|

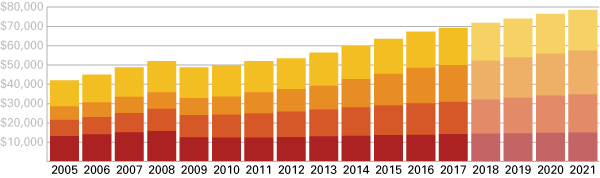

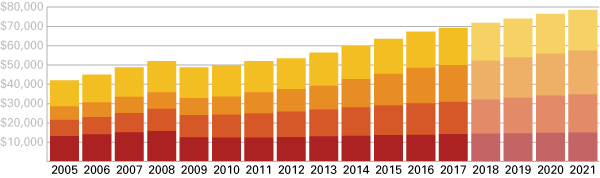

Media continues to gain on ticket sales as the industry’s most lucrative revenue stream.

GETTY IMAGES |

The North American sports industry’s bull market just keeps charging.

Sports’ most lucrative revenue streams are projected to grow from $69.3 billion this year to a record $78.5 billion in 2021, extending the industry’s recent seller’s market, according to a report scheduled to be released today by PricewaterhouseCoopers.

The PwC Sports Outlook — an annual study that tracks sales of tickets, merchandise, media rights and sponsorships generated by U.S. and Canadian-based professional and college sports properties — forecasts that the four categories will combine to see growth every year from 2017 through 2021, for an overall increase of 13.4 percent.

For the second year in a row, the report suggests that the presence of long-term media rights and labor contracts should separately, but almost concurrently, guarantee revenue stability in the sports industry.

First, the primary rights deals for the NFL, NBA, MLB, NHL, NASCAR, MLS, College Football Playoff and NCAA men’s basketball tournament are each secured for the next several years. And although Facebook, Twitter, Amazon, YouTube and Vice Media recently have increased their investments in the sports media space, their presence is seen as incremental rather than disruptive, at least in the short term.

The media segment is expected to top $20 billion next year and overtake gate revenue as the industry’s largest segment.

A second often volatile area that is expected to be relatively calm for the next couple of years is labor. The MLB, NFL, NHL and NBA collective-bargaining agreements each run through at least the end of their 2021 seasons. MLS has two years remaining on its CBA.

For now, however, ticket sales generate the most revenue for the industry ($19.2 billion in 2017), as they have since at least 2005, the first year that PwC analyzed those specific segments. That niche is expected to grow 9 percent during the measured cycle, spurred by the more than $15.2 billion that is currently committed to building or upgrading 81 stadiums, racetracks and arenas in the U.S. and Canada.

The report does not include the annual cost to lease premium seats or fees for personal seat licenses. Its gate-revenue calculations are based on the face value of tickets.

While the report indicates that sponsorship was surpassed in size by media rights in 2015, the study still projects an industry-high 19 percent growth for the sponsorship sector between this year’s $16.7 billion to $19.9 billion in 2021.

Finally, licensed merchandise sales make up the fourth-biggest contributor to the industry’s overall economy, according to the study. Such sales are projected to increase 5 percent by 2021, from an estimated $14.4 billion this year to $15.1 billion.

Minor League Baseball provides a good example of how this niche continues to grow. The property’s 160 clubs combined to wear 1,300 jerseys last summer, a 160 percent increase over the 2013 season, helping to drive both b-to-b and consumer business for the organization’s apparel partners.

Although the study generally focuses on the industry’s primary revenue drivers, this year’s report also included an in-depth analysis of the recent surge in franchise sales prices.

When Guggenheim Baseball Management bought the Los Angeles Dodgers in 2012 for $2.15 billion, for example, the sports world considered the price tag an aberration.

The same word was used two years later when Steve Ballmer, of Microsoft fame, shelled out $2 billion for the nearby Los Angeles Clippers, and again this summer when casino magnate Tilman Fertitta successfully bid $2.2 billion for the Houston Rockets at the same time Derek Jeter and Bruce Sherman were cobbling together $1.2 billion to buy the Miami Marlins.

