After sponsoring the Super Bowl halftime show for the past four years, the buzz among sports marketers in San Francisco was whether this will be Pepsi’s final year attaching its name to the high-profile event.

Coldplay was the featured act during this year’s show, but it was clear that Beyoncé (also sponsored by Pepsi) stole the show. Controversy did surround Beyoncé’s performance. Her song “Formation” drew attention with its Black Panther-themed backup dancers and alleged anti-police stance.

|

This year’s show had more viewers than the game itself.

Photo by: GETTY IMAGES

|

But politics aside, there can be no doubt that the show delivered, since it actually garnered better numbers than the game, as viewership peaked at an average of 115.5 million during halftime. This year marked the final year of Pepsi’s deal, and the show’s politically incorrect overtones, which have appeared in other years — M.I.A. flipping the bird during the Super Bowl XLVII show and Janet Jackson’s wardrobe malfunction in Super Bowl XXXVIII — illustrated the risks of the property as a marketing investment.

“Sponsors like Pepsi want it as a marketing vehicle, but the halftime show can and has been hijacked by the performers,” said a senior marketer who works with some of the country’s biggest sports marketing spenders. Others questioned whether the marketing opportunity afforded by halftime has tilted too much in favor of the performing musicians at the considerable expense of the sponsor.

“It was all about Beyoncé’s stage,” said an agency marketing source. “That’s the risk you run as a halftime show sponsor.”

Marketers are generally conservative, and the NFL is even more so. It gets down to an issue of control versus getting the most popular musical acts. Pepsi’s decision on a renewal will surely come down to balancing how much the halftime show has done for Pepsi versus how much Pepsi has done for the halftime show.

Which might lead to another brand providing the halftime fizz next year.

SPONSORSHIP WRAP: The end of the NFL season marks the beginning of the league’s sales season. With recent long-term renewals with Anheuser-Busch and Bridgestone for an additional five years, there’s no major renewal with a red flag. Still, the NFL sales team likes to get out ahead of sponsors long before their rights run out.

So take note: Most, if not all, of the league’s technology sponsors have deals that expire within the next 26 months, and its tech roster includes some of its biggest corporate patrons. There is Verizon’s huge content/sponsorship play, sideline rights with Bose and Microsoft, and SAP’s business-to-business software rights. A renewal from some or all of those will require prescient forecasting of where technology is heading, and a plan to artfully dissect the category and distribute the nation’s most valuable sports content across the roiling and unpredictable technology landscape.

Meanwhile, new targets include health insurance, an open category largely throughout sports. The only large health care deal among the big stick-and-ball leagues was Kaiser Permanente’s deal last year that made it the NBA’s “official health care partner.”

“Health care is a focus, as we think about keeping our players healthy during the season, after the season, after they’ve retired, and how we convey that message to our fans,” said Renie Anderson, NFL senior vice president of sponsorship and partnership management.

|

Bridgestone, which provided this fun element as part of the NFL Fan Experience, recently signed a long-term renewal.

Photo by: GETTY IMAGES

|

The NFL also is seeking a b-to-b partner without need for the NFL’s pricey intellectual property, but one that would benefit from some form of league integration. “The idea is to offer a b-to-b company an opportunity to take the ultimate case study to the marketplace,” said Doug Smoyer, NFL vice president of business development.

For example, a data storage company could leverage being the repository of the NFL’s statistical database to potential clients and have a league official like Chief Information Officer Michelle McKenna-Doyle join its new business pitches.

Also on the NFL’s shopping list is frozen foods, while the timing category remains a target, though the sort of integration the NFL wants with that deal would likely make cutting in network TV rights holders a necessity.

A few of the league’s sponsorship renewals bear scrutiny because of their legacy. Nationwide is approaching the last of a three-year deal that sees it sharing equity with USAA, with which it split insurance rights in 2014.

“We wanted to build awareness of all of our offerings on TV, where the top draw is the NFL, and we’ve seen increased awareness and purchase consideration,” said Nationwide CMO Terrance Williams. “We need to communicate about all of our offerings. We’re known for auto insurance, but Nationwide offers a broad range of financial services, including retirement, so we envision [Nationwide spokesman] Peyton Manning being as valuable to us post-football as he is now.”

