On the eve of the college football season, two powerhouses in sports marketing, UPS and MillerCoors, are taking aggressive steps to create some of the largest sponsorships in collegiate athletics.

These extensive eight-figure deals will provide the companies with a significant presence on campus and a broad national platform, the kind that’s been difficult to achieve in the fragmented college space.

The UPS agreement with close to 70 schools and a handful of conferences will give the logistics and shipping giant promotional rights from coast to coast. The deal, believed by industry sources to be worth $20 million to $25 million a year, includes many of the top college football programs in the country from IMG College’s stable, which features Texas, Michigan, Ohio State, Florida, Georgia, UCLA and others.

By comparison, State Farm’s portfolio of 90 schools is considered one of the largest in the college space, but it took the insurance company about 25 years to string together all of these deals individually.

UPS’s deal represents one of the most ambitious plans to stitch together a national program outside of a traditional NCAA corporate sponsorship, and it showcases the growing role of college sports as a viable national platform.

“What we’re seeing could be a tipping point for these types of huge, scalable deals in college athletics,” said Rick Jones, a veteran sports marketer in the college space with Fishbait

|

| Where MillerCoors uses the college logo, it will use responsibility messaging with it, such as “21 Means 21.” |

Marketing, which represents the college coaches associations. “I’m really eager to see what’s next on the horizon and whether this is the start of something or just some individual deals. But what it shows with so many schools is that the model can work.”

UPS also is in talks for sponsorship positions in the Big Ten and Pac-12 conferences, with its activation focused on the football championship games for both leagues. UPS already has a partnership with the SEC.

Officials from UPS and IMG College would not comment on the deal.

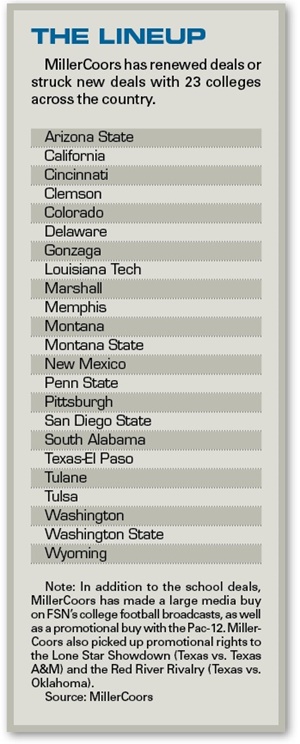

MillerCoors, meanwhile, unveiled an integrated marketing program across 23 schools to its employees and distributors last week that includes heavy responsibility messaging and the use of college marks on point-of-sale material.

Both IMG w and Learfield Sports, the nation’s two major multimedia rights holders, signed deals with MillerCoors, which will promote its Miller Lite and Coors Light brands.

Terms of the deals were not announced, but MillerCoors’ total spending is believed to be in the $10 million range annually, according to industry experts.

The heavier presence in college football will help the Coors Light brand offset the loss of its NFL official partnership this fall. Coors signed on in 2002 as the NFL’s beer category sponsor, a position it held through the 2010 season before Anheuser-Busch took it over this season.

“These are deals that offer multi-regional properties and very strong retail activation tools,” said Jackie Woodward, MillerCoors’ vice president for media and marketing. “We’re still very strong in the NFL with 21 team deals. We’re strong with fantasy football and Major League Baseball. College is now becoming a very nice part of the overall portfolio, particularly with our responsibility messaging.”

For UPS, the deals represent a deeper association with college properties. The company first moved into the space in March 2010 when it struck a deal to become an NCAA corporate partner, which gives it full promotional rights against the Final Four and NCAA tournament.

This deal with close to 70 colleges will put UPS on the ground for college football season with access to signage, TV and radio advertising, game programs, Web advertising, hospitality and tickets.

Many of UPS’s sponsorships include a significant business-to-business component as well, and it remains to be seen if these schools will make the company their exclusive source for shipping and logistics.

Industry sources say it’s common for the athletic department to introduce its sponsors to key decision-makers on the other parts of campus, where UPS might find more business.

The company is believed to be working through the final stages of closing the deals and an announcement could come in the next week or two.

