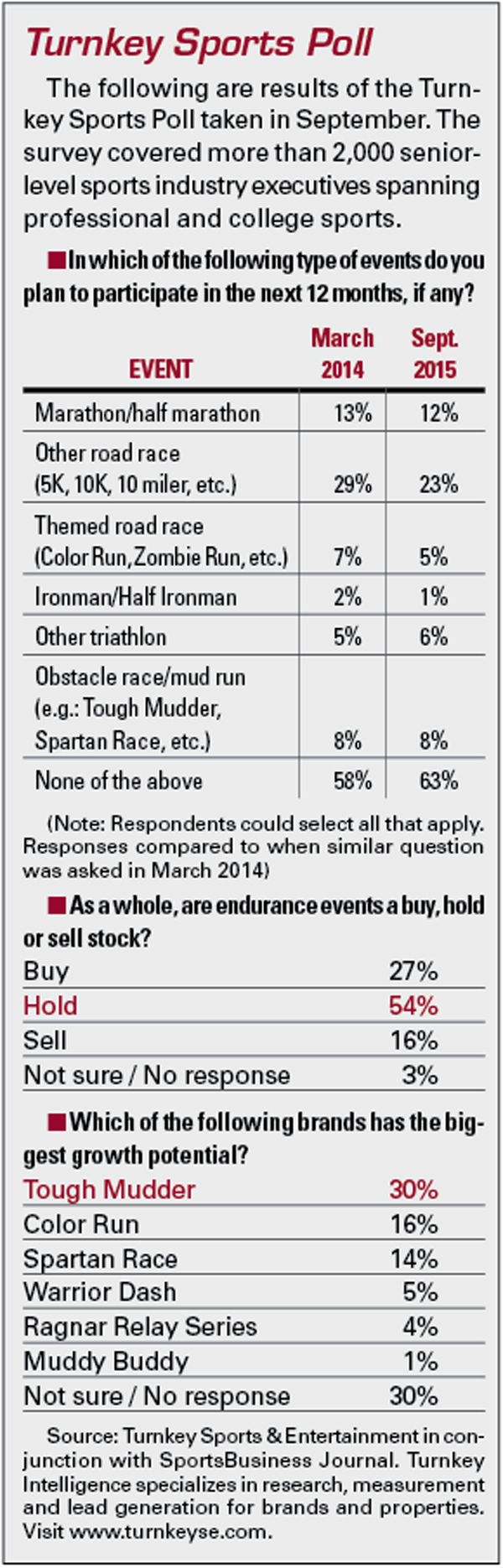

Over the summer, Tough Mudder co-founder and CEO Will Dean invited his archrival, Spartan Race co-founder and CEO Joe De Sena, to dinner. The two biggest names in obstacle course racing quietly met in New York for a cordial evening of sushi, green tea and incognito conversation.

It wasn’t quite the Camp David Accords, but the detente is a remarkable turnabout from just two years earlier, when the competitors regularly traded insults through the media. De Sena once told Outside magazine “there’s not a person on this planet I despise more than Will Dean.”

Both men say the meal symbolizes more than just a personal cooling off. It’s something of a metaphor for the

|

Participants make their way through the course during a Spartan Race event.

Photo by: Spartan Race |

maturing obstacle racing industry six years after America first became infatuated with mud, water and obstacle-enhanced distance running.

“I think once we all became more established, we probably relaxed a bit,” said De Sena, speaking from Malaysia, where he now lives as he attempts to build Spartan Race internationally.

After an extraordinary growth spurt in popularity and revenue lured dozens of startups to the nontraditional endurance sports category, enthusiasm has fallen off considerably in 2015. New entrants are scarce. Many small series have folded or are looking for a buyer as the barriers to growth become apparent, while the early winners — primarily Tough Mudder, Spartan Race and Warrior Dash, though other smaller outfits survive — now turn their attention to assuring their long-term survival with fine-tuned brand identities and diversified revenue streams.

From London, Dean summarized Spartan Race and Tough Mudder’s diverging paths in the industry’s adolescence: “We both kind of realize that there’s more than enough space for two quite differing value propositions.”

