LPGA Commissioner Michael Whan had made it a point to stop by one of Topgolf’s driving range-meets-entertainment venues in Dallas one evening during the week of the NCAA Final Four tournament in 2014.

Upon arriving, he was immediately taken aback.

“It was a Tuesday and it was packed,” Whan remembers. “I wondered if I could even get a bay.”

Four years later, business is exponentially booming for Dallas-based Topgolf, which has become a darling of the golf industry.

Topgolf now has 38 U.S. and three overseas venues where customers can hit chip-embedded balls at high-tech driving range targets in a lounge-like atmosphere, complete with DJs and drink specials.

Topgolf’s future will be based on its ability to continue to scale and attract repeat visitors.topgolf

Last year, Topgolf had a massive 13 million customer visits and that number is expected to continue growing rapidly through an aggressive expansion strategy that includes plans to open between seven and 10 new venues annually for the foreseeable future both in the U.S. and overseas.

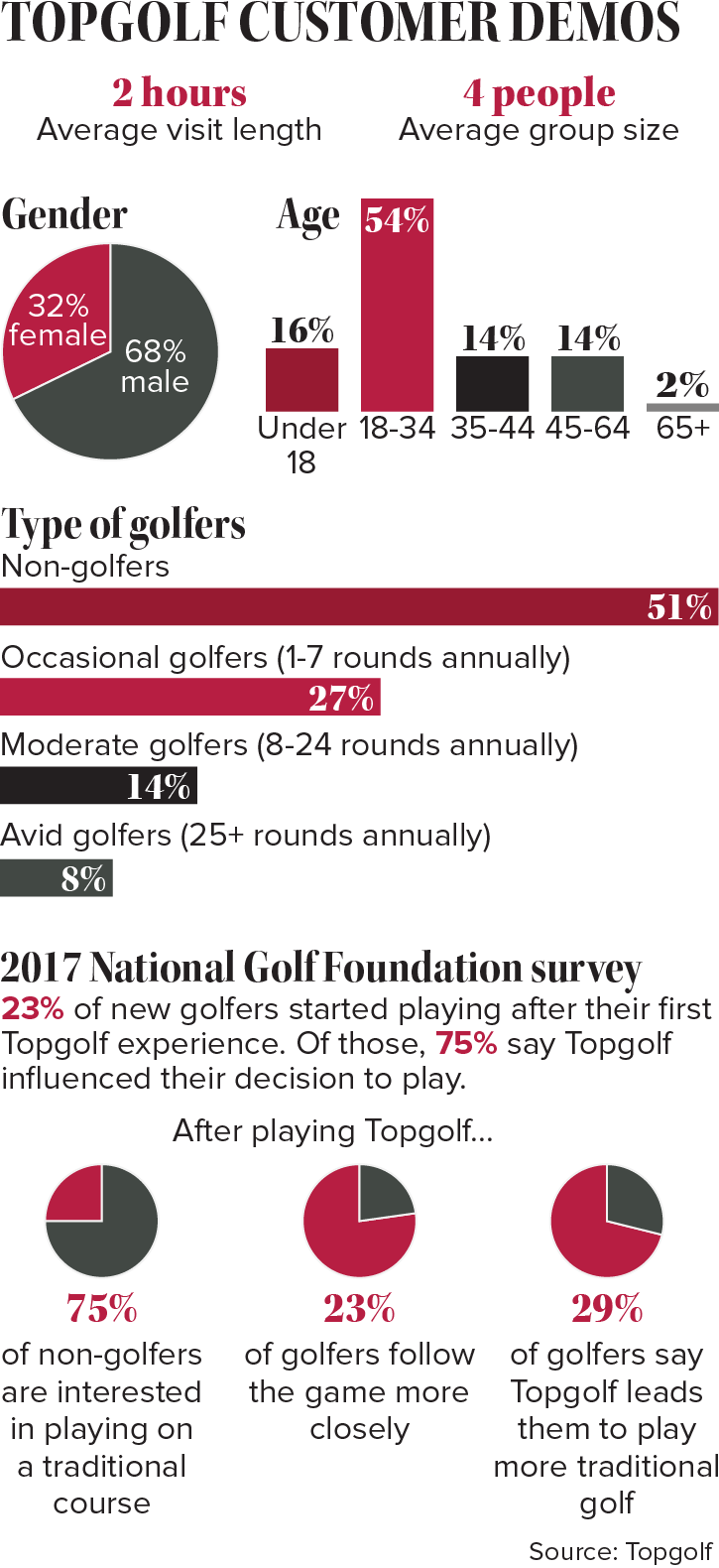

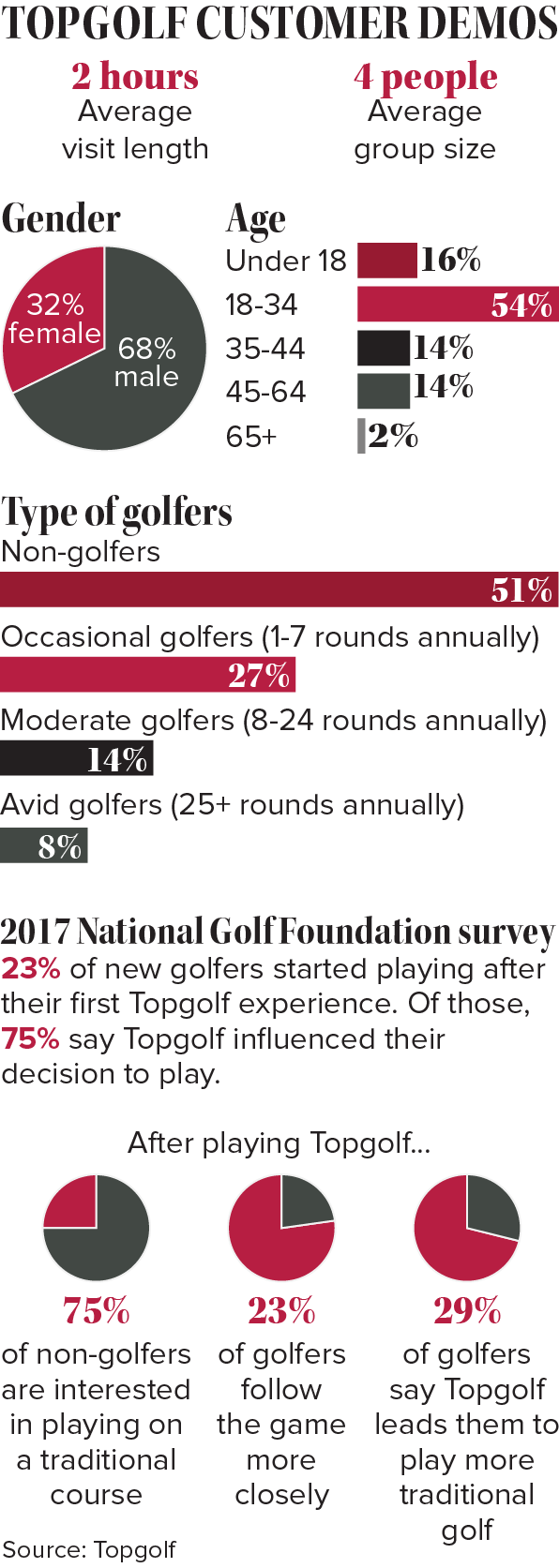

Topgolf venues overall averaged more than 35,000 customer visits per day last year, with the average customer spending two hours per visit at a venue, according to the company.

It’s those numbers that have participant-hungry golf courses and the national golf associations all clamoring to draft off Topgolf’s success. With such dizzying expansion, it’s no surprise that the PGA Tour, PGA of America and LPGA have promotional partnerships with the company in an attempt to convert the hordes of casual and non-golfers who are flocking to Topgolf over to traditional golf.

“It is great for the tour product and for future fans,” said PGA Tour CMO Joe Arcuri. “We value who they reach and their diversity.”

While the eye-popping success of Topgolf has pleasantly surprised industry insiders and provided the sport with a jolt of innovation, just how much can Topgolf’s massive draw help the golf business? Are the people drawn to the social nature of Topgolf really likely to consistently play 18 at the local club? And for Topgolf, despite its current success, how does it continue to scale and generate repeat visitors?