While the prices may have been eye-popping to sports fans, they represent a new reality for the industry, said Michael Keenan, sports practice leader at PricewaterhouseCoopers.

“For high-net-worth individuals, these are trophy assets,” Keenan said. “Such things don’t come up very often, so combine that scarcity of availability with lower interest rates and stronger cash flows and you have a seller’s market. That’s why bids are coming in higher than what makes sense.”

Keenan, who oversaw this year’s report, has seen the industry from many angles. He was at PwC from 1988 to 1996, then spent a decade on the NFL Management Council and was senior director of labor finance there before joining the Cleveland Browns for four seasons as chief financial officer and then president. He returned to PwC in 2011.

PwC data indicates that from 1990 through 2015, teams generally sold at price levels with multiples ranging between two and five times the prior season’s revenue. Additionally, while the perceived value of a team often spikes after a leaguewide media rights deal is signed, it usually falls “back within the longer-run range, below roughly five times,” according to the study.

The report says, however, that a number of sales dating back to the Dodgers’ transaction have been sold recently “at multiples of six times or higher.”

While Keenan did not provide transaction-specific data, Forbes magazine estimated that Fertitta’s $2.2 billion Rockets purchase, for example, was nine times the team’s $244 million revenue in 2016-17.

The report said that “capital appreciation remains the primary investment objective” when it comes to buying a team, but that more owners are beginning to seek out more private partnerships to exploit the “synergistic opportunities of structuring a sports team within a broader portfolio of real estate, hospitality, and/or entertainment assets.”

Keenan said that increased privately funded ancillary real estate development around venues not only will help teams increase revenue across the ticket, sponsorship and merchandise categories, but will serve as a buffer in a tough-to-predict economy.

“The uncertainty surrounding proposed tax reform in the U.S., such as the elimination of tax-exempt status for public bonds used to fund facilities, and exclusion from preferential income tax rates on business income associated with entertainment and sports, makes it critical for teams to look for more private investment,” he said.

PwC projects that the North American sports market will grow to $78.5 billion in 2021, and that next year the media rights segment will become the industry’s most lucrative revenue stream.

|

| |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

| Gate revenue* |

$13,284 |

$14,261 |

$15,139 |

$15,984 |

$15,778 |

$16,176 |

$16,116 |

$15,821 |

$17,142 |

$17,448 |

$17,963 |

$18,649 |

$19,159 |

$19,556 |

$20,006 |

$20,469 |

$20,902 |

| Media rights |

$7,041 |

$7,546 |

$8,388 |

$8,540 |

$8,809 |

$9,423 |

$10,858 |

$11,619 |

$12,262 |

$14,595 |

$16,305 |

$18,372 |

$19,075 |

$20,135 |

$20,960 |

$21,755 |

$22,667 |

| Sponsorship |

$8,380 |

$9,003 |

$10,016 |

$11,616 |

$11,514 |

$11,820 |

$12,615 |

$13,257 |

$13,900 |

$14,689 |

$15,481 |

$16,301 |

$16,658 |

$17,614 |

$18,391 |

$19,342 |

$19,876 |

| Merchandising^ |

$13,358 |

$14,191 |

$15,255 |

$15,860 |

$12,631 |

$12,571 |

$12,482 |

$12,771 |

$13,144 |

$13,493 |

$13,806 |

$13,966 |

$14,390 |

$14,554 |

$14,729 |

$14,939 |

$15,087 |

| Total |

$42,063 |

$45,001 |

$48,798 |

$52,000 |

$48,732 |

$49,990 |

$52,071 |

$53,468 |

$56,448 |

$60,225 |

$63,555 |

$67,288 |

$69,282 |

$71,859 |

$74,086 |

$76,505 |

$78,532 |

* Does not include the cost to lease premium seats or licensing fees for PSLs; includes only the face value of the ticket.

Source: PwC

^ Food and beverage concession sales are not included.

Note: Estimates listed for 2005-2016 may have changed from previous versions of the report. As PwC adds teams to its portfolio, the company gains access to more exact, confidential data that it folds into the historic analysis.