Campbell Soup, an NFL sponsor since 1997, also is up for renewal. Word in San Francisco was that a one-year extension is close to being done. However, we were unable to learn why the league’s second most-tenured corporate sponsor isn’t returning for multiple years, a move that seems peculiar.

SUPER BOWL REMATCH?: While a Super Bowl 50 rematch between the Panthers and Broncos should be a no-brainer to kick off the 2016-17 NFL season on NBC, the NFL also is considering staging an AFC championship rematch between the Patriots and Broncos to open the season.

|

When the NFL releases the schedule for the 2016-17 season, chances are it will start with a Panthers-Broncos rematch.

Photo by: TERRY LEFTON / STAFF

|

Sources said the Super Bowl rematch is more likely, as CBS likely will fight harder to keep the marquee Patriots-Broncos game than Fox will for a Panthers-Broncos rematch that does not have Manning. Since 2012, the league has put the highly rated Patriots-Broncos game on “Sunday Night Football” every other year. NBC carried it last year.

This is just one of the back-and-forth negotiations that take place during every Super Bowl week as top TV network executives lobby the NFL for the best matchups during the upcoming season. All of the networks were in San Francisco — CBS, ESPN, Fox and NBC — to fight for the teams and matchups that bring the highest TV ratings. That meant a lot of lobbying for the Dallas Cowboys and Green Bay Packers, less so for the Jacksonville Jaguars and Tennessee Titans.

Despite the fact that they’re coming off a 4-12 season, next season’s Cowboys games drew the most interest, particularly with road games against the Packers, Steelers and 49ers. The Cowboys’ popularity should come as no surprise. Even in down years, the Cowboys have drawn the league’s biggest audiences.

Sources said that the league is likely to schedule a Cowboys-Redskins matchup for Fox’s Thanksgiving Day game. Look for the league to cross-flex an NFC North rival to play the Lions on CBS, most likely the Vikings. The Lions’ only two home games against AFC opponents are unattractive TV matchups (Jacksonville and Tennessee). The Bears have played the past two Thanksgivings, and the Packers have played two of the past three, creating an opening for the Vikings.

As in the past two years, expect two of the teams that play on Thanksgiving to play the following week on “Thursday Night Football.” Last season, the first “TNF” game after Thanksgiving was a Packers-Lions matchup; the season before, it was a Cowboys-Bears game. All four teams also played on Thanksgiving Day.

Network executives expect a “Thursday Night Football” lineup to be as strong as last season, at least as far as the CBS and NBC portions go. The NFL looks less likely to put divisional games on Thursday night as last year, when its first 11 matchups pitted division rivals against each other.

One of the more interesting wrinkles of the schedule will be in Los Angeles, where the Rams will share Memorial Coliseum with the University of Southern California. The NFL and the Rams have to get permission from the university in order to host a Thursday or Monday night game.

|

This was Hyundai’s first year as an NFL sponsor.

Photo by: TERRY LEFTON / STAFF

|

NEW CAR SMELL 1: Hyundai was the first auto brand to win USA Today’s Ad Meter beauty contest in 28 years, and it did so in its first year as an NFL sponsor. This year was the ninth time in 10 years that the Korean automaker has advertised on the Super Bowl. Along with four ads in the game, Hyundai added lead sponsorship position and displays within the NFL Experience, along with car displays and other activations in the Super Bowl City outdoor fan fest in San Francisco.

“Originally, I thought that was a lot of activation for a game 40 miles south,” said Dean Evans, Hyundai America’s CMO, “then I saw the crowds. And in the car business if you can get your cars closer to people, you’re a hero.”

Awareness and favorable opinion among NFL fans have increased after one season as an NFL sponsor, he added. Looking to next season, Evans said Hyundai is seeking increased dealer activation of its league rights and possibly alignment with some coaches. Advantage International is Hyundai’s sports agency of record.

NEW CAR SMELL 2: While Hyundai has official NFL auto marketing rights, Mercedes is taking a bigger bite than ever out of the NFL. It added stadium naming rights in Atlanta to its deal at the home of the New Orleans Saints. It also sponsored Next Generation Stats during the postseason, putting Mercedes in the Super Bowl without spending huge dollars. An aggressive NFL media spend is expected to increase next season.