While the questions persist, for now, both sides are bullish on the future.

“We see a lot of ways with golf to have a meaningful business,” said Erik Anderson, executive chairman of Topgolf Entertainment. “There is a lot of white space. A lot of growth.”

Impact on the game

The player data is immensely attractive. Topgolf states that about 51 percent of its customers are non-golfers who wind up swinging a club for the first time with their friends at a Topgolf venue, a statistic that has industry insiders brimming with optimism that the company can attract new and younger fans and players to the game, which skews to an older demographic. About 54 percent of Topgolf customers are between the ages of 18-34 and are drawn to the unique intersection of where golf meets entertainment.

“Any environment where individuals are swinging golf clubs is terrific,” said Sarah Hirshland, senior managing director of business affairs for the USGA, which last year partnered with Topgolf to hold U.S. Open watch parties at all Topgolf venues. “Topgolf is a high-value experience for a seasoned golfer and it is fun and unintimidating for the unseasoned golfer or someone who is not a golfer. Topgolf has done a wonderful job of running its business and creating an experience that is putting golf clubs in people’s hands.”

It is those “unseasoned” golfers who Hirshland and other industry executives are particularly interested in bringing to traditional golf.

“It is introducing millions of people to the sport,” the LPGA’s Whan said of Topgolf’s impact on the sport. “What is exciting is the belief that they can be LPGA viewers or on-site fans. It is something that the game hasn’t seen in a while.”

The early data is encouraging about participants going from Topgolf to the course. A recent survey conducted for Topgolf by the National Golf Foundation shows that 23 percent of new golfers started playing after their first Topgolf experience, while 75 percent of non-golfers said they were interested in playing on a traditional course after playing Topgolf.

