Editor’s note: This story is revised from the print edition.

Ticketmaster and three major sports leagues are attempting a significant recalibration of fan ticket-buying behavior with the broad rollout of TM+, a new product combining primary and secondary listings online on a single event page.

TM+ debuted in a soft launch late this past summer with several NFL teams, and now is approaching a full deployment with 21 NFL teams, 14 NHL teams and 23 NBA teams. In the case of the NBA specifically, the rollout of TM+ marks a further advancement of the NBA.com/tickets portal that Ticketmaster and the league introduced last year.

|

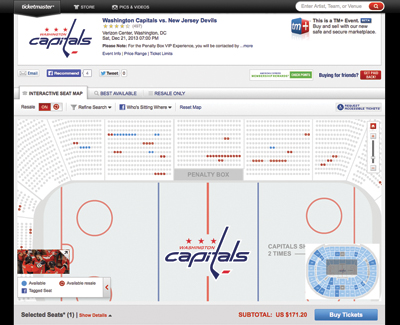

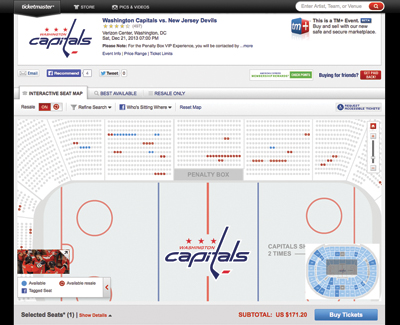

On the blended Ticketmaster pages, primary inventory is shown in blue and secondary in red.

|

With TM+, the leagues and Ticketmaster are seeking to recondition buyers that in recent years have initially looked to secondary markets, some not officially aligned with the teams and leagues, for event tickets. Company research found that as much as 40 percent of sports ticket purchases on the secondary market happened without any prior inquiry into primary market availability.

“As the secondary market has grown, it’s created the impression that the primary market didn’t have any good seats,” said Jared Smith, Ticketmaster North America president. “The core idea here is to give the fan the full sweep of options in one place and, as a result, actually improve both markets.”

Ticketmaster has also begun to conduct beta testing of TM+ for music events, with a broader rollout anticipated for next summer’s peak concert season, particularly in amphitheaters owned by parent company Live Nation.

On Ticketmaster game listing pages for the participating teams, seat maps show primary market inventory in blue, and secondary market inventory in red. With such a blending list, any real or imagined firewalls between primary and secondary ticket markets are eliminated.

“It’s sort of a basic, traditional retail concept of stack ’em high and watch ’em fly,” Smith said.

TM+, roughly two years in development, does not carry any third-party secondary ticket listings. Instead, listings are solely through Ticketmaster-supported TeamExchange sites and the company-owned TicketsNow resale destination. As a result, the creation of TM+ also provides a boost to Ticketmaster’s secondary ticket destinations that have struggled to match the scale of industry giant StubHub.

Specific sales results from the initial rollout of TM+ have not been disclosed. But Ticketmaster and the involved leagues said they have seen double-digit percentage sales growth on both their single-game primary and secondary markets as a result of the new platform. And Smith said conversion rates among fans browsing for seats on TM+-enabled pages is roughly 50 percent higher than those without the blended offerings.

“We have more than doubled our revenues on secondary last year with the new portal, and have seen strong growth beyond that this year, in part because of TM+,” said Amy Brooks, NBA senior vice president of team marketing and business operations. “We want that NBATickets.com page to be the source for basketball tickets and where our fans go, and TM+ helps advance that. The goal for us now is to build additional awareness.”

For the NHL, TM+ was a critical component of the league’s recent renewal of its broad partnership with Ticketmaster.

“Leakage to other resale marketplaces has been an issue, no doubt,” said Susan Cohig, NHL senior vice president of integrated marketing. Participating teams in TM+ will get fees on resale transactions made through the platform that were previously lost to other marketplaces.

“The idea is to provide maximum choice and opportunity to the fan, and though it’s still in early days for us, the initial feedback has been good,” Cohig said.

The advent of TM+ also is intended to further Ticketmaster’s already aggressive data mining efforts, in part through its Live Analytics division. By having secondary and primary ticketing in one location, it becomes much easier to aggregate and analyze shopping and purchasing patterns, and make pricing and marketing decisions accordingly.

“The value of the data we generate is incredible, and it’s easy to see how this ultimately can change how we market and merchandise the inventory,” Smith said.