“With our headquarters moving to Atlanta, the stadium deal is a great statement,” said Stephanie Zimmer, Mercedes-Benz USA department head of brand experience marketing, standing next to the Iron Schöckl, a steel mountain built near AT&T Park to test G-Class vehicles. “As a brand, we’re looking to appeal to a wider audience with more price points, and football is the right property for that.”

LICENSE TO SELL: Aramark, operating the NFL Experience merchandise store for the second consecutive year, again set records. We couldn’t help but wonder how much bigger that record would have been if the NFL Shop at Super Bowl, Presented by Visa was located in the same building as the NFL Experience, instead of across Fourth Street in Moscone West, which also housed Radio Row and the Media Center. No one at Aramark was complaining, however.

“We’ve sustained 50 percent revenue growth for the past two years,” said Aramark Sports and Entertainment President Carl Mittleman, adding the company’s previous record was eclipsed by midday Friday, two days before the game.

A new feature at the store was a VIP Boutique, which required a $300 purchase to enter. Among the bling inside was a 16-ounce gold “coin” from The Highland Mint for $50,000. The coin went unsold, but five of the $2,500 lamb leather New Era caps with an 18 karat gold Super Bowl 50 pin attached were purchased, and only 50 were produced. Mittleman said in terms of buzz and sales, the VIP Boutique was a success and will return for next year’s Super Bowl in Houston with a western theme. It also worked well as a celebrity lounge for those appearing at the store, which included Joe Montana, Andre Reed, Steve Young and chef Andrew Zimmern.

We’ll be surprised if the idea isn’t appropriated by other large sports properties at their jewel events. For Super Bowl LI in Houston, Aramark has food/beverage and merchandising rights for both the NFL Experience and NRG Stadium.

|

Aramark set records for merchandise sales.

Photo by: AP IMAGES

|

Legends, operating a merchandise store at a Super Bowl venue for the first time, also set records, bringing in $4.6 million in merchandise sales. Officials with Legends, which ran the event’s retail operation in conjunction with Facility Merchandising Inc., could not confirm the number but said the record extends to the week leading up to Super Bowl at their location outside the Santa Clara Convention Center, across the street from the stadium. On the food and drink side, Centerplate’s total sales were $6.2 million, resulting in a per cap of $87.57. MetLife Stadium, host of Super Bowl XLVIII, holds the record of $94.60 per cap.

Facility Merchandising Inc. has had venue merchandising rights for 25 previous Super Bowls. Without commenting directly on the sales increase, FMI President and CEO Milt Arenson attributed the strong results to balmy weather, Denver’s proximity to Santa Clara, the likelihood that it was Manning’s final NFL game, as well as demand for generic Super Bowl 50 products. The gold and black color scheme of the 50th logo also dovetailed nicely with current fashion sensibilities. Licensees also said that the “50” logo was easier to work with than the generic Lombardi Trophy plus roman numerals logo, which the NFL has been using as its mark since 2011. Prior to that, Super Bowl logos had local flavor as part of their design.

I WANNA BE CAM: Everybody wants to get slimed, we suppose.

In the fall, Nickelodeon — the network known for dousing its guest hosts with a slimy green liquid — signed Carolina Panthers quarterback Cam Newton to host a 20-episode series called “I Wanna Be.” The show premieres in September, and Nickelodeon executives say they are close to having other prominent athletes host shows for the network.

The kids network made its first trip to the Super Bowl this year, producing content and establishing relationships with the country’s most popular sports league. Nickelodeon had a booth at the Moscone Center, which was hosting the NFL Experience, and used its on-air talent to interview players throughout the week. Nickelodeon’s week culminated with its coverage of the flag football championship the Saturday before the Super Bowl.

Nickelodeon, which also has relationships with the NBA, MLB, MLS and PGA Tour, is making a bigger push to attach its brand to sports, which should not come as a surprise given that live sports consistently is the highest-rated programming on television.

Keith Dawkins, Nickelodeon executive vice president, described his network’s Super Bowl presence as a “content marketing experience. … The NFL is trying to reach kids and families, and we’re trying to find new content. This is a way to bring two different brands together for a common goal.”

WHERE TO GO?: It wasn’t particularly difficult for TV networks to decide where to construct their Super Bowl sets in San Francisco. Most, like ESPN, used the Golden Gate Bridge and Alcatraz as backdrops, letting viewers know immediately that they were in the city by the Bay.