“I am incredibly bullish on it,” said Jeff Price, chief commercial officer for the PGA of America. “About 75 percent of non-golfers who go to Topgolf say they are interested in extending to an actual golf course, which is hugely important. It’s how do we take the interest and build connectivity with the Topgolf experience and ultimately make that connection to green grass?”

That’s a goal of golf governing bodies, who already have instituted youth development programs aimed at attracting more young golfers to the game.

The challenge is balancing Topgolf’s position as a young, hip, social scene geared to drinking, eating and meeting people with the golf group’s interest in growing the game.

The “connective” PGA of America efforts include Topgolf holding sponsorship and media events, and other fan engagement efforts tied to PGA of America events along with Topgolf promoting the PGA Junior League Golf program.

Topgolf also hires PGA professionals as instructors at Topgolf venues, while the PGA Tour and the LPGA co-promote with Topgolf by holding sponsor and media activities at Topgolf venues.

Another literal connective effort is Topgolf’s latest plan to build a new venue on the site of a West Palm Beach, Fla., public golf course.

“Topgolf is broadening and deepening and driving a younger demographic to be aware of golf,” said Andy Pierce, global president of golf and consulting for Lagardère Sports and Entertainment. “I never would have envisioned that it has become as popular as it is.”

Challenges

Even with the dizzying ascent of the company, Topgolf faces challenges with its growth and expansion.

Anderson would not disclose any company financial information or the cost of building Topgolf venues, but building between seven and 10 new venues annually would require a hefty dose of capital. Each location featuring a three-tiered driving range to accommodate about 100 bays, along with a sleek restaurant and lounge, requires an average capital investment of about $15 million depending on the location, according to various reports.

topgolf

Capital is also needed to support the company’s strategy to offer broader entertainment products either through acquisition or development.

While the company is expanding, it lacks a large presence in the Northeast and in Southern California, with no current facilities in Los Angeles or San Diego. Overhead can also run high, as Topgolf has about 15,000 full and part-time employees overall, which leads to staffing and training challenges as the company manages growth while focusing on providing a consistent and engaging fan experience.

“Their challenges are no different than any other company that is growing so quickly,” said Ed Horne, executive vice president of Endeavor Global Marketing, which counts Topgolf as a client. “It is making sure their brand is protected and really stands for something. It’s whether the locations they are building are consistent so that there is a reason for people to come back more than once.”

There is also competition entering the market. Drive Shack, backed by TaylorMade, this spring is set to debut its first golf/entertainment facility in Orlando with a three-story driving range that, like Topgolf, will offer a bar and restaurant experience.

“Getting good locations is hard, training is hard and we compete against all forms of entertainment,” Anderson said. “That is why we are so focused on content and experience.”

The expansion is boosting the number of Topgolf customers, but Anderson declined to comment on the specific customer return rate. “People come back, it is a meaningful repeat business,” he said.

Continued access to capital is a major priority if Topgolf is to continue its growth trajectory.

“Any time you have a business that requires that kind of capital investment and real estate, you have to be creative in what is the model for capital maintenance,” Hirshland said. “You have to continue to reinvest in the experience.”

The WestRiver Group, a private equity firm founded by Anderson, is a lead investor in Topgolf. Other lead investors include Callaway, which took a stake in the company in 2006; Carolina Hurricanes owner Thomas Dundon, who bought a stake in 2011; and Providence Equity, which took an undisclosed stake in 2016.

Said PGA Tour CMO Joe Arcuri, “It is great for the tour product and for future fans. We value who they reach and their diversity.”topgolf

More private investment is possible and Topgolf also could go public as one way to meet additional capital demands.

“We don’t rule it out,” Anderson said of the possibility of going public. “We are the subject of inquiries from the capital market world and our investors would look at it as a way to grow the company and get liquidity. We are not naïve to say we would never look at it. It is time and circumstance specific.”

Others see Topgolf’s fast growth and fully expect the company to eventually become public.

“Topgolf is doing some interesting things and is having an impact, ” said Scott Seymour, senior vice president and managing director of Octagon’s golf business. “My guess is they go public in the next three years. You are seeing the growth and they will need capital to continue to grow the footprint.”

All eyes on the future

In the past year, Topgolf has pushed to broaden its footprint with a steady diet of new venues and products marketed outside of its driving range/entertainment venues (see related story).

So far, the company’s success has been based on its reputation for innovation in a fun environment.

What that success means in terms of revenue and profitability aren’t made public by the privately held company, but the company has found the formula to attract a crush of interest from both golfers and non-golfers alike.

“It starts with the fact that the millennial audience is largely focused on experiences,” Horne said. “It is all about having great experiences and sharing it. Topgolf, in addition to tapping into golf as a property, has seen their growth based in providing great experiences both in their venues and outside.”

As Topgolf continues to expand, all eyes will be on whether Topgolf can play a major role in developing a new generation of golfers and enthusiasts of the game.

“Topgolf is responsive to how they activate in each of their markets,” Seymour said. “Young people are fickle. Attention spans scatter. They need to be smart in how they reach and connect with those people.”