UPS’s sponsorship represents one of the first major wins for IMG College’s new national sales group, which has been touting the college space as a viable alternative to other national properties.

IMG College was formed through $300 million worth of acquisitions, starting with Collegiate Licensing Co. and Host Communications in 2007 and adding ISP Sports in 2010. That $300 million was essentially a bet that the combined companies could consolidate the fragmented college market and make it easier to navigate for sponsors.

The acquisition of ISP Sports and its 50-some schools increased IMG College’s total client list to more than 80 across the country, giving it the critical mass it needed to create broad national sponsorship packages that also offered the ability to activate on college campuses and sporting venues.

Industry sources say the highest levels of leadership, from IMG Sports & Entertainment President George Pyne down, have been involved with both of these negotiations to get them closed.

MillerCoors’ 23-school deal isn’t as broad as UPS’s, but it probably was a good bit more complicated.

Beer advertising and sponsorships are so sensitive on college campuses that many schools won’t accept it, even if they’re turning down an attractive revenue opportunity. North Carolina, for example, does not permit any advertising or promotion of alcoholic beverages, even if it’s responsibility messaging.

“There might be a little more openness to the category now,” said Joel Erdmann, athletic director at South Alabama, a school that sells beer at its football, basketball and baseball games. “If it’s done responsibly, it can be a viable method of generating revenue, but you have to be sensitive to how it’s presented. There are cultural issues on every campus that ADs have to take into account.”

To pave the way for MillerCoors to form partnerships with 23 schools that represent 17 states, IMG College and Learfield Sports had to first identify the schools that would allow a beer sponsorship.

“Most of the conversations with IMG, Learfield and the schools was about making sure we’re bringing the right level of responsibility messaging,” Woodward said. “We’re not trying to reach underage drinkers, but we want to do what we legally have a right to do and that’s actively market to legal-age consumers. That was the biggest focus of our discussions.”

Among the more high-profile schools are Arizona State, California, Clemson, Colorado, Penn State and Washington. Several midlevel schools such as Louisiana Tech, Gonzaga, Memphis, Marshall, South Alabama, New Mexico and Wyoming are included as well.

Many variables went into the selection of the 23 schools. In some cases, such as a national power like Penn State, MillerCoors weighed the national and regional profile of the school. It also considered the needs of distributors in certain markets. For example, where Miller Lite has an NFL relationship in a market, MillerCoors could provide a college relationship for Coors Light in the same market.

Sales trends for Miller Lite and Coors Light also factored in.

Some of the deals, like Washington’s, are renewals of existing contracts, while other schools either didn’t have a sponsor in the beer category or they’ve switched from a competitor to MillerCoors. More schools could be added this fall, Woodward said.

“You have to have a great understanding with your partner,” said O.D. Vincent, senior associate athletic director at Washington, which has MillerCoors as its domestic partner and a local brewery for its craft beer category. “You understand going in that it’s a very sensitive category and you’ve got to treat it responsibly so that it becomes an enhancement for both brands and something that’s not a drawback to either party.”

MillerCoors will not put university marks on bottles or cans, nor will it use actors to portray college athletes in advertising.

The brewer will put college marks on point-of-sale advertising at retail outlets, but won’t use the marks in its TV advertising.

MillerCoors marks and school logos could appear on co-branded merchandise such as T-shirts, hats, koozies or coolers.

Where MillerCoors uses the college logo, it will use responsibility messaging with it, like “21 Means 21” or “Great Beer, Great Responsibility.”

Woodward didn’t say exactly what percentage of the ads must be responsibility based.

“We’ve had some deals with colleges in the past, mostly around retail activation,” Woodward said. “What’s new is our ability to create a broader platform across the U.S. and the responsibility messaging that we’re bringing to every school.”

In addition to the media buys across TV, radio, Internet and print, MillerCoors will have access to traditional sponsor assets such as hospitality and tickets. Any in-stadium signs will display a responsibility message.

Schools have veto power on any ads it does not approve.

Additionally, MillerCoors is creating a grant program called “Great Plays” that will provide funds for on-campus programs that address alcohol responsibility issues. MillerCoors, which is represented by Genesco Sports Enterprises, has not yet determined how much money it will give annually through the grant program.