When San Jose Sharks defenseman Doug Murray was a teenager in Stockholm, his only contact with televised NHL content was a copy of “Hockey’s Greatest Hits,” a compilation of bloopers, fights and goals released on VHS in 1990.

“The truth was that there was no place to find games on TV,” said Murray, now 31.

These days, Murray said his Swedish parents stream his games live on the Internet early in the morning, or watch rerun games on television. They may have an even easier time watching Doug play this coming season, as the NHL has launched an aggressive European media strategy.

Previously, NHL televised games were packaged with other American sports and distributed in Europe by ESPN on ESPN America, the English-language, pan-European television platform. But now the league and its new European rights holders — Stockholm-based Medge Consulting and Oxford-based Advisers Media International — are negotiating individual television deals on a country-by-country basis. The strategy will enable local television licensees to adapt the games to native-language telecasts instead of English.

“One third of our players come from Europe, and European fans want to be able to see the best players, especially when they are local,” said John Collins, COO of the NHL. “We want to be able to shorten the distance between European fans and our game.”

In addition to attempts to gain broader television distribution, the league’s strategy includes an increase in content this season. The league is expanding the total number of available games in Europe by 25 percent to between 435 and 480 for the regular season and playoffs. It also is increasing the number of weekend games shown during prime-time European hours by 40 percent, to 94.

|

| In October the league will roll out foreign-language versions of its website. |

To complement the expanded programming, the NHL in the first week of October will launch its website in seven languages: German, Swedish, Finnish, Czech, Slovak and Russian, as well as one for French Canadians. It will offer original native language editorial content and video online, and will customize the content around nationally known players. In its new licensing deal, the league controls its digital rights, which enables it to also distribute Game Center Live applications and streaming packages directly to European customers.

But on the eve of puck dropping on the 2011-12 season, the new television strategy has yet to become reality. It hinges on AMI/Medge’s ability to sign local sublicensing deals with regional European television distributors. According to league sources, AMI/Medge have yet to finalize any regional deals. The size and scope of these sublicensing deals will reveal whether the NHL’s popularity in Europe is indeed as deep and wide ranging as the league believes it to be.

NHL Commissioner Gary Bettman said he is not worried about the lack of deals so far, and said the league and AMI/Medge are very close to finalizing numerous partnerships in Europe.

“It takes time to do these things. We had to first complete our deals with AMI and Medge,” Bettman said. “Of the North American sports, we may be the most popular in Europe and Russia, and we want to make sure we’re focused on the opportunity.”

Collins said the plans for Europe are part of the league’s goal of growing its overall marketing footprint in the U.S. and abroad. He said that with the league’s 10-year television deal with NBC in hand, the NHL can now focus its attention on Europe.

The league’s previous, six-year European media partnership with ESPN ceded the league’s digital and television rights in

|

| Previously, NHL games were distributed in Europe by ESPN on ESPN America. |

an exclusive bundle to ESPN. That deal was originally signed in 2005 with the Setanta Sports-owned NASN, which ESPN purchased in late 2006 and renamed ESPN America. ESPN America delivered 250 live and tape-delayed NHL games alongside NFL, NCAA and NBA programming to 19 million homes in Europe and Asia last year.

Bettman called the NASN/ESPN America deal a “one-size-fits-all solution,” and said the league signed it while trying to rebuild its brand domestically after the lockout.

“Their business model and our business model weren’t the same,” Bettman said. “They’re delivering lots and lots of sports on a mass basis. We felt we needed to be more targeted by country.”

The league put its international rights for Europe, Africa and Asia to tender in May. ESPN bid on the rights, but the league signed a five-year deal with AMI/Medge in June. Both firms have experience selling licensing rights for the English Premier League, with Medge having 20 years of experience working in Scandinavia and AMI having strong relationships in Russia and Eastern Europe. Not surprisingly, the deal has Medge overseeing sublicensing agreements in Scandinavian countries and AMI selling in Great Britain and the rest of continental Europe.

ESPN may have lost in its bid to maintain the rights, but an ESPN spokesperson said ESPN America is in discussions with AMI and Medge to distribute NHL programming as a sublicensee in select markets in Europe, Asia and Africa.

The new deal with AMI/Medge brings a significant financial upswing. According to sources, NASN’s original deal was worth $11.25 million a year with the right to renew for $12 million a year for 2009-10 and 2010-11.

