Brand exposure for companies doing business with NASCAR’s Sprint Cup Series in 2011 totaled $1.13 billion, an increase of 20 percent from 2010, according to the results of a study conducted by Repucom exclusively for SportsBusiness Journal/Daily.

Repucom ranked the multicolored NASCAR logo as the top generator in media value for the second straight year, capturing about 15 percent of the total value calculated for brands. Series title sponsor Sprint ranked second, at 10 percent of the total.

In terms of overall media value, according to Repucom, nine of the top 11 brands saw a year-over-year increase in media value. Repucom did not provide specific dollar amounts for the value of all exposures.

Of the 10 brands that ranked immediately below the NASCAR brand, only four of them — Lowe’s, Budweiser, 3M and Aflac — were primary team sponsors, but with each of these brands, other elements beyond team assets contributed to the total. Budweiser, for example, title sponsored the Budweiser Shootout, while 3M gained additional signage exposure via its official sponsorship of NASCAR.

Among other sponsors:

|

Lowe’s ranked as the top primary team sponsor in media value; Budweiser backed driver Kevin Harvick and ranked 8th (top).

Photo by: GETTY IMAGES |

• Pizza Hut, which did not have a presence in the Sprint Cup Series in 2010, finished 2011 ranked No. 9 for brand exposure, fueled in large part by a presenting sponsorship for prerace shows.

• Chevrolet was the clear leader among NASCAR’s four official automakers, with exposure nearly two-thirds more than the next highest brand, Toyota. Ford moved up a spot from last year to No. 5, and Dodge finished the 2011 season ranked No. 23.

Much of the increase in exposure value this season came from a rise in advertising rates during NASCAR telecasts. Compared with 2010, the cost of media to reach those viewers (CPMs) rose by 8 percent through the first three quarters of 2011 across both cable and network broadcasts, according to Repucom. In the fourth quarter, cable CPMs were up 3 percent while network costs decreased 4 percent, but that decrease did not play a major factor in the value of media for NASCAR as seven of the final eight races aired on ESPN.

The value also increased because Sprint Cup viewership went up. For the first time since NASCAR TV viewership peaked in 2005, the sport this year saw a year-over-year increase in viewers. The 33 regular-season races that were not affected by rain averaged 6.45 million viewers, up 8 percent over 34 races last year.

Nearly $350 million of the season’s accumulated media value levels came from sponsor exposure on the 12 cars that qualified for the Chase for the Sprint Cup, according to Repucom. Incumbent series champion Jimmie Johnson captured the 2011 battle for sponsor media value, edging Kyle Busch by nearly 3 percent and Carl Edwards by 14 percent. Tony Stewart, this year’s series champion, ranked fifth in overall exposure for his sponsors.

Methodology

By the numbers:

NASCAR Sprint Cup Series

Summary

• Total monetary value: $1.13 billion (+20%)

• Individual brand exposures: 435,000 (+28%)

• No. of brands tracked: 1,800

• No. of hours: 630 hours of sponsor exposure (+19%) during 170 hours of broadcast coverage (+4%)

• Avg. detections per race: 10,762 (+28%)

Top brands

| 2011 rank (2010 rank) |

Brand |

| 1 (1) |

NASCAR |

| 2 (2) |

Sprint |

| 3 (3) |

Chevrolet |

| 4 (4) |

Toyota |

| 5 (6) |

Ford |

| 6 (5) |

Lowe’s |

| 7 (8) |

Fox |

| 8 (7) |

Budweiser |

| 9 (NR) |

Pizza Hut |

| 10 (14) |

3M |

| 11 (21) |

Aflac |

NR: Not ranked in 2010

Source: Repucom

For this study, detections of primary and secondary car and driver partners were analyzed, along with all race venue signs, on-screen graphics and audio mentions from race broadcasts on ABC, Fox, ESPN, TNT and Speed. The broadcasts covered the 36 regular-season Sprint Cup Series races, the Sprint All-Star Showdown, the Sprint All-Star Race, the Budweiser Shootout and the two Gatorade Duel 150 races, for 41 events total. Prerace coverage was included, but live race footage accounted for more than 90 percent of the media value generated for sponsors.

Nearly 100 sponsored locations were measured in areas ranging from leaderboard graphics that viewers see on their TV screens to exposure a sponsor may have received by having its logo on a trophy. Additionally, verbal mentions were counted, but those calculations are based exclusively on sponsor mentions and do not factor in mentions of driver names.

Because location and clarity affected the measured value of each detection, quantity did not always translate into increased value. Also, for the purpose of summary calculations, each audio mention was assigned a duration of four seconds with a quality score of 100 percent.

Repucom, in partnership with Nielsen, calculates spot rates by integrating event-specific viewership data from Nielsen and media cost data (CPMs) obtained from SQAD, an independent media cost forecasting agency. That information is then applied to the logo detections for the various brands to calculate a dollar value for each brand’s exposure.

Repucom earlier this year acquired Image Impact, a Kansas-based company that, like Repucom, tracked media valuation and brand exposure. SportsBusiness Journal/Daily in prior years used Image Impact data for year-end coverage of brands’ exposure through NASCAR. Comparisons here to 2010 data are to figures from past Repucom research.

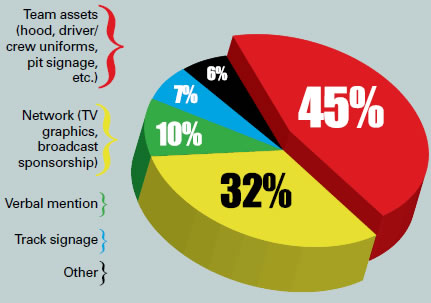

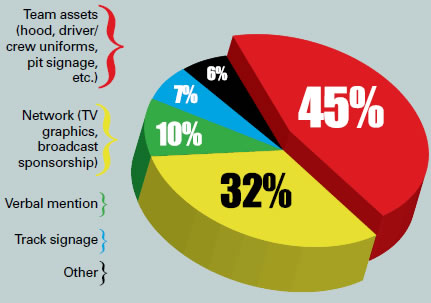

Source of the exposure

Where sponsor logos were seen

Duration

rank |

Source/location

(% of total duration) |

Total duration

for that source |

Top brand

(No. 2 brand)* |

| 1 |

TV graphic (logo) (26%) |

161h 56m 9s |

NASCAR (Sprint) |

| 2 |

Hood (15%) |

94h 57m 18s |

Chevrolet (Lowe’s) |

| 3 |

Driver firesuit (13%) |

82h 50m 40s |

NASCAR Sprint Cup Series (Alpinestars) |

| 4 |

Front quarter panel (4%) |

26h 51m 54s |

Mechanix (3M) |

| 5 |

Upper rear quarter panel (4%) |

25h 10m 38s |

Red Bull (Lowe’s) |

| 6 |

Pit signage (3%) |

20h 8m 33s |

Sunoco (Target) |

| 7 |

TV graphic (text) (3%) |

16h 44m 45s |

NASCAR Sprint Cup Series (Sprint) |

| 8 |

Track billboard (2%) |

14h 46m 26s |

Sprint (Toyota) |

| 9 |

In-car TV panel (2%) |

14h 23m 31s |

Chevrolet (Lowe’s) |

| 10 |

Pit crew uniforms (2%) |

14h 21m 7s |

Office Depot (Lowe’s) |

* Measured by total on-screen duration for brand’s logo.

Source: Repucom