Editor's note: This story is revised from the print edition.

Now that the NFL has a fresh labor deal in hand, the league is focused on investing in and growing the game. For many, that means finally returning the league to Los Angeles, which has not had an NFL team since 1994, when the Rams and Raiders played their last games there and left the market.

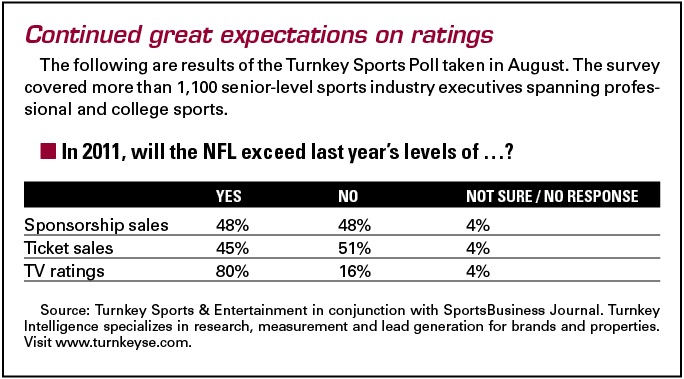

But don’t count the league’s TV partners as anxiously pushing to be in the country’s second biggest market. TV networks aren’t fighting the NFL’s desire to put a team in Los Angeles, but they certainly aren’t clamoring for it, either. After two consecutive seasons of record high TV ratings, network executives say they are happy with their rights packages as they currently stand.

“Our package is fine the way it is right now,” said Sean McManus, chairman of CBS Sports. “We’re not lobbying to add another market. If it happens, we’re more than happy to take advantage of the opportunity if it’s an AFC team. If it doesn’t happen, we’ll adjust.”

Last year, CBS, ESPN, Fox, NBC and NFL Network set viewership records during the regular season.

So why is the NFL making such a big push for the Los Angeles market?

While owners talk about returning to such a major market, with a young generation of fans and serving as a gateway to the Pacific Rim, most media analysts believe the push for Los Angeles has as much to do with increasing media rights fees as anything else.

The NFL’s network TV deals expire after the 2013 season, and having a team in the country’s second biggest TV market could boost the fees the league is expecting, analysts say.

Currently, Fox pays $720 million a year, and CBS pays $620 million a year for their Sunday afternoon packages. Sources expect those fees to eclipse $1 billion a year in their next contract, which starts with the 2014 season and is expected to be negotiated at the end of this year.

|

IDA MAE ASTUTE / ESPN

Sources say ESPN is close to an extension for “Monday Night Football” worth $1.8 billion a year. The NFL is shopping a separate eight-game package that could be worth $700 million a year. |

Sources say ESPN is close to a “Monday Night Football” extension that’s worth $1.8 billion a year; and the NFL is shopping an early season eight-game package that could be worth as much as $700 million a year.

The question is how much higher would those rights fees go if a market the size of Los Angeles had a team.

“The concern networks have is that the NFL will use a move to Los Angeles as a way to leverage higher rights fees in the next negotiation,” said Neal Pilson, who ran CBS’s sports department in the 1990s.

But will a return to Los Angeles mean more eyeballs? Even the most optimistic predictions show little TV ratings growth for the league nationally. Pilson predicted that an NFL team in Los Angeles would have a minimal effect on the league’s national ratings, adding perhaps a “few tenths of a ratings point,” he said.

A competitive team in the market could lift national ratings marginally. But a subpar team could create problems — as a poor team that struggles to sell out games would see games blacked out in the market.

“The team has to be good so they get sellouts,” said Bill Wanger, executive vice president of programming and

research for Fox Sports. “What you don’t want is a team moving here and not selling out.”

During the Rams’ and Raiders’ last season in Los Angeles, in 1994, the teams had trouble selling out and blackouts were a problem.

“That’s the history of the L.A. market,” Pilson said.

Wanger said the lack of a team in the country’s second biggest market has allowed other NFL teams to make inroads there. In the years since Los Angeles lost the NFL, Wanger said national clubs like the Dallas Cowboys and Pittsburgh Steelers have become popular, since their games were often part of nationally broadcast games that were available in Los Angeles. That would change if a team returns to Los Angeles.

“What will happen is that you’ll get fewer games in the city, but you’ll get higher ratings,” Wanger said.

In 1994, the last season Los Angeles had an NFL team, the market ranked 17th in market ratings, with a 13.4 rating for its Fox games. Last year, Los Angeles ranked 50th, with an average rating of 8.6 for its Fox games. Last season, for example, the Cowboys game against Brett Favre and the Minnesota Vikings was the highest rated game in the market, with a 14.3 rating. Wanger would expect a local team to occasionally pull ratings in the 20s.

“For the league to prosper without a team in a market the size of Los Angeles is an indication of the strength of the NFL as a TV property,” said Ed Desser, president of Desser Sports Media. “I don’t see Los Angeles being transformed by the addition of an NFL team like a lot of other markets would.”

Last month, NFL Commissioner Roger Goodell addressed CBS’s NFL producers and talent, telling them that the league needs to make sure that any team is successful from a fan standpoint, competitive standpoint and commercial standpoint.

“We don’t have a vote. We don’t have a say,” McManus said. “We’ve expressed our interest that if there’s a team, we would like it to be an AFC team.”

John Bogusz, executive vice president of sales and marketing for CBS Sports, said that a team in the Los Angeles market would marginally help networks’ ad sales pitch, even if it didn’t directly help sales, which are more than 80 percent sold so far this year.

“It would just be a positive story that you have a home team in that market,” Bogusz said. “It would be nice.”

For the many transplants in Los Angeles, the city is an NFL fan’s dream, with the maximum number of games broadcast into the market each season. Last season, Fox and CBS broadcast 52 games in Los Angeles.

Chicago, for example, which sold out every game last season, had 50 Sunday afternoon games. Tampa, which had all eight of its home games blacked out last season, had only 42.

“That difference in games is significant,” Wanger said. “You’ll get more games and more of those national appeal teams without a team. However, if you get a good team — and hopefully it’s an NFC team — the benefits are great. That’s the bottom line.”