Sources familiar with the AMI/Medge deal pegged it at $20 million to $22 million a year, with the league and Medge also splitting licensing revenue for Scandinavia. And under the NHL’s new domestic television deal with NBC, it no longer pays 50 percent of its international licensing revenue to Versus, which was part of its old deal with NBC.

“We were licensing our players and assets to third parties to grow their business,” Collins said. “Now we’re taking control to grow our business.”

AMI officials did not return calls for this story.

Tim Smart, owner of Medge, called the NHL a “blue-chip brand” in Scandinavia due to the sport’s coverage in print and broadcast media, as well as the history with hockey in Sweden and Finland.

But Smart said the NHL’s television rights were devalued by the ESPN America non-hockey programming and the lack

of prime-time games. The disparity in perceived value, Smart said, has slowed negotiations on the local level.

“As a product it has been very invisible, which was a combination that ESPN is not a successful channel in these markets, and the game was not marketed sufficiently,” Smart said. “They say, ‘We love the brand but we see no ratings.’ That is where we are starting from.”

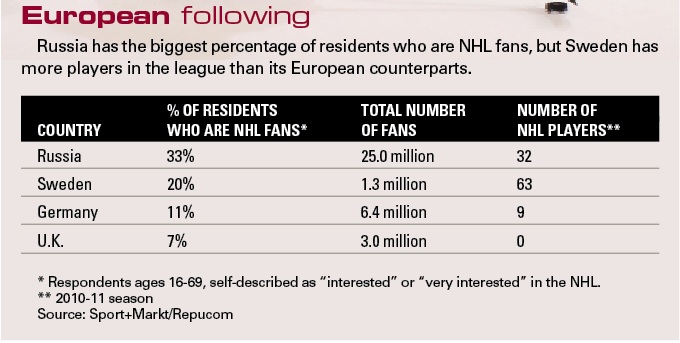

Sources interviewed for this story agreed that the league should be able to sign deals in Scandinavia, Russia, the Czech Republic and Slovakia, but questioned whether the league would be able to sign deals in Germany, the U.K. and Latin countries, where hockey is not as popular.

“There are a lot of territories in Europe where it makes more sense for [the NHL] to be with ESPN, and they will struggle to get carriage in some markets,” said one source. “Outside of the Nordics and Russia and the Czech Republic, I don’t see where the broadcast options are for them.”

Alan Gold of Evolution Media Capital, who negotiated the tender process for the NHL, said the league’s hands-on approach to its programming, and its greater offering of prime-time games, should turn the tide in the local negotiations.

“Before this current deal, all of the live games were coming in during the middle of the night,” Gold said. “To be able to grow the fan base and get them engaged, you need to deliver games in European prime time.”

Medge’s Smart, who previously purchased NBA rights for French TV channel Canal+, said the league’s commitment to long-term growth in events and media in Europe delivers value. Smart said he does not expect Medge to make a profit on its financial commitment to the NHL this season. The firm has hired Peter Gudmundson, the former CEO and general manager of Sweden’s premier professional hockey league, to work alongside the NHL in establishing and growing events.

“We are prepared to sacrifice significant profits on the league right now because it makes sense to have the longer-term relationship,” Smart said. “We are not just in this to buy and sell the rights; we are looking for longer-term relationships.”

Collins and other NHL officials said the new strategy is the first step in the league’s plan to build a media business in Europe that has a similar focus and structure as its North American operation. The plan includes the eventual launch of the NHL Network in Scandinavia, however officials declined to say when that could happen. Bettman said the league will open an office in London within the year, though he declined to discuss the size of the venture. The league also is deciding how to sell its digital rights in Europe.

According to Collins, the European media strategy will pave the way for an increase in European games, but no definite plans for games can be laid until after the next round of labor negotiations with the NHLPA. Currently, the league is discussing event plans with Creative Artists Agency, and the ideas being considered include a return of the World Cup of Hockey, which was last held in 2004, or a Ryder Cup-style tournament between NHL and European teams.

Harvey Schiller, CEO of GlobalOptions Group and former president of the Atlanta Thrashers, said that of all the professional leagues, the NHL has the best shot at creating a thriving media business abroad.

“It’s a sport that is not completely dominated by American players, which gives it an appeal in Europe,” Schiller said. “In some of the Latin countries they will have a hard time, but across Europe, people talk about hockey. They know what a puck looks like.”