Houston-area ticket broker Patrick Ryan, through his companies, ranks among the biggest resellers of Golden State Warriors tickets anywhere in the country, holding a large collection of season tickets at Oracle Arena. And he’s not planning on renewing many of them for next season.

Ryan’s brokerage The Ticket Experience and secondary ticket analytics outfit Eventellect generate plenty of fan interest for the NBA’s defending champion, current best team and by far the hottest basketball ticket on the resale markets. But the Warriors recently announced a new price structure in which brokers will be charged ticket prices for the upcoming 2016 playoffs and 2016-17 regular season in some cases more than double the rates for individual fans.

|

The red-hot Golden State Warriors raised ticket prices across the board, but they saved the biggest price increases for brokers.

Photo by: Getty Images |

Ryan doesn’t necessarily begrudge the Warriors’ attempt to maximize revenue at a historical apex for the franchise, an effort that also includes an across-the-board price increase for existing season-ticket holders. But beyond the big price bump that essentially doubled his seven-figure costs with the team, Ryan fears a series of “unintended consequences” in the market for Warriors tickets.

“They’re going to essentially create a lot of forced resale behavior,” Ryan said. “There will be a lot more liquidity in the market as a result of the price increases, people selling more tickets to finance the original purchase. And if the product goes backward at all, there’s a real chance for a stoppage in the market for everybody.”

Brandon Schneider, the Warriors’ senior vice president of business development, branded their two-tiered price structure a continuation of “what we’ve done for years in terms of rewarding our most loyal fans.”

It also represents an extension on the new and increased challenges that individual ticket brokers face in an industry moving quickly toward consolidation and increased team involvement in all facets of their ticketing operations.

Across the industry, recent moves have constricted the playing field for individual ticket brokers. The Boston Red Sox have partnered with MLB Advanced Media and subsidiary Tickets.com to create a team-driven resale platform called Red Sox Replay, in turn cutting ties with both StubHub and Boston-area broker Ace Ticket. The Philadelphia 76ers, beginning next season, will run all their ticketing through a team-branded platform on StubHub, with no designation of tickets as primary or secondary.

Several teams, including the New York Yankees and Dallas Cowboys, no longer accept print-at-home tickets, making it more difficult for anybody not using their officially sanctioned and electronically integrated resale platforms to make last-minute sales.

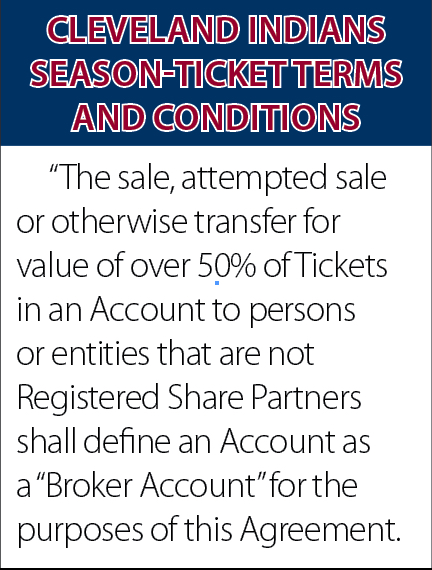

The practice of teams assessing Warriors-like surcharges to buyers of bulk tickets and to those living outside of immediate market territories has been increasingly imposed as a means to address broker activity. Others such as the Cleveland Indians have specifically delineated in their season-ticket terms and conditions the percentage of seats that can be resold before being classified as a broker, with 50 percent standing as a common threshold. And many teams have recently moved to consolidate their internal dealings with local brokers to only a handful of resellers or even a single entity in an attempt to more closely manage the resale marketplace.

“Before, a lot of teams had to beg people to take their tickets, and brokers played an important role in assuming some of that risk from the team,” said Ben King, a New York-based ticket broker. “But now, even some not-so-good teams are consolidating a lot of their resale business. I’m doing a lot more group business and other events like concerts because of it.”

Individual brokers also are facing increased legislative and regulatory pressure, such as in New York where state Attorney General Eric Schneiderman recently issued a public report calling for price caps on ticket resales in the state, among other remedies.

“Fans should be able to buy and sell tickets where they want,” said Gary Adler, executive director and general counsel of the National Association of Ticket Brokers. “The best thing is an open and free market, and it is disturbing to see the efforts out there to circumvent competition and limit the transferability of tickets.”

