The NFL last week approved two significant limited-partner transactions, each totaling in the low nine figures, according to sources familiar with the deals.

The Brown family, owners of the Cincinnati Bengals, bought back from the Knowlton estate its remaining shares in the team, sources said, while the San Francisco 49ers are selling a stake in the club to a Silicon Valley individual to help fund the team’s planned new stadium in Santa Clara.

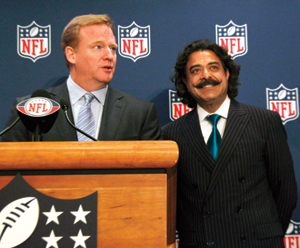

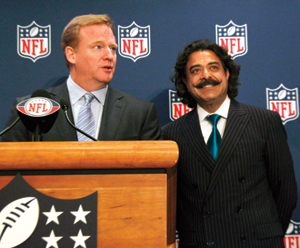

Combined with the approval of Shahid Khan’s reported $760 million purchase of the Jacksonville Jaguars, the developments underscore how the NFL is more than ever a desirable investment.

|

NFL owners welcomed Shahid Khan (right, with Roger Goodell) to their ranks.

Photo by: AP IMAGES

|

“With a new CBA [and] with new TV money, it makes limited partnerships a lot more attractive,” said Randy Vataha, president of Game Plan, which advises in team sales. “There are no big bumps out there.”

The identity of the Silicon Valley investor was not available, and 49ers owner Jed York declined to comment. A spokesman for the Bengals also declined to comment.

The Bengals battled the Knowlton estate for much of the 2000s. Austin “Dutch” Knowlton, a Bengals founder who also was an owner of the Cincinnati Reds, died in 2003, sparking an estate battle over the value of his stake in the football team. The buy-back of the remaining Knowlton stake is the last chapter in that story.

Sources said the Brown family did not have to borrow to finance the transaction because the team has been profitable the last decade; it had the reserves to finance the buy-back. While the Bengals have been long cast as a low-revenue team, accurately so, the club also has very little, if any, debt and a stadium lease described widely as a sweetheart deal for the club.

Meanwhile, the 49ers are borrowing $850 million to fund their planned stadium in Santa Clara, leading observers to question how the club could afford so much debt. Paring down the debt with the proceeds from an equity sale appears to be one answer. The stadium is slated for a 2015 opening.

Potential NFL stadiums across the league got a boost last week when owners, meeting in Dallas, passed a 25-year stadium-financing program, replacing a program that expired in 2006. Teams will be able to get up to $200 million, more than the $150 million available under the old program, paid for through diverted revenue streams, owner loans and assessments against other clubs. The new program can assess each team up to $1 million annually for the quarter century of the program.

A key distinction in the new program, said Neil Glat, NFL senior vice president, is that unlike the old program that gave more money to teams in bigger markets, this system will base payouts on how much teams are putting in. Also, like the old system, renovations are still eligible for funding, but now the first $50 million is not covered.

NFL owners at their meeting also approved two smaller limited-partner transactions. The Philadelphia Eagles had some internal ownership transfers that were minor, the team said, and the Atlanta Falcons executed a share sale. A Falcons spokesman did not immediately reply for comment.

In addition, the owners approved creating the first league-run venture capital fund. Each team will make available up to $1 million for the fund.

“The aim of it is to invest in various technologies and companies that we think are doing great things that will make our world better but also the experience in the NFL better,” Commissioner Roger Goodell told reporters last week. “They may or may not be NFL partners. They may be people who provide technology in our stadiums, on our fields, as part of media. We will look at those different technologies. We’ll have a committee that will be making those decisions, and we’re very excited about it.”