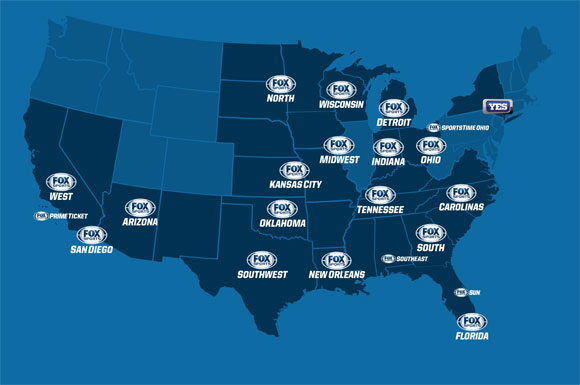

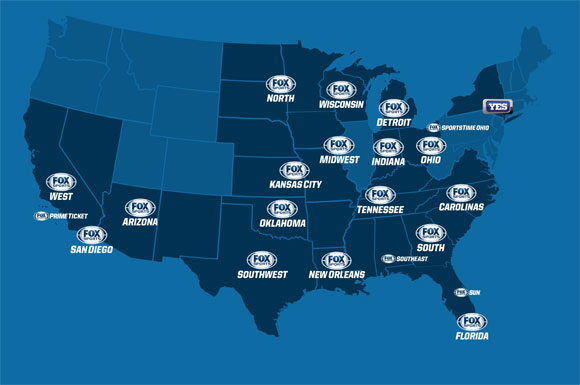

Thursday's announcement that Disney will purchase several properties of 21st Century Fox is "likely to raise thorny regulatory concerns at a time when the Justice Department has been putting media mergers under the microscope," according to James & Peltz of the L.A. TIMES. Disney, which owns ESPN, "would take over" 22 RSNs under the deal. The merger "would not include Fox’s FS1 and FS2 sports channels, but the deal still could give Disney greater leverage with cable and satellite distributors." Antitrust lawyer and former FTC Policy Dir David Balto: "Any increase in Disney sports programming will be extremely problematic and will get intense scrutiny." CFRA Research analyst Tuna Amobi indicated that regulators are "sure to focus on how the Disney and Fox cable sports divisions would meld." However, Amobi added that likely will not "'be a deal killer' because ESPN is largely a national sports network and the Fox networks are regional with exclusive rights to hometown teams." Antitrust lawyer Scott Martin: "I’m not sure putting ESPN with the regional sports networks really harms consumer welfare." He did note that it is "not clear the government would feel the same way" (L.A. TIMES, 12/15).

REGIONAL NETS CAUSE FOR CONCERN? CNBC's David Faber said the inclusion of the RSNs in the deal is "one area where there is some concern" regarding regulatory concerns. Faber: "The question is will they be so dominant in sports that perhaps it will be non-competitive" ("Power Lunch," CNBC, 12/14). In N.Y. James Stewart writes there are "more serious antitrust issues" about Fox’ RSNs, given ESPN’s "dominance of cable sports." If that market is "measured by cable sports revenue, the Disney-owned ESPN is so dominant that nearly any acquisition of another cable sports provider," even Fox’ relatively small RSNs, "would trigger antitrust review." The Disney-Fox deal is "shaping up as another litmus test" for U.S. Assistant Attorney General for the Antitrust Division Makan Delrahim, who is "already under fire for taking AT&T and Time Warner to court." New York Univ. School of Law professor Scott Hemphill said of the deal, "From a horizontal perspective, sports is the main issue" (N.Y. TIMES, 12/15). MoffettNathanson estimates that Fox is "parting with a portfolio" of RSNs that bring in annual Ebitda of $2.3B (WALL STREET JOURNAL, 12/15).