Shifting marketplace

For all of the 20th century and the beginning of this one, individual brokers were the ticket resale industry in sports.

And while many teams would sell season tickets on the primary market to brokers, the secondary market was largely opaque, offering little to no consumer data to teams on who was buying and selling their tickets. And the secondary market was largely composed of small, individual brokers who largely operated only in their individual home markets.

|

The Cleveland Indians include language in their season-ticket contracts that spells out who they consider to be a broker.

Photo by: Getty Images |

Several major trends over the past decade have radically transformed that situation. StubHub’s formation in 2000, and purchase by eBay seven years later, at once legitimized the resale industry and nationalized it with the power of the Internet. Many brokers began to use StubHub as a sales channel, and parallel to that, formed their own online sales efforts that extended beyond their city borders. And competing efforts, such as Ticketmaster’s Ticket Exchange, saw their own escalation and integration with primary ticketing.

Teams also have sought to play a much more active role in the resale activity happening around their teams. In addition to striking various official secondary ticket partnerships, active management of broker relationships is now commonplace in the industry.

The Kansas City Royals, for example, two years ago began a process to whittle down their relationships with more than 100 individual brokers to fewer than 10, each of which participates in profit-sharing agreements with the club.

That process began even before the team’s ascent to two straight American League pennants and a World Series title, but now takes on even greater importance with the club standing as one of the hottest tickets in baseball.

“We’ve tried to get our arms around all of this and have a bit more control around what we do in the secondary market,” said Mike Bucek, the Royals’ vice president of marketing and business development. “Having a smaller number of brokers that we work with also has created a situation where they all sort of self-police each other in the market. We’re not innovators or pioneers in this regard. This is happening a lot around the industry ”

A series of corporate mergers, expansions and partnerships, meanwhile, have largely consolidated much of sports ticketing on the primary and secondary markets to just four entities: Ticketmaster and parent Live Nation, MLBAM and its Tickets.com, the combined AXS-Veritix, and StubHub, which has partnered on many efforts including the 76ers’ initiative with Spectra Ticketing & Fan Engagement.

Those four entities have each invested millions in not only helping teams and leagues manage their ticketing efforts, but answering a range of detailed data-driven questions about fan behavior and consumer preferences.

“Teams are looking at this aspect of their business more holistically than ever,” said Jared Smith, president of

Ticketmaster North America. “They want to understand as much as they can about how they market, how they price and what the impacts are.”

That, in turn, has pushed many brokers to a more fringe position. Some operators, such as Ryan, have formed their own ticket and pricing analysis extensions to provide additional value to teams. But strictly buying and reselling tickets outside of an official team or league partnership has grown more difficult than ever.

“It’s always hard to be an independent when there are great market forces at play, and that’s the situation here,” said Jim Holz-man, Ace Ticket chief executive. “What used to be a mom-and-pop industry has really matured into a multibillion-dollar giant.”

But for some brokers, the issue is less about simply David-and-Goliath and more about restrictions in one’s ability to do business.

“I don’t begrudge a team selling their tickets for the prevailing price,” said Lee Shenker, vice president and general counsel for Maryland-based ASC Ticket Co. “But once they get their price, we should be able to do what we want with that ticket.”

Business adjustments

The response by many individual sellers to the new market realities has often been to shift their focus away from individual ticket sales, or to other events besides sports, as King said.

Other brokers, in many ways, have shifted back to how things were before the rise of more faceless online sales and industry consolidation, relying heavily on individual customer relationships. Holzman describes himself as less of a ticket broker and more of a “concierge.”

“We’re not just an anonymous seller,” Holzman said. “We know the venues inside and out and are experts in what we sell. We also own our inventory. That’s a different model than others who are just making a market. But we came from the brick-and-mortar world where relationships were king, and we’re going to stay with our strengths.”

Shenker said he is concerned about a return to prior years in which some brokers tried to mask their status as a broker.

“With more teams going to two-tiered pricing and specific definitions for what a broker is, I do worry that some people are going to try to obscure the fact of what they are,” he said. “When you have a straight arbitrage opportunity between broker pricing and nonbroker pricing, there will be some masquerading out there.”

