The trial lawyer hasn’t sat in a single IMG management meeting. He hasn’t met officially with any of the potential IMG buyers. He wasn’t even in the country the week KKR dropped its bid for the company.

But when it comes to the sale of IMG, Washington, D.C.-based attorney Mark MacDougall has the most powerful voice in the room.

|

MARK MACDOUGALL

Photo: COURTESY OF AKIN GUMP STRAUSS HAUER & FELD

|

IMG Chairman Ted Forstmann granted MacDougall power of attorney before his death, giving him complete responsibility for Forstmann Little’s 85 percent stake in IMG, and he’s led the sales process ever since.

MacDougall worked with Forstmann Little’s two trustees to determine when the company went on the market. He sat through more than 20 pitches from banks that wanted to handle the sale.

He spurned Goldman Sachs and JPMorgan Chase, banks with whom Forstmann had a close relationship, and instead selected Evercore and Morgan Stanley as the lead banks. And then he backed away, allowing the bankers to deal directly with the buyers and report back to him on the sale’s progress.

People around the process describe it as regimented and tight. One person on the buy side, lamenting the lack of access to a document room for due diligence, called it annoying.

But it’s the perfect reflection of MacDougall, who colleagues and competitors describe as a smart, principled and intense attorney with a reputation for being an aggressive and zealous representative for his clients.

“He’s a no-nonsense, fair, good guy to have in your foxhole — I don’t care what kind of fight you’re in,” said Bill Nettles, the U.S. attorney for South Carolina, who worked with MacDougall on several criminal defense cases.

Everything MacDougall’s done around IMG has been driven by one mission — to get the highest possible price for the shareholders, which includes everyone from institutional investors like GE and Boeing to former Forstmann Little partners to IMG employees.

“He’s doing the right things,” said Julian Robertson, the hedge fund pioneer and a member of IMG’s board who was named chairman of Forstmann Little after Forstmann’s death. “I think the world of Mark MacDougall and I very much respect what Ted Forstmann decided to do [in granting him power of attorney].”

|

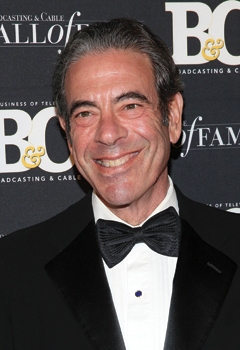

Former ESPN exec Mark Shapiro (top) is working on the William Morris Endeavor/Silver Lake Partners bid. NFL Network CEO Steve Bornstein (below) is with the CVC Capital/Peter Chernin bid.

Photo by: TONY FLOREZ PHOTOGRAPHY

|

MacDougall’s role in the sale of IMG caught many at the company by surprise because he is a relative newcomer to the world of Forstmann Little and Forstmann’s inner circle.

For nearly three decades, Forstmann relied on Steve Fraidin for most of his legal needs. The two did countless deals together, including the acquisition and sale of Gulfstream. But they had a falling out in 2010 around the same time that Forstmann was dealing with a lawsuit that alleged he had gambled on college and pro sports.

Forstmann had met MacDougall more than a decade ago through Bob Strauss, a founding partner of Akin Gump Strauss Hauer & Feld, and had used MacDougall on several minor issues. He hired MacDougall to be his primary lawyer in 2010, and Akin Gump began working on a lawsuit in 2011 filed by the same man who accused Forstmann of betting on sports. (The case is pending.)

|

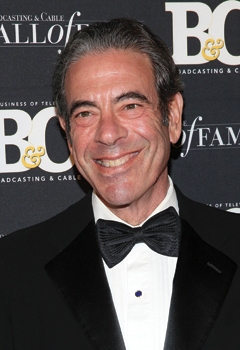

Photo by: GETTY IMAGES

|

The job fit MacDougall perfectly. He is a pioneer in an area of law he calls reputational recovery, a field that involves working with clients who have been the target of false accusations by the media, government officials and companies. He has worked with clients who have been wrongfully accused of having links to Al-Qaeda and committing murder in Eastern Europe. He works with private investigators to prove the allegations are false and then secures a retraction in publications.

It’s a specialty that can pay upward of $1 million a case, and a profile in “The American Lawyer” on his work in the area earned him the nickname “The Cleaner.”

“Our job is to kill the false story. Not the bad story, which is what a PR guy does,” MacDougall told the publication.

MacDougall was not available for comment for this story.