Next year in Houston, though, is proving to be more of a crapshoot. The city does not have as many iconic structures as San Francisco’s steep hills, cable cars and identifiable bridges.

Seth Markman, ESPN’s senior coordinating producer of NFL studio shows, said the network most likely would construct its sets away from the city center in a way that puts the city’s skyline as the backdrop. Markman knows where he wants to be but said ESPN and the city’s host committee still were months away from finalizing the spot.

When Houston hosted a Super Bowl in 2004, ESPN set up shop downtown — but that pre-dated the NFL’s Super Bowl City rollout, which takes up a lot of space. Markman said ESPN needs to make sure it finds a space big enough to account for several sets and demo fields.

“For us, the No. 1 thing other than needing enough size is to get an iconic backdrop,” Markman said. “Houston has some challenges. There are some famous landmarks, but nothing that screams Houston, Texas.”

Markman said ESPN is less concerned about amassing crowds around its sets. Last year, ESPN was based in Scottsdale instead of Phoenix. In 2012, it set up shop in Fort Worth instead of Dallas.

“It’s not ‘College GameDay,’” Markman said. “Our top priority is to make the shows look as nice as possible.”

DA SUPER BOWL, MON: ESPN held the Super Bowl rights to the Caribbean, but that did not stop a small cable channel from bringing a skeleton crew of four to San Francisco to promote the game. The Trinidad-based Flow Sports owns an NFL regular-season package and produced interstitials between one and four minutes from the game site to promote a game that was being carried by its biggest rival.

“We want to continue to build an association with the NFL,” said the channel’s Los Angeles-based general manager Sean Riley, a former affiliate executive with Fox Cable. “We’re trying to bring our viewers closer to one of the biggest sporting events in the world. We feel like we need to be here to cover the week’s activities.”

In addition to Riley, Flow Sports, owned by Britain’s Cable & Wireless Communications, had a producer, cameraman and on-air talent on the ground in San Francisco.

BITS & BYTES: Extreme Networks, the NFL’s Wi-Fi analytics firm, said 10.15 terabytes of data were used at Levi’s Stadium, more than triple the game in New Jersey two years ago, and nearly double last year. In all, 42 percent of the crowd used the Internet. Interestingly, the No. 1 use was for cloud storage, which ranked fourth last year and third in New Jersey. Social media, No. 1 the last two years, was second this time, followed by Web surfing, real-time communications and search. The No. 1 app used was Facebook, followed by Twitter, Instagram, Snapchat and Periscope.

“Cloud use kind of skyrocketed,” said Mike Leibovitz, director at Extreme. “Maybe this is California and they want to take more pictures.”

Periscope, which drew great attention last year as a possible threat to media rights by allowing video broadcasting at events, had about 150 peak users, Leibovitz said. The NFL could have blocked the app but chose not to, he added.

BAY BOWL ENCORE?: Will the Bay Area get another Super Bowl? More than likely yes, though not for a while.

In May, NFL ownership votes on the 2019 and 2020 Super Bowl sites, with Tampa, Miami, Atlanta and New Orleans bidding. Atlanta’s new stadium and Miami’s renovated facility are the front-runners. While Atlanta is not expected to be a regular Super Bowl host, Miami and New Orleans already are “in the rotation.”

The new Los Angeles stadium is likely to get into the bidding for 2021, and L.A. easily could be a host every five years. Throw in Arizona, and if San Diego succeeds at building a stadium, then there are even more strong contenders. Cowboys owner Jerry Jones still wants another one for Dallas.

The 32 NFL owners make an internal political choice in awarding Super Bowls, so all the talk of how great the week was in San Francisco is not as important as those considerations. No doubt Super Bowl City, with its array of technology, the surprising ease getting in and out of Levi’s Stadium and the great weather all will help the case for another Super Bowl, but it could be another decade or more.

|

At this year’s Super Bowl, Condoleeza Rice was among the guest judges for 1st & Future (below), a new competition showcasing technology.

Photo by: AP IMAGES (2)

|

NEW LEAGUE INITIATIVES: Super Bowl Week included two new league events, the NFL Women’s Summit and 1st & Future, a “Shark Tank”-like competition showcasing technology to advance the NFL.