Among larger brokers, though, there is a potential for some consolidation of their own.

|

The Kansas City Royals have greatly whittled down their relationships with brokers.

Photo by: Getty Images |

“You have something around $1 billion in inventory controlled by the top 10, top 15 entities out there,” Shenker said. “So there is potentially an opportunity out there for a more combined, leveraged response.”

Adler, meanwhile, said membership in the NATB has stayed relatively stable in recent years at about 225 member entities, with a 95 percent annual retention rate, high for an industry as volatile as ticket reselling.

Brokers, however, have garnered a bad name in many political circles and were lambasted in the Schneiderman report for widespread use of “bots,” automated software designed to acquire tickets online at speeds far beyond human capability. The NATB in its code of ethics outlaws the use of bots. And despite his criticisms of many elements of the Schneiderman report, particularly with regard to price caps, Adler said he agreed with the overall spirit of the inquiry. But there remains concern within the organization of potential overreach by regulators.

“We’ve worked hard to help legitimize the industry,” Adler said. “But I fear that we’re going to continue to see restrictions that will be bad for consumers.”

Ranked by revenue generated on StubHub's secondary market, Jan. 1, 2015, through Feb. 21, 2016.

| 2015 MLB regular season |

2015-16 NFL regular season |

2015 college football regular season |

2015-16 NHL regular season |

2015-16 NBA regular season |

| Rank |

Event |

Rank |

Event |

Rank |

Event |

Rank |

Event |

Rank |

Event |

| 1 |

San Diego Padres at Los Angeles Dodgers, April 6 (Opening Day)

Avg. Ticket Price Sold on StubHub: $158 |

1 |

New England Patriots at Dallas Cowboys, Oct. 11

Avg. Ticket Price Sold on StubHub: $304 |

1 |

Ohio State at Michigan, Nov. 28

Avg. Ticket Price Sold on StubHub: $258 |

1 |

Boston Bruins at Montreal Canadiens (Winter Classic), Jan. 1

Avg. Ticket Price Sold on StubHub: $329 |

1 |

Golden State Warriors at New York Knicks, Jan. 31

Avg. Ticket Price Sold on StubHub: $398 |

| 2 |

Colorado Rockies at San Francisco Giants, April 13 (Raising the Giants' World Series Champions pennant)

Avg. Ticket Price Sold on StubHub: $198 |

2 |

New England Patriots at

New York Giants, Nov. 15

Avg. Ticket Price Sold on StubHub: $356 |

2 |

Michigan State at Michigan, Oct. 17

Avg. Ticket Price Sold on StubHub: $258 |

2 |

New York Rangers at Chicago Blackhawks, Oct. 7

Avg. Ticket Price Sold on StubHub: $326 |

2 |

Utah Jazz at

Los Angeles Lakers, April 13

Avg. Ticket Price Sold on StubHub: $675 |

| 3 |

Arizona Diamondbacks at San Francisco Giants, April 18 (Giants World Champion ring ceremony)

Avg. Ticket Price Sold on StubHub: $124 |

3 |

New York Jets at

New York Giants, Dec. 6

Avg. Ticket Price Sold on StubHub: $327 |

3 |

Alabama at Georgia, Oct. 3

Avg. Ticket Price Sold on StubHub: $355 |

3 |

Washington Capitals at

New York Rangers, Jan. 9

Avg. Ticket Price Sold on StubHub: $268 |

3 |

Oklahoma City Thunder at Golden State Warriors, Feb. 6

Avg. Ticket Price Sold on StubHub: $471 |

| 4 |

Toronto Blue Jays at New York Yankees, April 6 (Opening Day)

Avg. Ticket Price Sold on StubHub: $121 |

4 |

Seattle Seahawks at Dallas Cowboys, Nov. 1

Avg. Ticket Price Sold on StubHub: $237 |

4 |

LSU at Alabama, Nov. 7

Avg. Ticket Price Sold on StubHub: $325 |

4 |

Anaheim Ducks at

Chicago Blackhawks, Feb. 13

Avg. Ticket Price Sold on StubHub: $274 |

4 |

Cleveland Cavaliers at

Golden State Warriors, Dec. 25

Avg. Ticket Price Sold on StubHub: $533 |

| 5 |

Minnesota Twins at Detroit Tigers, April 6 (Opening Day)