The reputational recovery work is only a small portion of what MacDougall does. He spends most of his time doing corporate litigation. He recently led a lawsuit by Bahrain’s state-controlled aluminum company against Alcoa that alleged the U.S. corporation committed fraud and racketeering. It was considered the first claim of alleged bribery by a foreign company in the U.S., and Bahrain’s aluminum company secured a settlement valued at $450 million.

“It takes a lot to dig in and find a basis to make the allegations he did,” said Richard Beizer, who represented another party in the case. “He’s smart. Tenacious.”

MacDougall also does pro bono criminal defense work, primarily in South Carolina, where he’s represented several defendants facing the death penalty. Most recently he worked on the capital trial of Earnest Daise in Beaufort, S.C., which in October resulted in the first unanimous life verdict in a South Carolina death penalty case in more than a decade.

“He can see ways that you can’t think of that [a case] could play out,” Nettles said. “It’s not paranoid, but you need to have thought through all the permutations. If ‘A’ happens, we have a plan. If ‘B’ happens, we have a plan. He’s got the ability to see around corners.”

IN THE RUNNING FOR IMG

William Morris Endeavor and

Silver Lake Partners

There’s no doubt that WME co-CEO Ari Emanuel wants to push into sports, and sources say he believes IMG is the perfect vehicle to do it. The question is: What does Silver Lake Partners think? The private equity firm has a minority stake in WME and would be the one putting up most of the money for IMG. Former ESPN executive Mark Shapiro is working on their bid.

The Carlyle Group

The private equity fund said last week that it had raised $13 billion for its newest fund, giving it more than enough cash to acquire IMG. It is working with ICM Partners, the movie, TV and literary talent agency. It’s unclear what their commitment or vision is for IMG, and some financial sources question their interest, but they stayed in the bid process even after KKR, another finalist, recently dropped out.

CVC Capital and Peter Chernin

The London-based private equity firm, which owns Formula One, was one of the first potential buyers to begin researching IMG. Its interest in the company has been strong, and they have the financial support of Mumtalakat, a Bahrain-based fund, and sports and entertainment expertise of former News Corp. President Peter Chernin. NFL Network CEO and former ESPN Chairman Steve Bornstein also is working on their bid.

Colleen Coyle, who worked with MacDougall at Akin Gump for two decades, said: “If any one of my children were ever in trouble, Mark is the first person I would turn to. As a trial lawyer, he’s very aggressive. He really, really defends his clients to the max. He’s very bright and has very high principles and expectations of the people he works with.”

MacDougall grew up outside of Boston. His mother was a nurse and his father was a union carpenter. After graduating from Notre Dame, he earned an MBA at Boston University and worked in corporate lending at a bank before going to law school at nights at George Washington University.

IMG will be the first multibillion-dollar sale he’s overseen. The company, which was put on the market in August, has three final bid groups: William Morris Endeavor and Silver Lake, The Carlyle Group, and CVC Capital and Peter Chernin (see box).

It is the second asset Forstmann Little has taken to market since Forstmann’s death two years ago. It put the fitness chain 24 Hour Fitness up for sale earlier this year. In that process, sources familiar with the process said MacDougall took a hands-off role, allowing Goldman Sachs to lead the sale. Forstmann Little ultimately pulled 24 Hour Fitness off the market when it didn’t fetch a sufficient offer.

MacDougall has been more involved in the IMG sale, sources familiar with the process said. He has a distrust of IMG management, according to sources, and challenged IMG Chief Executive Officer Mike Dolan earlier this year after learning of Dolan’s unauthorized meetings with potential buyers before the sales process officially began. He’s also kept the high-profile advisory board out of the process, a move that many see as a response to former board member Michael Ovitz’s alleged attempt to take over IMG in 2011.

“He doesn’t dictate the process with the exception of a deep distrust of management,” said a source familiar with MacDougall’s approach.

But another source said, “He is 100 percent making the decision.”

There are parallels between MacDougall’s role in making the final decision about the future of IMG and the role Jones Day attorney Michael Horvitz played in the 2004 sale of IMG to Forstmann Little. Horvitz was chairman of the McCormack Family Trust. He let management make presentations and then he negotiated the deal with Forstmann Little after it submitted a winning, $750 million bid.

Nearly a decade later, MacDougall will play the same role. The only difference is he has a much bigger number to hit. This time IMG is expected to go for $2.5 billion or more.