While sponsors, analysts and the properties themselves are certain obstacle races are more than a fad, the long-term growth prospects of this new kind of sport are still open to debate. In 2015, somewhere around 4.5 million Americans will have participated in an obstacle race when the season wraps up in the next few weeks, estimates business analyst Melissa Rodriguez, who authored a report on the industry in December 2014. That’s a 7 percent gain over 2014 but short of her original prediction of 19 percent growth to more than 5 million entrants in 2015.

Establishment sports in the U.S. would love that kind of annual growth, but single-digit increases are a sharp drop-off from recent years. After sextupling in 2011, nearly doubling in 2012 and growing 48 percent in 2013 and 24 percent in 2014, numbers indicate the “gold rush” is clearly over. All told, Rodriguez estimates, obstacle racing revenue grew from $15.9 million in 2009 to $362 million in 2014.

“The participation, in the U.S. in particular, is going to level off and stabilize,” she said. “We’re not going to see the type of growth from 2010 to 2012 or 2013 in the next four or five years. It’s not a bad thing. When you think about in general, comparing obstacle race participation with trail running, triathlons, there’s only so far it can go.”

Even if many individual race properties have collapsed or lost momentum — Foam Fest, Run or Dye, the Hero Rush, the Ruckus Race and The Great American Mud Run are just a few series to cancel events amid financial problems in the last two seasons — the races that survive this shaking-out period have reason for optimism.

Every major race series says 40 percent of their participants are repeat customers. Tough Mudder says about 550,000 people entered a race on one of 60 tour stops this year, and Spartan Race says about 750,000 people participated in one of 150 distinct races (many tour stops include multiple races.)

The series are building out business lines to create a 365-day-per-year bond with participants, such as Tough Mudder’s “Mudder Maker” workout series with Virgin Active health cubs, and Spartan Race’s TV series on NBC.

“It’ll have a core following, kind of like triathletes,” Rodriguez said, predicting that obstacle racing will stay popular with between 3 and 5 percent of American adults. “If you look online there are some very passionate obstacle racers.”

With that assurance, the market leaders have turned their attention to distinguishing themselves, hoping to avoid the pitfalls so many smaller races encountered by being seen as commodities. That’s a big reason De Sena and Dean now get along — in their eyes, they’re no longer competing.

“None of this is in my mind negative or derogatory, but Tough Mudder and Spartan Race are the same thing like

|

Tough Mudder has promoted itself as an outlet for teamwork and camaraderie, aiming to be the best of the “experience” races.

Photo by: Tough Mudder |

boxing and UFC are the same thing,” Dean said. “There might be some superficial similarities, but actually they’re quite different sports.”

Spartan Race, which took venture capital from Boston Celtics co-owner Jim Pallotta’s Raptor Consumer Partners in 2012 and is not profitable as it expands aggressively, wants to be seen as the defining brand of a wholly distinct competitive sport, a la Ironman. Through its TV contract with NBC Sports Group, it promotes elite competitors in world championships, encourages pursuit of finishing time records and De Sena has an ostentatious goal: Spartan Race in the 2024 Olympics.

He’s banking on customers wanting an intensive, goal-oriented task with clear results. While so many of the industry’s also-rans simply sold a “fun experience,” this is his way of standing out.

“It’s been an enormous pain trying to sell that,” he said, reflecting on how shorter, socially oriented races naturally have a larger market. “But we’ve turned the corner, because the finish line actually means something, and it means so much that it gets you to try to do it again.”

Tough Mudder, however, is a major exception to De Sena’s line of thinking. Tough Mudder has never been particularly concerned with elite athletes, and doesn’t even time the races. All along, Tough Mudder has promoted itself as an outlet for teamwork and camaraderie, and also hopes to be known as the most innovative obstacle maker — essentially, Dean wants to be the best of the “experience” races. And it’s profitable.

Seeking a niche

Spartan Race and Tough Mudder still have company in the space, though. Warrior Dash, a series created by Red Frog Events in 2009, produced 35 days of races in 30 events in 2015, according to its website.

