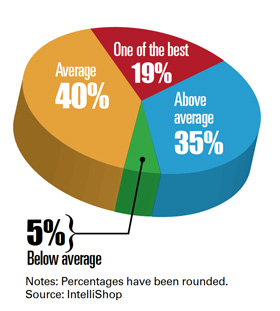

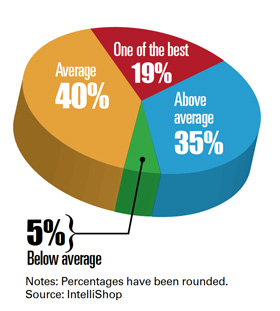

More than half the potential buyers in a recent mystery shopper survey conducted for SportsBusiness Journal by research firm IntelliShop characterized their attempts to purchase NBA season tickets from a team sales agent as being an above-average telephone sales experience, if not one of the best such experiences they have had.

Professional mystery shoppers called each club in late December, as the 2011-12 season was getting under way, to ask about buying season tickets. League officials were not notified in advance of the survey.

The shoppers evaluated the agents through the various steps of the sales process, including touting the benefits of season-ticket ownership; assessing the needs of the prospective buyer; closing the sale; and their overall ability to engage the prospect emotionally.

About the survey

IntelliShop, an Ohio-based market research company, provides customer-focused research services such as mystery shopping and customer satisfaction surveys. The company has an in-house staff of about 50 employees and it retains and manages panels of nearly 400,000 “mystery shoppers” who are brought in as topic-specific independent contractors for the company.

|

From Dec. 20-30, IntelliShop representatives contacted each NBA club, indicating that they were interested in purchasing season tickets. Boston, Chicago, Miami, Oklahoma City, and the Los Angeles Clippers and Lakers were excluded from the survey after indicating on the first call that such tickets were no longer available. Four calls were completed to each of the remaining 24 clubs, with each call marking a survey opportunity.

IntelliShop educated its shoppers on the teams and the physical layout of each team’s arena. It also trained the shoppers to sound disappointed that the season seats they wanted would cost as much as they did once they learned that the quoted price was more than their budget. This allowed IntelliShop to measure which alternatives the sales agents used to overcome the price objection.

The survey consisted of 27 mostly objective, multiple-choice questions. One question — “Which of the following ‘selling points’ did your agent mention as a reason for buying season tickets (or a partial-season-ticket plan)?” — had 15 answer options, all of which could have been checked off by the caller.

More-subjective topics included evaluating volume and clarity of the sales agent’s voice, the agent’s ability to retrieve and access information, and background noise.

IntelliShop conducts about 125,000 mystery shops and 200,000 customer surveys per year. The firm has conducted mystery shopper services for the Cleveland Indians in the past but has not had a sports client since spring 2010.

According to the results, 54 percent of the mystery shoppers said that compared to other telephone sales experiences they’d had as mystery shoppers, the NBA call was “one of the best” or “above average.” In addition, more than one-third of the agents had a phone personality that was described by shoppers as “truly exceptional.”

“From the ‘niceness’ standpoint, these are really, really good numbers,” said Chris Denove, senior vice president of research and analytics at IntelliShop, which has assessed companies in the health care, automotive and software industries, among others, in addition to sports.

The numbers come in the wake of last fall’s lockout and the resulting shorted season this year. Jim Grayson, director of sales for the Milwaukee Bucks, said the labor strife, which led to the cancellation of one-fifth of teams’ typical 82-game schedules, made the season-ticket sales process a little more difficult. But, he added, NBA teams view their sales work as a yearlong effort.

“Every offseason has its challenges, and the lockout was just another variable that we had to deal with,” Grayson said. “But the whole season leading up to the lockout, we never stopped having conversations with our fans. Our approach to fans was this: ‘It’s a short-term pain, but there will be games again.’”

The Bucks fared well in the survey. During nearly every surveyed call, the team’s sales agent mentioned the benefits of being a season-ticket holder, made an attempt to convince the caller that the caller would be getting great seats, and was rated by the IntelliShop caller as providing “one of the best sales experience I’ve ever had.”