Avg. Ticket Price Sold on StubHub: $141 |

5 |

Philadelphia Eagles at Dallas Cowboys, Nov. 8

Avg. Ticket Price Sold on StubHub: $224 |

5 |

Texas at Notre Dame, Sept. 5

Avg. Ticket Price Sold on StubHub: $521 |

5 |

Carolina Hurricanes at Chicago Blackhawks, Dec. 27

Avg. Ticket Price Sold on StubHub: $268 |

5 |

Cleveland Cavaliers at New York Knicks, Nov. 13

Avg. Ticket Price Sold on StubHub: $260 |

| 2015-16 college basketball regular season |

2015 MLS regular season |

Boxing |

UFC |

NASCAR |

| Rank |

Event |

Rank |

Event |

Rank |

Event |

Rank |

Event |

Rank |

Event |

| 1 |

Duke at North Carolina, Feb. 17

Avg. Ticket Price Sold on StubHub: $471 |

1 |

New York City FC at LA Galaxy, Aug. 23

Avg. Ticket Price Sold on StubHub: $83 |

1 |

Floyd Mayweather-Manny Pacquiao, May 2

Avg. Ticket Price Sold on StubHub: $4,454 |

1 |

UFC 194: Jose Aldo-

Conor McGregor, Dec. 12

Avg. Ticket Price Sold on StubHub: $841 |

1 |

Daytona 500, Feb. 21, 2016

Avg. Ticket Price Sold on StubHub: $214 |

| 2 |

Kentucky at Kansas, Jan. 30

Avg. Ticket Price Sold on StubHub: $548 |

2 |

New York Red Bulls at New York City FC, June 28

Avg. Ticket Price Sold on StubHub: $62 |

2 |

Miguel Cotto-

Canelo Alvarez, Nov. 21

Avg. Ticket Price Sold on StubHub: $959 |

2 |

UFC 184: Rousey vs. Zingano, Feb. 28

Avg. Ticket Price Sold on StubHub: $249 |

2 |

Daytona 500, Feb. 22, 2015

Avg. Ticket Price Sold on StubHub: $166 |

| 3 |

Louisville at Kentucky, Dec. 26

Avg. Ticket Price Sold on StubHub: $286 |

3 |

New York City FC at Orlando City SC, March 8

Avg. Ticket Price Sold on StubHub: $58 |

3 |

Gennady Golovkin-

David Lemieux, Oct. 17

Avg. Ticket Price Sold on StubHub: $127 |

3 |

UFC 189: Chad Mendes-Conor McGregor, July 11

Avg. Ticket Price Sold on StubHub: $687 |

3 |

Ford EcoBoost 400 NASCAR Sprint Cup, Nov. 22, 2015

Avg. Ticket Price Sold on StubHub: $143 |

| 4 |

North Carolina at Duke, March 5

Avg. Ticket Price Sold on StubHub: $1,634 |

4 |

New England Revolution at New York City FC, March 15

Avg. Ticket Price Sold on StubHub: $65 |

4 |

Floyd Mayweather-Andre Berto, Sept. 12

Avg. Ticket Price Sold on StubHub: $594 |

4 |

UFC 187: Johnson-Cormier, Weidman-Belfort, May 23

Avg. Ticket Price Sold on StubHub: $375 |

4 |

Quicken Loans Race for Heroes 500, Nov. 15, 2015

Avg. Ticket Price Sold on StubHub: $79 |

| 5 |

North Carolina State at North Carolina, Jan. 16

Avg. Ticket Price Sold on StubHub: $165 |

5 |

New York City FC at New York Red Bulls, Aug. 9

Avg. Ticket Price Sold on StubHub: $70 |

5 |

Wladimir Klitschko-

Bryant Jennings, April 25

Avg. Ticket Price Sold on StubHub: $181 |

5 |

UFC 192: Daniel Cormier-Alexander Gustafsson, Oct. 3

Avg. Ticket Price Sold on StubHub: $193 |

5 |

Duck Commander 500 NASCAR Sprint Cup, April 11, 2015

Avg. Ticket Price Sold on StubHub: $93 |

Note: Rankings reflect only regular-season data, so playoffs, all-star games and bowl games are excluded. Also, the chart does not include ticket packages for college basketball tournaments that included more than one game. NHL, NBA and college basketball data is season-to-date. Source: StubHub