NFL Commissioner Roger Goodell opened the Women’s Summit with the plan to establish a “Rooney Rule” for executive hiring, which was a smart move to generate news. The audience of roughly 300 was 75 percent female, with representation from across the industry. Content was geared to getting more young women to participate in sports and fitness, with photos of the speakers playing youth sports adorning the walls.

The 1st & Future competition, held at Stanford’s Graduate School of Business, offered a fascinating look at innovation and new technology. Goodell opened

by saying, “This is the closest I’ll ever be to Stanford Business School,” and after introducing the event, took a seat next to Jon Bon Jovi to watch the competition.

Three groups of four companies presented on the subjects: “Bringing Home The Game,” “Tomorrow’s Athlete” and “The Future Stadium.” Tech pitches were made over five-minute intervals to judges such as Nike’s Mark Parker, Condoleezza Rice, media trend analyst Mary Meeker, GE’s Beth Comstock and others, while the likes of Patriots owner Robert Kraft, Eagles owner Jeffrey Lurie, Jets owner Woody Johnson, Nike’s John Slusher and AOL’s Tim Armstrong watched from the audience.

Winners were LiveLike, which makes a virtual reality system for sports leagues; Kenzen, which makes a wearable patch that monitors biometrics; and Hyp3r, which collects social media data at sporting and entertainment events. Each received a $50,000 grant, meetings with NFL execs and Super Bowl tickets.

League officials were noncommittal about bringing the event for next year in Houston, stressing the competition made sense this year because of Silicon Valley’s abundance of all-star talent and judges.

AIRBORNE: Wheels Up and its antecedent Marquis Jet stage their Super Bowl party primarily for their private aviation client base. Still, over the years, the migration of sports marketers to private aviation and the many sports clients they service have transformed the Saturday afternoon affair into the leading sports industry party, long ago eclipsing Leigh Steinberg’s Saturday soiree.

|

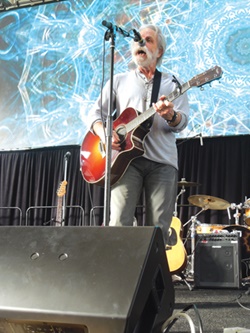

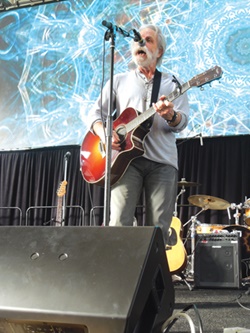

Bob Weir performs at the Wheels Up Super Bowl party.

Photo by: TERRY LEFTON / STAFF

|

This year, Wheels Up was flying even higher, with upward of 1,100 people at the Herbst Pavilion at Fort Mason. Athletes included Shaquille O’Neal, Rob Gronkowski and J.J. Watt, with the Grateful Dead’s Bob Weir as entertainment.

“We didn’t plan it, but over the years, our party has grown from a pure client hospitality function to an industry meeting place to a party people talk about as one of the best,” said Gary Spitalnik, Wheels Up executive vice president. “We’re OK with that, believe me, and our clients still love it.”

VIEW FROM THE U.K.: The 50th, or any Super Bowl, couldn’t be more different than Wimbledon. That’s why it was fascinating to hear impressions from officials of the All England Lawn Tennis Club, who sat behind the goal posts during their first visit to the American spectacle.

Alexandra Willis, head of digital and content, and Mick Desmond, head of media and commercial, for the All England Club, and other executives with them, came away not only impressed but also with ideas to bring back to England. Willis said that the way Levi’s Stadium uses its video boards could be replicated at Wimbledon.

“We don’t use our screens very well. They are very functional; I wouldn’t say they are as additive as they could be,” she said during a third-quarter break. While changes to video boards would not occur inside the tennis stadiums, outside, on the so-called Henman Hill, Willis envisions a change. The screen there shows tennis matches and has a scrolling ticker. Willis would like the same mixture on the screens she saw at the Super Bowl: live game action, replays and social media.

Willis also was surprised to learn that most teams hired producers to program the video boards, underscoring how much effort American teams put into the process. Willis also liked the on-field interviews at the end of quarters, during which the NFL Network’s Melissa Stark and Kevin Frazier talked about the game.

Staff writer Don Muret contributed to this report.