Warrior Dash’s 5K race has 2.5 million all-time finishers, but has contracted its schedule in recent years from 50 events in 2012 to 30 events this year. While Spartan Race and Tough Mudder have diversified, Warrior Dash is sticking with its entry-level distance and expects to spend 2016 perfecting the festival side of its races, meaning the post-race music, vending, beer and spectator experience, said Red Frog co-CEO Ryan Kunkel.

The decline in events, plus Red Frog’s emphasis on other business lines, such as a recently acquired, high-volume catering company and its successful Firefly and Big Barrel music festivals, has led many in the race business to think Warrior Dash is less strategically important than it once was. Kunkel strongly denied that.

|

Shock Top has sponsored Warrior Dash (above), Spartan Race and Tough Mudder.

Photo by: Getty Images |

“It is a core piece of our business and we are committed to ensuring that it is a quality, well-executed series,” Kunkel said.

As obstacle racing’s great shake-out was already underway, a small Boston race series called Rugged Maniac received a helpful boost from Mark Cuban on “Shark Tank.” The infusion helped Rugged Maniac expand more rapidly, and co-founder Rob Dickens believes he’s picking up market share in the laid-back 5K version of the sport from Warrior Dash. But Rugged Maniac, which reported $7 million in revenue from 25 events this year, finds itself increasingly challenged to compete as a smaller property, Dickens said.

“There are only so many dates and so many locations that can support a race, and the big ones are gobbling up the locations,” Dickens said.

The long tail won’t disappear entirely. Entrepreneurs believe that race concepts that truly stand out, or capture a new trend before others do, can still make money from obstacle racing even if Tough Mudder and Spartan Race come to dominate at scale. As many failed startups learned, the challenge in obstacle racing isn’t necessarily operating a single event, it’s expansion.

Powdr Enterprises, which this year acquired Human Movement Management, the operator of the Dirty Girl mud

run and the Zombie Run, believes highly unique races can thrive long term, such as a race held at one of Powdr’s resorts, said President Wade Martin.

Outside of the megabrands, Martin said, the smart posture will be a flexible platform for participatory sports as entertainment.

“While I think some of the events or concepts will be fads, I think the genre and the idea of active entertainment will stay strong,” said Martin, who was formerly CEO of Dew Tour operator Alli Sports.

With a natural limit to participants, the biggest immediate challenge for the obstacle races is diversifying revenue streams away from a heavy reliance on entry fees, which start around $100 for the shorter races and can eclipse $200.

Sponsors like Anheuser-Busch’s Shock Top brand and Under Armour have signed with obstacle course races, and Reebok has a title sponsorship with Spartan Race, but in general, the corporate world hasn’t fully committed.

Sponsorships don’t generate a material revenue stream at Spartan Race, De Sena said. Nearly 80 percent of Tough Mudder’s revenue still comes from entry fees, Dean said, with the remainder coming from sponsorships and merchandise. And sales at Rugged Maniac have been difficult, Dickens acknowledged.

“We’re four or five years away from it being mainstream with big sponsors,” De Sena said.

But obstacle races can offer sponsors a very modern path to consumers that should appeal to many corporate brands, said Elizabeth Lindsey, co-managing director of consulting for Wasserman Media Group. These sports offer a way to connect one-on-one with consumers and are intrinsically tied to social media and group experiences.

“The attraction of it is, every consumer sees themselves as something of a closet sports star, and these participatory sports are fun to watch, but you can envision yourself running that race,” she said.

At this adolescent phase of obstacle racing, big-time sponsors are just waiting for the properties to get “a few gray hairs,” Dean said.

Therein lies the challenge for obstacle course races, said Lindsey: show sponsors an established, bankable identity while maintaining an edge. “A lot of [sponsors] would be attracted to the newness of it, and the unpredictability of it, and this sort of dynamic nature,” she said.

Dean argues it may be sponsorship strategy that needs to mature, not obstacle racing. “We don’t have traditional TV, and that’s a decision we’ve made,” he said. “However, we do have literally billions of media mentions through social media, and I think major sponsors are far more comfortable with this today than they were three to five years ago.”