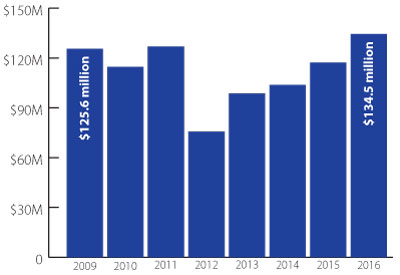

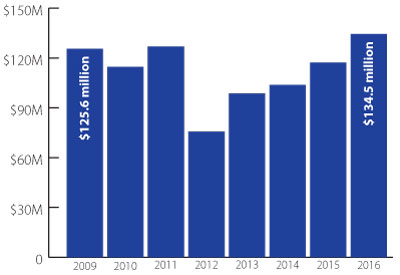

The NFL Players Association’s commercial revenue reached $134.5 million in the year covering the most recent season, an all-time high, fueled by the reappearance of payments from Electronic Arts and a large contribution from the NFL.

The increase in revenue — up 30 percent over two years, according to an analysis of annual reports filed by the NFLPA with the Department of Labor — helped send total union assets over $400 million for the first time. If assets continue to grow at a similar pace, the NFLPA should enter the next round of labor negotiations in a few years with more than half a billion dollars.

The current collective-bargaining agreement extends until 2021.

The NFLPA did not reply for comment, and union officials in the past have declined to answer questions about the annually required filings.

The annual report uses cash and not accrual accounting, meaning it only reflects cash that came in during the measured 12-month period. The money represents licensing deals such as those for jerseys and trading cards, as well as from marketing appearances arranged for players through the union. Those deals are agreements that involve six or more players — known in the industry as group-licensing deals.

| 1 |

NFL |

$55.8 million |

| 2 |

Electronic Arts |

$28 million |

| 3 |

Trading cards (Panini, Topps) |

$26 million |

| 4 |

Nike |

$5.2 million |

| 5 |

Outerstuff |

$4 million |

Source: SportsBusiness Journal analysis of NFLPA annual reports

John Lieberman, a member of the New York State Society of Certified Public Accountants and past chairman of its Entertainment and Sports Committee, estimated that of the NFLPA’s $400 million in assets, $300 million could be liquid.

“That’s a lot of cash they are sitting on,” Lieberman said.

The union created its sports licensing and sponsorship arm in the 1990s to ensure it had a financial sum to steady it during labor battles with the league. Ironically, a healthy share of the union’s assets is now funded by the league.

The NFL pays the union annual fees in part not to compete with league sponsorships. In the most recent season, that figure totaled $55.8 million.

The most recent annual report covers the 12-month period that ended Feb. 29, 2016.

Another big contributor is Electronic Arts. Until the 2011 lockout, EA was the largest contributor to the NFLPA’s bottom line, often topping $30 million annually. Then, EA’s payments, as noted in the annual reports, plummeted to seven figures. The NFLPA never answered why the decline occurred, but some experts suggested the union took a large upfront payment during the lockout in exchange for smaller fees in future years.

The NFLPA did not have to disclose its financials during the lockout.

The money from EA is now back, with EA in the most recent annual report shown paying $28 million. That more than made up for a $10.7 million drop, to $26 million, from trading card companies Topps and Panini.

The NFLPA also took in income from daily fantasy companies for the first time: $531,250 from DraftKings, and $50,000 from FanDuel.

The annual report additionally shows group licensing distributions to players, and it’s the first report to fully capture the effects of Adrian Peterson’s child abuse scandal from the fall of 2014. Peterson’s group licensing income noted in the 2014 annual report (which covered the 2013 NFL season) was $967,298. It dipped to $484,969 in last year’s report (which included the 2014 season). In the most recent report, covering a full year since the scandal, Peterson’s income was $116,421.

|

| Year* |

Amount |

| 2016 |

$134.5 million |

| 2015 |

$117.2 million |

| 2014 |

$103.7 million |

| 2013 |

$98.6 million |

| 2012** |

$75.6 million |

| 2011 |

$126.9 million |

| 2010 |

$114.6 million |

| 2009 |

$125.6 million |

* Fiscal year, ending the last day of February

** For March 1-11, 2011, and July 26, 2011-Feb. 29, 2012, the period around the NFL lockout. The union decertified during the lockout and did not have to file financials for that time period.

Source: SportsBusiness Journal analysis of NFLPA annual reports |