Denove said the NBA team agents collectively did an excellent job of selling the benefits of the seats. Eighty-two percent made some effort to talk positively about the offered seats, and 59 percent of the mystery callers said their agent made a “significant effort to stress the benefits” of the suggested seats, such as proximity to concessions or ease of getting to and from the seats.

The study found that “needs assessment” is an area where agents have room for improvement, though. Many agents, according to the study, failed to consistently ask other questions that could help them make a sale. For example, only 28 percent asked if the caller had ever owned season seats before, and only 17 percent asked if the seats were for business or personal use.

Three-fourths of agents collected contact information for follow-up; 43 percent offered while still on the phone to send follow-up materials by email. Only a few agents took advantage of the opportunity to move the sales venue from the telephone to a face-to-face meeting by inviting the caller to come down to the arena to sit in the targeted seats.

“We talk constantly about ‘connecting before converting,’” Grayson said. “We tell our folks this is a telemarketing position, but you will be most successful face to face.”

The Bucks are one of approximately a dozen NBA teams that utilize Ballena Technologies’ 3-D arena-imaging technology on the club’s website to show fans what the view is from certain seats. Grayson said that is a valuable tool for fans who are unable to make it in to actually sit in the seats.

Denove said his history of analyzing mystery shopper data shows that numbers related to “asking for the sale” are typically low among salespeople in all industries, including automotive and financial services, where representatives often get criticized for hard-sell tactics. Overall, 53 percent of the NBA team agents asked the mystery caller at some point if the caller wanted to actually buy the seats. While not providing specific numbers, citing client confidentiality, Denove said the NBA agents’ rate is higher than what’s seen in most other industries tracked by IntelliShop.

About one-third of MLB team sales agents in an IntelliShop study done last year for SportsBusiness Journal formally asked callers if they were ready to purchase. (SportsBusiness Journal, May 23-29, 2011, issue)

“Every call is so completely different, so there’s really no way a league could have a standard for close rates,” said Chris Granger, NBA executive vice president who oversees the league’s team marketing and business operations division. “Teams’ demand rates are different [and] what that buyer is interested in widely varies.”

The NBA, because of the team operations division, is often regarded as being an out-front league in assessing and developing team-level sales efforts.

“We host a series of workshops during the year where the top sales people in ticket sales from each team spend two days talking about what works for them in terms of selling groups or season tickets,” Granger said. He added that the league office conducts secret shopping on many of its team operations, including the ticket-sales process, advertising and game-day experiences.

The league will host its next season-ticket sales workshop in New York in March, Granger said, marking the beginning of the season-ticket sales cycle for next season.

|

SURVEY RESULTS

|

|

Overall evaluation of call compared to other telephone sales experiences

|

|

| |

| Percentage of agents who mentioned the following selling points during the sales pitch* |

| Payment plans available |

37% |

| Flexibility program for selling unused tickets |

25% |

| Exclusive access to special areas |

21% |

| Access to preferred parking |

16% |

| * Responses listed are the most-frequently mentioned responses out of 15 possible benefits listed on the caller's survey |

| Team leaders: Atlanta, Dallas, Denver, Golden State, Indiana, Memphis, Milwaukee, New Jersey, New Orleans, Orlando, Phoenix, Portland (teams' agents touted multiple benefits during every call) |

| |

| Effort to have caller visit arena to sit in available seats |

| Significant effort made |

29% |

| Briefly mentioned this option |

2% |

| Did not mention this option |

69% |

| Team leaders: Cleveland and Phoenix (every call); Atlanta and Charlotte (three out of four calls) |

| |

| Agent's inquiry about caller's budget |

| Near beginning of call |

35% |

| After caller expresses concern over quoted price |

48% |

| Did not ask caller about budget |

17% |

| |

| Agent's response to hearing that the quoted price was more than the caller could afford |

| Suggested partial seat plan |

6% |

| Suggested less-expensive seat location |

45% |

| Provided option of partial plan or less-expensive seat |

30% |

| Tried to convince caller to increase budget |

6% |

| Did not offer an alternative |

13% |

| |

| Agent's effort to close the sale over the phone |

| Asked once if caller wanted to buy |

41% |

| Asked more than once |

12% |

| Did not ask for the sale |

47% |

|

|

|