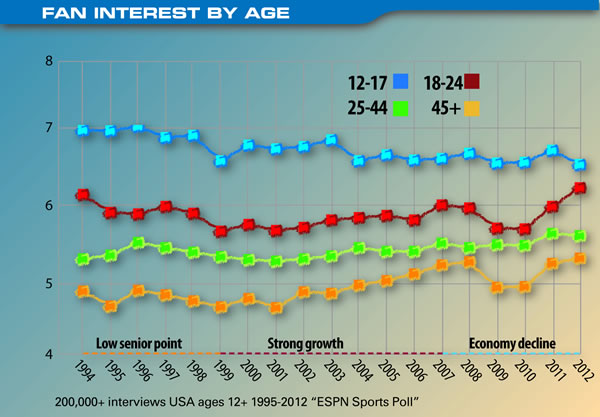

Going back to 1995, the sports interest level of those 45 and older has grown by nearly three times as much as for those younger than 45. The top chart shows the average fan interest score (0-10 scale) by age group going back to 1995. There are three distinct periods:

• 1995-2000 is the low level for sports interest for those older than 45;

• From 2001 through 2007, and before the economy declined, there was accelerated growth in sports interest for older fans;

• Since 2008, in harder economic times, interest has continued to grow.

Starting in 2002, the interest level of Americans 65 and older surpassed the interest of those 45-64 and has stayed ahead of 55-64 ever since. The 45-54 regained a lead over 65 and older since the recession. At the same time the interest of 12- to 17-year-olds has declined significantly since 1995.

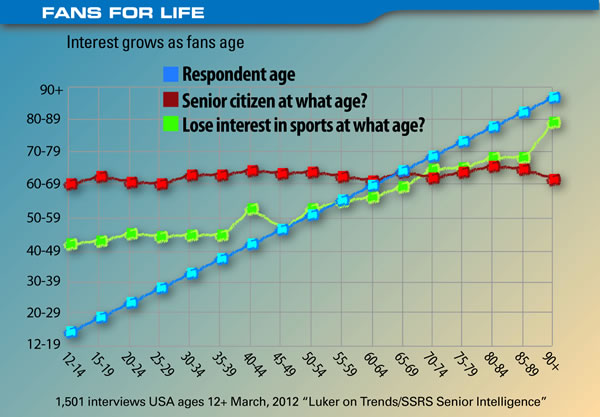

Thirty-five-plus is a broad target. So in March, the Sports Poll asked the random sample of 1,500 Americans ages 12 and older: “At what age do you think a person typically becomes a senior citizen?” Later in the survey, we asked: “At what age do you think people typically lose their interest in sports?” The second chart shows the results.

The straight blue line rising from the left to the right is the age of the respondent. The red line is the age they said people become senior citizens. I was a bit surprised to learn that people younger than 20 didn’t say 30. The average across all ages was 63 and the range was actually quite tight — from 62 for respondents ages 12-23 to 64 for respondents ages 63 and older.

The findings for when we lose our interest in sports were far different. The overall average age was 48. But those 12-23 said 40 on average, those 24-45 said 48, and the older you were after age 48, the older the age of losing interest and the closer that age was to the respondent’s age.

In May, we asked 1,500 respondents: “As you get older, do you think your enjoyment of sports will increase or decrease?” One might have assumed it would decrease over time. But there was never an age when more than 41 percent said their interest would decrease as they get older. At worst, they said it would stay the same. Thirty-three percent of Americans older than 65 said they expected their interest to continue to grow as they aged.

Three big stories here. First, older fans are getting more interested in sports as they age, not less. Second, as they get past an age at which we might think they would have already lost interest (48), they haven’t yet hit the age when it begins to fade. In other words, as Americans are aging, their interest in sports is persisting beyond what older Americans used to experience. Third, there is never a time, never an age, when the majority says their interest in sports will decrease going forward.

FUTURE FIVE

The economy remains the top issue, with perceptions spreading over more issues. Fans watching on TV versus attending a game or event is a newly rising issue.

| Rank (Pvs) | Issue | Score (% of first-place votes) |

| 1 (1) | State of U.S. economy | 231 (48) |

| 2 (3) | Ability of middle-income American families to spend money on sports | 177 (13) |

| 3 (2) | How financial pressure companies feel will affect sports investments | 158 (3) |

| 4 (NR) | Fans preferring to watch on TV rather than attend games or events | 157(7) |

| 5 (5) | The trend in attendance at professional and college sports events | 154 (0) |

NR: Not ranked

Note: Results from a panel of 31 industry leaders. Participants ranked each of 10 issues with 10 points being assigned for a 1st-place vote, nine for a 2nd-place vote, down to one point for a 10th-place vote. Percentages have been rounded. Only the top five are listed.

And this is just the tip of the iceberg. When it comes to fan behavior — except for use of new technology — those older than 35 account for more consumption than those younger than 35. And the oldest fans out-consume the youngest. When it comes to watching sports on TV and consuming sports information, the skew toward 35 and older is magnified considerably.

Here’s what makes this an iceberg. Every day 10,000 baby boomers retire. That will be true for another 19 years. Those who are 50 and older significantly out-earn those who are younger and have overwhelmingly more accumulated spendable wealth beyond income than their younger counterparts. As they continue to age, they will also have increasingly more time to spend on sports interests — interests they say will never die.

The only thing holding back the economic growth of the older sports market at this point is inattention on the part of the sports industry. We look at the aging fan bases of NASCAR, PGA Tour and MLB and see trouble.

The AARP sees opportunity. I think AARP has it right.

Rich Luker (rich@lukerco.com) is the founder of Luker on Trends and The ESPN Sports Poll.