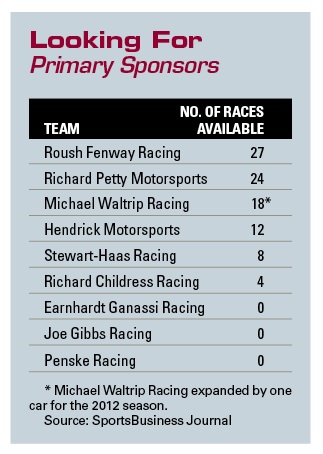

NASCAR teams started the year with three times more primary sponsorship inventory to sell than a year ago.

Six of the top-tier Sprint Cup teams have primary sponsorships available for a combined 90-plus races this year. It’s a total that would have been higher had Roush Fenway Racing and Richard Childress Racing not decided to contract by one car apiece, taking primary sponsorships for an additional 72 races out of play this year.

The teams with open inventory at the start of this season include Hendrick Motorsports, which has 12 races to sell on Kasey Kahne’s No. 5 car; Michael Waltrip Racing, which added 5 Hour Energy as a sponsor and expanded by one car this season, leaving it with 18 races to sell across the No. 15 and No. 55 cars; Richard Childress Racing, which has four races to sell; Richard Petty Motorsports, which has 24 races to sell on the No. 43 car; and Roush Fenway Racing, which has 27 races to sell on Matt Kenseth’s No. 17 car.

At this time last year, top-tier teams collectively had fewer than 25 available races.

“It’s a buyer’s market,” said Jeff Elliott, chief operating officer of Breaking Limits, a motorsports agency that works with General Mills and Front Row Motorsports. “There’s a lot of value to be had out there. It’s not unlike the housing market. You can walk into a neighborhood and have your pick of houses and maybe get more house for the money than you would have a few years ago.”

RCR chief marketer Ben Schlosser said the amount of open inventory reflects the number of long-term agreements that elapsed on the team side last year. Companies like Caterpillar, Aflac, Mars, U.S. Army, Crown Royal, 3M, General Mills, Best Buy, UPS and others all had multirace deals that expired in 2011. Caterpillar, Aflac, U.S. Army, UPS and Best Buy all decided to decrease the number of primary races they will sponsor this year, and Crown Royal decided to stop sponsoring race teams altogether.

Those moves opened up a lot of the inventory that’s available this year, and in some cases created a situation where teams have to find a sponsor to fill out a handful of races on a car that’s mostly full. That means teams tend to have more sponsors to manage than they ever had in the past. For example, RCR will have more than 40 sponsors across nine teams in the Sprint Cup, Nationwide and Camping World Truck series. The team’s previous high-water mark was 35 sponsors.

“The economics [of that many sponsors] are OK, but the complexity is way up,” Schlosser said. “You have to fit the pieces so they work together.”

Teams are optimistic they can close the inventory before the season starts. Sales executives and consultants worked through the holidays in an effort to maintain momentum with potential sponsors.

“There’s been good progress by all the teams filling up the inventory they have,” said Jonathan Gibson, Penske Racing’s vice president of marketing. “I have no doubt Hendrick will fund its other races, Waltrip will find a solution for [Clint] Bowyer, and Roush is optimistic. We’re moving in the right direction.”

But teams with open inventory are finding themselves on the wrong end of the supply-and-demand curve. The options at multiple teams give sponsors more leverage when they come to the table because they know that the teams need financial support.

“It’s pushed the price point down and recalibrated the economics of the sport, allowing new sponsors to get into the sport with top talent at reasonable prices that haven’t existed before,” said Jon Flack, president and chief operating officer of Just Marketing International, which works with Subway, Farmers Insurance and UPS. “When we’re talking to CMOs right now, we’re telling them that there’s lots of inventory, good drivers and good deals to be had right now.”

|

Best Buy shifted its spending from RPM’s No. 43 car to Roush Fenway’s No. 17 car.

Photo by: GETTY IMAGES (2)

|

Best Buy is an example of a sponsor that took advantage of the surplus of open inventory by cutting ties with RPM, where it was spending as much as $10 million on 24 races for the No. 43 car, and shifting its sponsorship to Roush Fenway Racing, where it reportedly will spend $4 million to sponsor nine races on the No. 17 car driven by Matt Kenseth and two races on the No. 99 driven by Carl Edwards.“Options like that didn’t always exist in the sport, but today I’m sure that was a good business decision for them,” Flack said.

Multirace agreements historically have been tough to close once a race season begins. Only three multirace agreements closed between January and May last year.

“We’re going to see a lot of sponsors take a wait-and-see attitude this year with the sport and choose to spend a little this year to see if a sponsorship works,” said Andrew Campagnone, a senior managing partner at Sports Marketing Consultants, which helped negotiate Farmers’ deal with Hendrick Motorsports.

Team and agency executives believe the combination of Sprint Cup ratings, which increased for the first time since 2005, and new sponsorship deals that closed late last year will give them momentum as they search for primary sponsors to fill open inventory this year.

“We’re feeling much better than we did six months ago,” Schlosser said.