POSSIBLE LEVERAGE IN NEGOTIATIONS: The WALL STREET JOURNAL's Flint & Kendall note ESPN and local sports channels are among the "most expensive for pay-TV distributors to carry," and analysts warn that a company "owning both will have a lot of leverage in negotiations." Bevilacqua Helfant Ventures co-Founder & CEO Chris Bevilacqua: "There is no question combining ESPN’s national sports rights portfolio with arguably the biggest regional sports operator is a potent combination." The high cost of ESPN to distributors -- roughly $8 per subscriber a month -- along with local sports channels, ABC’s television stations and entertainment cable networks including Disney Channel and Fox’ FX "could have cable and satellite operators raising objections." Others say that Disney may be able to "make the argument that between Comcast and AT&T, which own sports channels, and new players in sports such as Amazon and Facebook, there will be plenty of competition." Flint & Kendall note Disney and Fox "may be betting they can make a case that upheaval in the media world should change the lens through which regulators view this deal" (WALL STREET JOURNAL, 12/15). CNBC's Jim Lebenthal said, "What does the future for you look like? The answer is there's going to be a heck of a lot more consolidation in this industry" ("Fast Money Halftime Report," CNBC, 12/14).

HITTING CLOSE TO HOME: In N.Y., Zach Schonbrun notes "no one has ever controlled such a vast swath of the sports broadcasting landscape at one time." However, the portfolio will "not necessarily make other sports media moguls envious." The 22 RSNs are valued at about $20B but experts said that their "long-term viability is questionable given consumers’ rapidly changing viewing habits and the ongoing disruption in the pay-television market." Disney "might also complete" a $15B acquisition of Sky, and its international sports offerings, of which Fox currently owns a 39.1% stake. Sky’s "signature property is soccer’s Premier League." in recent years Fox Sports execs "grew frustrated" that the RSNs complex contracts "prevented them from putting more live games on the company’s national cable network," FS1. Games from the RSNs could eventually appear on Disney's upcoming streaming service, ESPN Plus, if contracts "can be amended and fees can be agreed upon, reducing the network’s reliance on cable in local markets." But it is "unclear how soon those offerings could take effect" (N.Y. TIMES, 12/15). VARIETY's Cynthia Littleton wrote the Disney-Fox deal is all about "building up its direct-to-consumer streaming capabilities." Disney has said that it "expects to realize" $2B in "cost savings within two years of the deal's closing" (VARIETY.com, 12/14). RECODE's Peter Kafka wrote ESPN's proposed solution to their problem of expensive sports media rights deals is a "surprising one: It is going to put itself on the hook for even more expensive sports deals." There are some "compelling arguments" for the move. For instance, buying up the RSNs means those local deals "won’t end up in the hands of someone else." Another "decent argument: Scale." However, Kafka wrote, "If [Fox Exec Chair] Rupert Murdoch is selling, I’d think very, very carefully about what I’m buying" (RECODE.net, 12/14). Meanwhile, sources said the RSNs could "provide Disney with additional leverage in it negotiations with future MVPDs, particularly with a Verizon carriage agreement" expiring in '18 (MULTICHANNEL.com, 12/14).

LOOKING AHEAD: In N.Y., Richard Morgan writes the Disney-Fox deal could provide a "shot in the arm" for ESPN. According to Fox, the RSNs have "61 million subscribers." A Nielsen survey last year revealed pay-TV subscribers "consider RSNs the fifth-most important channels in their packages." Their acquisition by Disney "demonstrates an abiding faith in sports programming, despite well-documented problems at ESPN." The RSNs will be "rebranded as ESPN properties ... with streaming rights most likely pursued by Disney whenever an RSN contract expires" (N.Y. POST, 12/15). N.Y.-based research firm GBH Insights Chief Strategy Officer Daniel Ives said, "I wouldn’t expect any change there in terms of content. Those (RSNs) are the golden goose so the last thing they want to do is tinker with it" (SAN DIEGO UNION-TRIBUNE, 12/15). Former NBA Commissioner David Stern said the deal is "very good" for the RSNs, as ESPN "has a lot of programming." Stern: "You're going to wind up getting that programming more exposure on the regional sports networks" ("Closing Bell," CNBC, 12/14). In Oklahoma City, Jeff Patterson notes Disney's acquisition of the RSNs means "the end" of FS Oklahoma and asks, "Are you ready for ESPN Oklahoma?" (OKLAHOMAN, 12/15).